Bitcoin Rejected at $90K Again, Ethereum Returns Below $3K: Market Watch

It almost feels like a deja vu in the past few weeks, and it happened again on Monday morning as BTC pumped to just over $90,000, only to be rejected violently there and drive immediately south to its starting position.

Most larger-cap altcoins followed suit, with ETH going above and below $3,000 in the span of hours.

BTC Stopped (Yet Again)

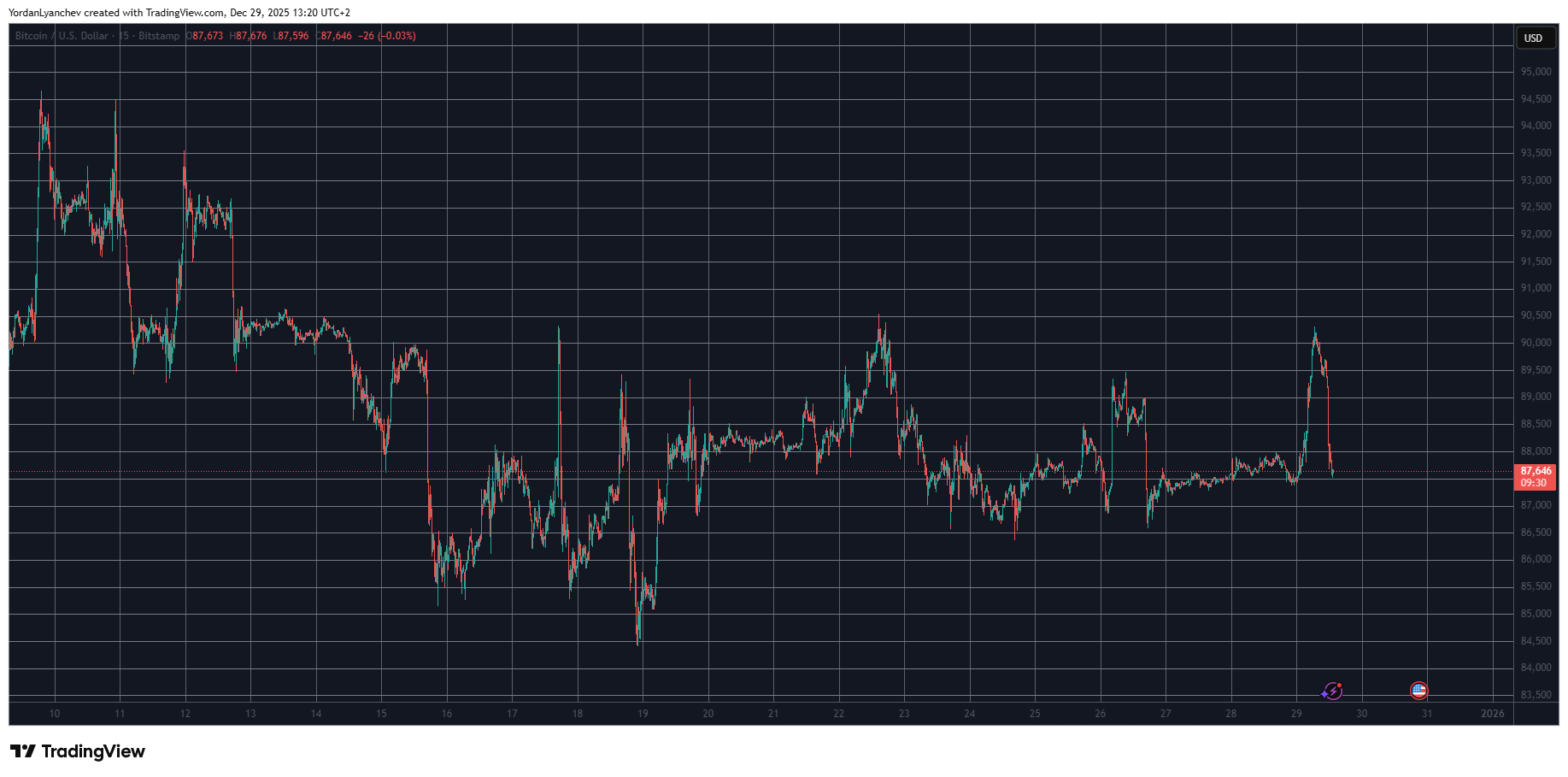

The chart below will clearly demonstrate BTC’s inability to break through the $90,000 resistance despite several attempts in the past few weeks. In fact, it has been rejected at least six times since December 16.

In the previous business week alone, it tried twice but to no avail. Last Monday, it jumped to $90,500 when the bears stepped up and drove it south by four grand in the next couple of days. Another failed attempt took place on Friday, but this time BTC couldn’t even reach $90,000.

What followed were a few days of sideways trading, in which bitcoin remained between $87,000 and $88,000. The bulls went back on the offensive earlier today, driving the cryptocurrency to another weekly high of $90,400.

The scenario repeated once again, though. The dead-cat bounce scenario, which many feared, drove bitcoin back down to under $88,000 as of press time. Its market cap is back to $1.750 trillion, while its dominance over the alts is just over 57% on CG.

BTCUSD Dec 29. Source: TradingView

BTCUSD Dec 29. Source: TradingView

Alts Stopped Too

Ethereum followed the market leader earlier today, surging past $3,000 as it neared $3,050. However, it met the same fate as BTC and is now back to $2,960. BNB has returned to $856, while XRP is beneath the crucial support of $1.90.

On a daily scale, SOL, ZEC, and DOGE are slightly in the green, while BCH has lost the most value from the larger-cap alts. CC is up by almost 4% to nearly $0.125.

The total crypto market cap gained and lost $70 billion in hours today and is now back to $3.060 trillion on CG.

Cryptocurrency Market Overview Daily on Dec 29. Source: QuantifyCrypto

Cryptocurrency Market Overview Daily on Dec 29. Source: QuantifyCrypto

The post Bitcoin Rejected at $90K Again, Ethereum Returns Below $3K: Market Watch appeared first on CryptoPotato.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

Crypto News: Donald Trump-Aligned Fed Governor To Speed Up Fed Rate Cuts?