Financing Weekly Report | 15 public financing events; Cryptographic security platform Blockaid completes $50 million Series B financing, led by Ribbit Capital

Highlights of this issue

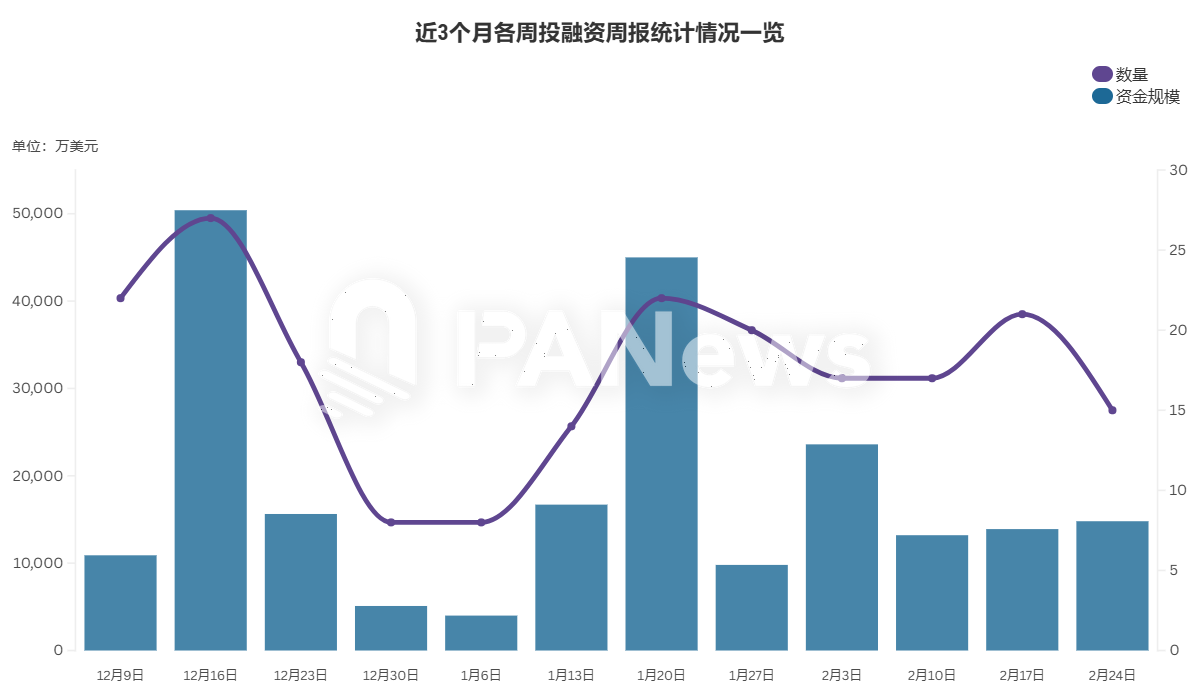

According to incomplete statistics from PANews, there were 15 blockchain investment and financing events around the world last week (February 17-23); the total amount of funds exceeded US$148 million, a slight increase compared to the previous week. An overview is as follows:

- DeFi announced five investment and financing events, among which stablecoin liquidity provider Mansa announced the completion of a $10 million seed round of financing, led by Tether;

- The Web3 gaming track announced one investment and financing event. Boyaa Interactive announced that it would invest approximately US$4.18 million in the Web3 project MTT ESports.

- Two investment and financing events were announced in the AI+Web3 field. ClustroAI completed a $12 million Series A financing, led by Forum Ventures.

- The Infrastructure & Tools sector announced 6 investment and financing events, among which the modular revenue layer Cygnus completed a $20 million Pre-Seed round of financing, with Manifold, OKX Ventures and others participating;

- Other categories announced 1 investment and financing event. ResearchHub, a tokenized social network founded by Coinbase CEO, completed a new round of financing of US$2 million, with BoostVC participating in the investment.

DeFi

Stablecoin liquidity provider Mansa completes $10 million seed round of financing, led by Tether

Stablecoin liquidity provider Mansa announced the completion of a $10 million seed round of financing led by Tether. This round of financing includes equity and debt financing. Tether contributed $3 million in equity financing. The new funds will support the company's expansion into Latin America and Southeast Asia, where liquidity challenges also limit cross-border transactions.

Packaged asset startup Universal completes $9 million financing, led by a16z

Universal has completed a $9 million round of financing led by a16z. Universal aims to enhance asset access for developers and end users by enabling all types of crypto assets to be traded on crypto trading networks through deep liquidity. Since the launch of Universal Protocol, more than $800 million of uAssets have been traded.

Curve founder’s new project Yield Basis raises $5 million at a $50 million token valuation

Michael Egorov, founder of decentralized exchange Curve Finance, is working on a new project called Yield Basis and has raised funds for it. Yield Basis aims to initially help tokenized Bitcoin and Ethereum holders earn returns through market making by mitigating impermanent loss. It is reported that Yield Basis raised $5 million in a token round at a fully diluted valuation of $50 million. The project will sell 10% of its "YB" token supply to investors, or 100 million of a total of 1 billion tokens. The token unlocking schedule for investors includes a six-month lock-up period, followed by a linear unlocking over two years.

Bitcoin staking platform Acre raises $4 million at $90 million valuation

Acre, a Bitcoin staking platform that allows users to earn rewards in the form of Bitcoin, has raised $4 million in a strategic funding round, with a token valuation of $90 million. Investors in this round include Draper Dragon, Big Brain Holdings, and Orange DAO. This round of financing also attracted participation from undisclosed angel investors, including individuals from companies such as Lido, EigenLayer, Wormhole, Thesis, and Quantstamp.

Bitcoin DeFi project Maestro completes $3 million seed round of financing

Bitcoin DeFi project Maestro announced the completion of a $3 million seed round of financing, led by Wave Digital Assets and Draper Associates, with participation from UTXO Management, Bitcoin Frontier Fund, Draper Dragon and Necto Labs. According to reports, Maestro is an enterprise-level infrastructure provider customized for Bitcoin DeFi, and has launched UTXO-based infrastructure services to simplify the complex process of building Bitcoin-native financial applications. Maestro provides APIs, developer tools and innovative solutions, such as memory pool meta-protocol indexing, which enables real-time on-chain insights.

Web3 Games

Boyaa Interactive announced another investment of approximately US$4.18 million in Web3 project MTT ESports

Boyaa Interactive, a Hong Kong-listed company, announced that it has signed a token subscription warrant with MTT ESports Limited and will make further investment in MTT ESports (second investment) with 4,180,749 USDT as consideration. After the second investment, Boyaa Interactive will obtain 10% of the total issuance of MTT tokens, that is, 210 million MTT tokens. It is expected that the MTT tokens will be unlocked linearly from January 2026 and will be unlocked within about 48 months. After the second investment, the total investment value of Boyaa Interactive in MTT ESports is equivalent to about 10 million US dollars.

AI

NVIDIA-backed AI startup ClustroAI raises $12 million in Series A funding led by Forum Ventures

ClustroAI, an edge AI startup based in San Francisco, has completed a $12 million Series A financing round led by Forum Ventures, with participation from MetaBlast and Metaverse Group, bringing the company's total financing to $15 million, including a seed round led by NVIDIA. ClustroAI focuses on edge AI technology, allowing AI models to run on local devices without relying on cloud computing. Its core technology uses a containerized architecture, supports large language models (LLMs), AI generated content (AIGC), speech translation, etc., and optimizes GPU resource allocation to accelerate the reasoning and training process while improving data privacy.

As a strategic partner, NVIDIA is promoting the migration of AI computing from data centers to local devices. ClustroAI plans to use the new funds to expand hardware compatibility to support chips such as FPGA, TPU, and NPU, while developing automated tools to make AI model updates more convenient. In addition, ClustroAI is building a distributed AI computing network that connects multiple device computing resources through container orchestration technology to improve local AI processing efficiency. The platform provides a unified API to simplify developer integration, reduce enterprise cloud computing costs, and improve security and flexibility.

Decentralized AI Neural Network Algorithm Protocol Uswap.ai Completes $1.5 Million in Financing

Decentralized AI neural network algorithm protocol Uswap.ai announced the completion of a $1.5 million financing led by Waterdrip Capital. According to reports, Uswap is a decentralized AI neural network algorithm protocol that integrates AI Agent into decentralized exchanges (DEX) and on-chain transactions, and can quickly create liquidity pools for various consensus assets.

Infrastructure & Tools

Crypto security platform Blockaid completes $50 million Series B financing, led by Ribbit Capital

Crypto security platform Blockaid recently completed a $50 million Series B financing round, led by Ribbit Capital, with participation from GV (formerly Google Ventures) and existing investors Variant and Cyberstarts. The financing will help Blockaid cope with the growing risk of cybercrime in the digital asset sector. In 2024, Blockaid successfully blocked 71 million potential attacks and avoided $5.3 billion in losses. The company expects that as users grow and token prices rise, cyberattacks will surge to "hundreds of millions" in 2025. Blockaid plans to use the funds to expand operations and increase investment in research and development, and expects its headcount to double this year. CEO Ido Ben-Natan said the company is currently facing the challenge of staff shortages due to changes in the U.S. regulatory environment and a surge in demand.

Modular revenue layer Cygnus completes $20 million Pre-Seed round of financing, with Manifold and others participating

Modular yield layer Cygnus announced the completion of a $20 million Pre-Seed round of financing, with participation from Manifold, OKX Ventures, Mirana Ventures, Optimism Retro Funding, etc. This financing will accelerate Cygnus's growth and expand its product range. According to reports, Cygnus is a modular actual yield layer that enables blockchains to customize their own re-staking networks and achieve shared security. In addition, Cygnus is building the first Web3 Instagram application layer, integrating on-chain and off-chain assets to power the creator economy.

Altius Labs Completes $11 Million Pre-Seed Round of Financing, Led by Founders Fund and Pantera

Crypto startup Altius Labs has completed a $11 million Pre-Seed round of financing, led by Founders Fund and Pantera, with participation from Archetype, Reforge, DCG, No Limit Holdings, Amber Group, and others. In addition, angel investors from projects such as Berachain, Movement, Ethena Labs, Ritual, dao5, Solana Foundation, and Hudson River Trading also participated in this round of financing. Altius Labs was co-founded by Anit Chakraborty, a former software engineer at Hudson River Trading, and Annabelle Huang, a former managing partner of Amber Group. It is committed to developing a modular execution stack that is independent of the virtual machine (VM) and can be independent of a single binary implementation and network design to achieve seamless integration with any L1, L2, and application chain to improve performance and enhance interoperability. The goal of the project is to help other crypto projects replicate Solana's success.

Fluent Labs Completes $8 Million Funding, Led by Polychain Capital

Blockchain developer Fluent Labs announced that it has completed an $8 million financing led by Polychain Capital to build its Ethereum Layer 2 hybrid execution network. The financing also received support from multiple institutions such as Primitive, dao5, and Symbolic Capital, and investors include well-known angel investors such as Balaji Srinivasan and Mustafa Al-Bassam. Fluent plans to use the funds to expand its core engineering team and support the construction of its ecosystem and test network infrastructure. Fluent aims to help developers seamlessly build applications across multiple blockchain ecosystems by integrating WebAssembly (Wasm), Ethereum Virtual Machine (EVM), and Solana Virtual Machine (SVM) applications into a unified execution environment.

Encrypted privacy data layer Primus completes $6.5 million in Pre-Seed and Seed rounds of financing, led by VanEck and others

The encrypted privacy data layer Primus announced on the X platform that it has completed a total of US$6.5 million in Pre-Seed and Seed rounds of financing, led by Dispersion Capital, Symbolic Capital, and VanEck, with participation from Samsung Next, Alchemy, Maelstrom, etc.

InfinityGround Completes $2 Million Seed Round, Animoca Brands and Others Participate

InfinityGround has successfully raised $2 million in seed funding, with participation from Animoca Brands, MARBLEX, MH Ventures, Frachtis, KuCoin Ventures, KnightFury, Presto and PAKA. InfinityGround is helping individuals shape an open, interoperable and AI-driven world on any blockchain at 10x the speed. InfinityGround supports developers to develop Agent applications on Base, BNB Chain and Kaia using a custom Agent IDE (Intelligent Development Environment) and IDK (Intelligent Development Kit) based on Initia Stack.

other

DeSci:

Coinbase CEO's startup ResearchHub raises $2 million in new funding

ResearchHub, a tokenized social network founded by Coinbase CEO, announced the completion of a new round of financing of $2 million, with participation from BoostVC, aiming to further use its ResearchCoin (RSC) token to incentivize scientists to publicly share academic content and build decentralized scientific collaboration and publishing tools to promote research cooperation, feedback and knowledge sharing among researchers. As previously reported, ResearchHub is building a platform where anyone can earn cryptocurrency rewards by contributing new knowledge to the global scientific community. Users earn ResearchCoin (RSC) by publishing content to ResearchHub, and the number of RSC received is proportional to the value that other members of the community believe the content is worth.

You May Also Like

Horror Thriller ‘Bring Her Back’ Gets HBO Max Premiere Date

While Shiba Inu and Turbo Chase Price, 63% APY Staking Puts APEMARS at the Forefront of the Best Meme Coin Presale 2026 – Stage 6 Ends in 3 Days!