XRP Still Has A Path To $28 This Cycle, Analyst Says

XRP could still reach $28 this cycle under a “non-base-case” scenario driven by an altcoin-heavy rotation, according to CryptoInsightUK analyst Will Taylor, who argued that XRP’s multi-year technical compression leaves room for an outsized move if market structure and sentiment align.

In his Dec. 27 “Weekly Insight” newsletter, Taylor framed the call inside a broader thesis: that capital chasing breakouts in traditional markets could eventually rotate into crypto, amplifying returns given crypto’s smaller aggregate market cap. Within that setup, XRP is his “core position,” and the token he sees as a primary beneficiary if altcoins capture a larger share of the cycle’s upside.

Can XRP Still Reach $28 This Cycle?

Taylor’s XRP outlook is tied to his expectation that total crypto market cap can reach roughly $10 trillion this cycle, a level he characterized as consistent with prior cycle behavior. The more important variable, in his view, is where Bitcoin dominance lands if that scenario plays out.

He wrote that dominance could fall into the “35.3 percent and 31.5 percent range,” which would imply Bitcoin at roughly a $3 trillion to $4 trillion market cap in that environment and “leave the door open for around six trillion dollars to flow into altcoins.” That’s the backdrop for his XRP targets: not a claim about XRP alone, but a wager on the size of the altcoin pie if the market turns risk-on.

Taylor also pointed to a prior discussion with trader Credible Crypto as an example of how high-cycle targets can emerge when liquidity, positioning, and sentiment converge. “My pinned post on X is a conversation with Credible Crypto where he talks about how, for example, XRP could go to $26 if the stars align for a cycle like this,” Taylor wrote. “And right now, it genuinely feels like those stars are starting to align.”

Taylor disclosed that XRP is the overwhelming majority of his portfolio, a disclosure he flagged as a potential bias. “As you guys know, I am around 90 percent XRP in my portfolio, so I definitely have some bias here,” he wrote, before laying out a profit-taking framework centered on a mid-cycle target zone.

“I would not be too surprised to see XRP reach a minimum of eight to thirteen dollars,” Taylor wrote. “I have discussed many times that I would be taking a lot of profit in that range, with an outside maximum target of up to around twenty eight dollars.”

He tied the higher-end target to a technical read of XRP’s long consolidation and the possibility that an altcoin-led cycle could be larger than many investors expect. Taylor described the $28 level as derived from the “initial breakout from the 2017 to 2018 cycle,” while emphasizing he had deliberately “diminished expectations” versus modeling a more aggressive, multi-leg extension.

Even so, his risk management plan is explicit about reducing exposure in the $8 to $13 band. “As I have said before, I plan to heavily de leverage between eight and thirteen dollars if we are offered that opportunity,” he wrote. “I will not be selling all of my bags, though, because I do think there is an outside chance that we push higher, potentially toward the twenty eight dollar area.”

The Argument For XRP

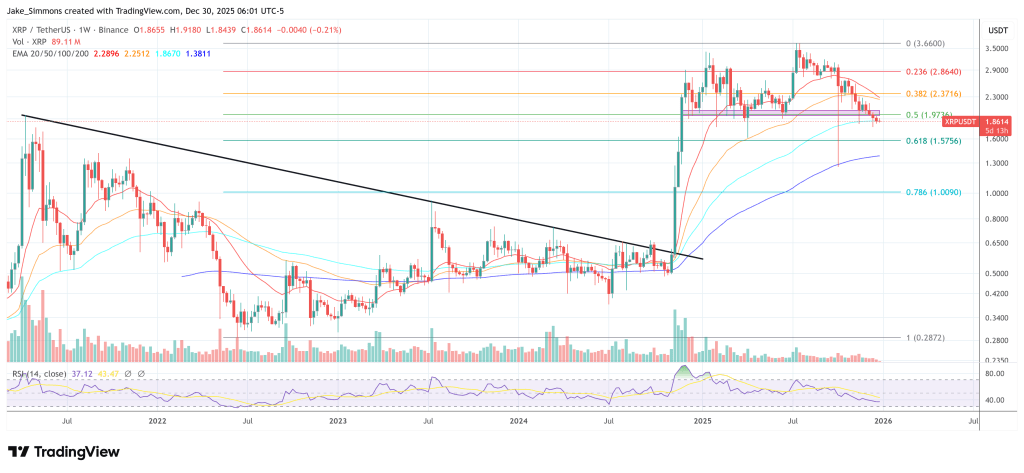

Taylor’s core claim is that XRP’s structure is different from many large-cap alts because it has, in his view, spent longer in “compression” and is now emerging from it. He argued XRP “has experienced longer compression than most altcoins, has broken out of an eight year trend, and has held previous seven year resistance as support.”

He also suggested that a favorable US policy narrative could act as an accelerant in a euphoric phase, pointing to “the rhetoric around US companies,” the “US Clarity Act,” and Ripple “remaining based in the US” as factors that could make a higher-end outcome less implausible in a risk-on environment.

Still, Taylor repeatedly stressed that the $28 figure is not his central expectation. “That being said, and I want to be very clear on this, this is not my primary target,” he wrote. “My primary target is and has been between eight and twelve dollars, potentially stretching to fifteen or sixteen dollars this cycle. The move toward twenty eight dollars is an outside scenario, not a base case.”

At press time, XRP traded at $1.86.

You May Also Like

Flare Mainnet Launches FXRP, Bringing XRP Into DeFi

Here’s Why Pi Network is Not Processing Your Payment Requests