Bitcoin Limps Into New Year at $87,000, Down 30% From All-Time Highs

Bitcoin Magazine

Bitcoin Limps Into New Year at $87,000, Down 30% From All-Time Highs

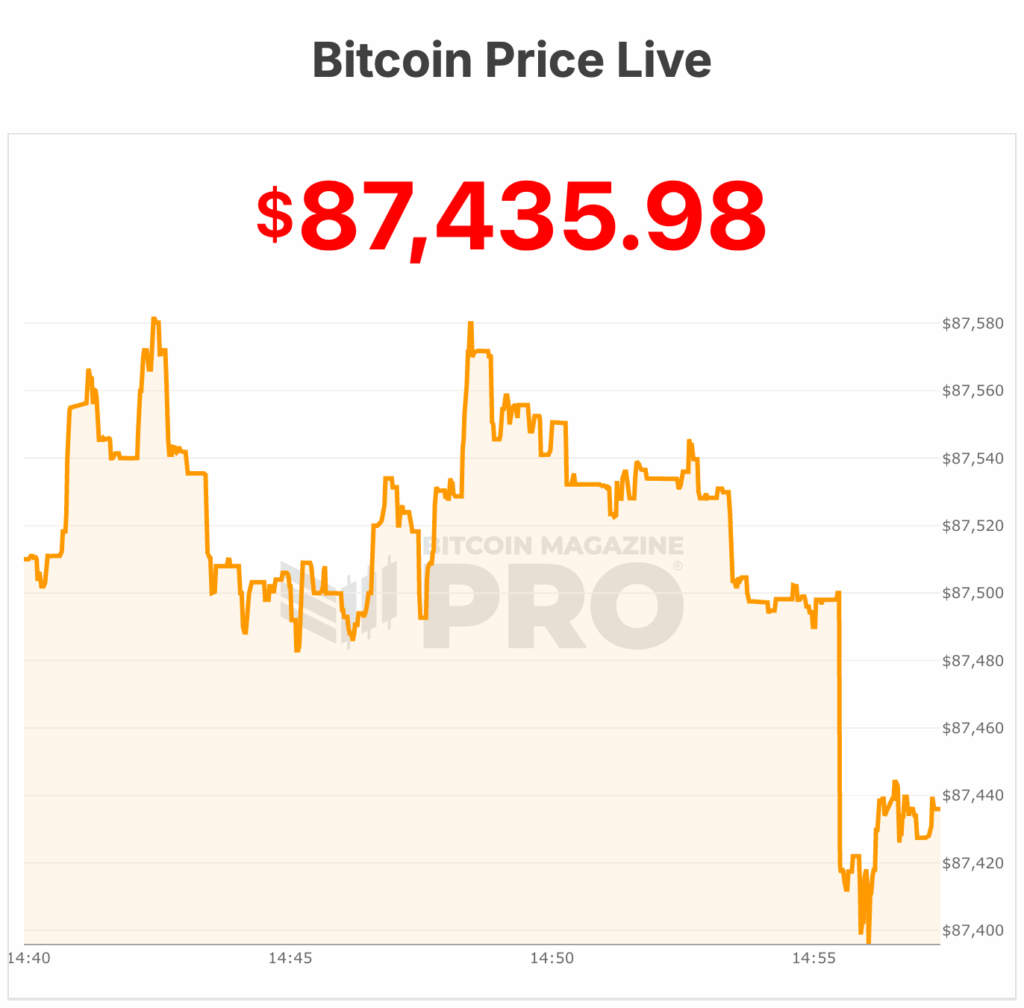

Bitcoin is closing out 2025 near $87,000, ending the year in a narrow trading range after months of fading momentum. Thin holiday liquidity and a lack of fresh catalysts left the market drifting into the final session of the year, capping a period marked less by explosive gains than by consolidation and unmet expectations.

At the time of writing, bitcoin was trading just below $88,000, roughly flat over the past week and modestly lower than where it began the year. The price has spent much of December oscillating between the low $80,000s and the high $80,000s, with repeated attempts to reclaim $90,000 failing to attract sustained follow-through.

The muted year-end action stands in contrast to the optimism that defined the start of 2025. Bitcoin entered January trading in the mid-$90,000 range, buoyed by strong inflows into spot bitcoin exchange-traded funds, expanding institutional participation, and expectations that easier monetary policy would push risk assets higher.

For a time, those narratives appeared intact.

Bitcoin went on to post a strong rally through the first half of the year, supported by steady ETF demand and continued accumulation by corporate treasuries and long-term holders. That advance culminated in October, when bitcoin briefly surged to a new all-time high above $125,000. The move was fueled by improving macro sentiment, positioning ahead of expected rate cuts, and renewed speculative interest across derivatives markets.

The rally, however, proved unsustainable. As the fourth quarter unfolded, tighter financial conditions, rising bond yields, and a stronger dollar began to weigh on risk appetite. Bitcoin rolled over alongside equities and other growth assets, giving back a significant portion of its gains.

By early December, the price had fallen more than 30% from its peak, re-entering a range that had defined much of the year’s trading.

Bitcoin macro pressures persist

Macro forces played a central role in shaping bitcoin’s performance in 2025. Inflation proved more persistent than many investors anticipated, prompting central banks to maintain a restrictive stance longer than expected.

That environment favored cash and yield-bearing assets over speculative exposure, limiting upside across crypto markets. Bitcoin, often framed as a hedge against monetary debasement, struggled to attract marginal buyers while real yields remained elevated.

Liquidity conditions also deteriorated into year-end. Trading volumes declined sharply in December as market participants stepped away for the holidays.

With fewer buyers and sellers active, price movements became choppy and conviction waned. The lack of strong inflows into spot ETFs during the final weeks of the year reinforced the sense of caution.

On-chain data reflected a similar dynamic. Long-term holders largely remained inactive, while short-term traders dominated flows, contributing to range-bound price action. Large holders reduced aggressive accumulation after the October peak, while retail participation ticked higher during pullbacks, a pattern consistent with consolidation rather than trend formation.

Still, 2025 was not without structural progress for bitcoin. The market continued to mature, with deeper derivatives liquidity, improved custody solutions, and broader integration into traditional financial infrastructure.

Spot bitcoin ETFs ended the year with tens of billions of dollars in assets under management, anchoring a new class of long-term demand even as short-term flows fluctuated.

Bitcoin also maintained its position as the dominant digital asset by a wide margin, outperforming most alternative cryptocurrencies on a relative basis.

While it lagged gold’s strong performance during periods of macro stress, bitcoin remained one of the most liquid and widely traded assets globally, reinforcing its role as the benchmark for the broader crypto market.

As bitcoin heads into 2026, the focus is shifting to whether the prolonged consolidation can resolve to the upside. Traders are watching the $90,000 level as a key psychological and technical threshold, while support in the low $80,000s has so far held.

A meaningful change in macro conditions, renewed ETF inflows, or a resurgence in institutional accumulation could provide the catalyst needed to break the stalemate.

For now, bitcoin enters the new year subdued, trading around $87,000 and searching for direction.

This post Bitcoin Limps Into New Year at $87,000, Down 30% From All-Time Highs first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

You May Also Like

Academic Publishing and Fairness: A Game-Theoretic Model of Peer-Review Bias

Foreigner’s Lou Gramm Revisits The Band’s Classic ‘4’ Album, Now Reissued