Solana Quietly Dominates as Network Usage Surges While SOL Price Stalls Below $130

The post Solana Quietly Dominates as Network Usage Surges While SOL Price Stalls Below $130 appeared first on Coinpedia Fintech News

Crypto markets started 2026 with a strong attention on Solana, even though the SOL price has been consolidating below $130 for weeks. According to recent on-chain data, whales accumulating Solana-related tokens was the most discussed trend in the market. Additionally, SOL’s network usage and transaction volume dominate despite low price action. This suggests smart money is taking positions, which might soon result in a breakout in Solana price chart.

Solana’s DEX Trading Volume Touches $1.6 Trillion

Solana became one of the top altcoins by performance in 2025 and it outpaced several CEXs by trading volume. According to the Solana vs CEX chart, the altcoin recorded $1.6 trillion in DEX trading volume. This figure ranks Solana just behind Binance which showed $7.2 trillion in trading volume.

According to an on-chain analyst, CryptosRus, Solana’s rising trading volume hints at increasing usage and transaction among investors. This rise in on-chain indicators amid a price stagnation suggests continuous accumulation among large investors. As a result, it might soon trigger a breakout for SOL price.

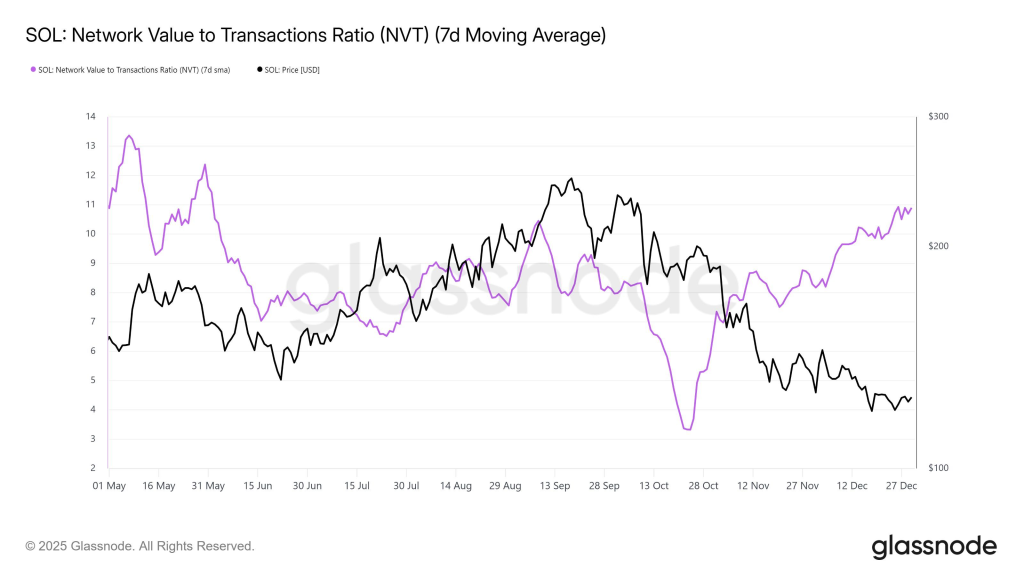

However, any breakout might trigger profit-taking sentiment among short-term holders, as revealed by the NVT data. Solana’s Network Value to Transactions (NVT) ratio has been rising and it is now at the highest level in seven months.

SOL NVT Ratio

SOL NVT Ratio

In the past, an increasing NVT ratio has often pointed to bearish threats, as SOL’s market value surges faster than ongoing transaction activity. This gap means Solana price is surging amid low transaction activity, making the altcoin overvalued. This often leads to short-term price pressure for SOL.

Also read: Ethereum and Solana Could Hit New All-Time Highs If US Crypto Law Passes

Additionally, the open interest of Solana slowed down from September 2025. Data from Coinglass reveals that the metric dropped from the high of $17 billion to $7.5 billion, as of January 2026.

These bearish metrics might keep Solana trapped within a selling region below $130 unless strong accumulation takes place.

What’s Next for SOL Price?

Solana has been holding near its 20-day EMA around $125 for several days, showing that buyers are still active and defending this level. However, sellers are strongly defending a push above $130, keeping SOL price trapped below the declining trend line on the 1-hour chart. As of writing, Solana trades at $124, declining over 1% in the last 24 hours.

SOL/USDT Chart: TradingView

SOL/USDT Chart: TradingView

If the price manages to close above the 20-day EMA, the SOL/USDT pair could move higher toward the descending resistance line. A break above $130 might force sellers to exit. However, there may be some selling pressure around the 50-day SMA at $133, but a breakout above it appears likely.

On the other hand, if the price falls away from these moving averages, it would suggest sellers are still in control, increasing the risk of a decline toward the support zone below $110 and possibly down to the key psychological level of $100.

You May Also Like

The Channel Factories We’ve Been Waiting For

Sui Ecosystem Gains Spotlight as Taipei Builders Demo Day Highlights New DeFi Ideas