Upexi Solana Treasury Strategy Tested as Shares Slide 7.5% After $1B Shelf Filing

This article was first published on The Bit Journal.

Shares of Upexi declined after the company disclosed plans to raise new capital through a broad securities filing. The announcement re-evaluated the market attention to the Upexi Solana treasury, which is now at the center of the strategy in the firm.

Shareholders calculated the risk of dilution against the continuous crypto market volatility. It was a cautious response as opposed to surprise.

Upexi Solana treasury Files $1B Shelf Registration as Shares Slide

Upexi filed a shelf registration with the US Securities and Exchange Commission to raise up to $1 billion. The filing allows future issuance of common stock, preferred shares, debt securities, warrants, or units.

Management said the proceeds could support general corporate needs. The move reinforced Upexi’s commitment to the Upexi Solana treasury.

Upexi Shares Slide as Crypto Strategy Shapes Investor Sentiment

Upexi shares closed Tuesday down about 7.5% at $1.84. After-hours trading showed a modest rebound to around $1.92. The price movement highlighted investor sensitivity to capital raises tied to crypto exposure. The Upexi Solana treasury remains a key driver of sentiment.

Also Read: Claude AI Predicts XRP, Solana and Ethereum Crypto Price Outlooks for 2025-2026

Upexi previously focused on consumer products and e-commerce. Its portfolio includes brands such as Cure Mushrooms and Lucky Tail pet care. In late April, the company pivoted toward a crypto treasury model. Since then, the Upexi Solana treasury has defined its public identity.

Upexi holds about 2.1 million SOL valued near $262.3 million. CoinGecko data ranks it as the fourth-largest corporate holder of Solana. This position places the Upexi Solana treasury among the most significant public crypto treasuries. The scale also increases exposure to price swings.

Source: Upexi

Source: Upexi

Treasury Performance and Losses

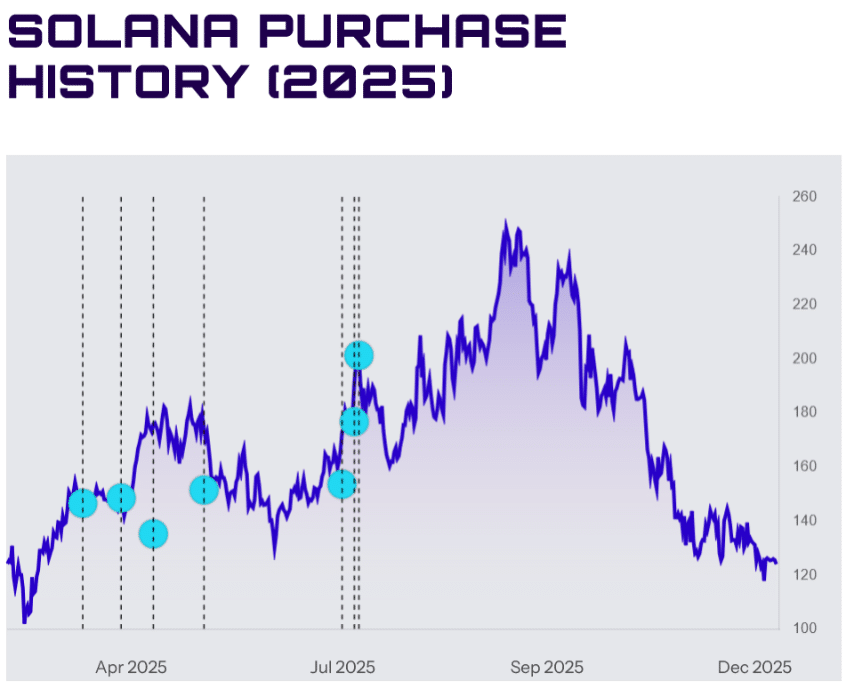

The company last purchased Solana on July 23. Since then, token prices have declined. The value of the Upexi Solana treasury peaked near $525 million in mid-September. At current levels, the company is carrying a paper loss of roughly 19%.

Slowing Corporate Crypto Accumulation

Corporate purchases of Solana have slowed in the second half of 2025. The slowdown follows a broader crypto market pullback. Confidence in treasury-heavy strategies has weakened. These trends add pressure to the long-term outlook of the Upexi Solana treasury.

Upexi said proceeds from future securities sales may fund working capital needs. Other uses include research and development, acquisitions, and debt repayment.

The company did not confirm when or if securities will be issued. Any expansion of the Upexi Solana treasury would depend on market conditions.

Solana Network Resilience

Solana recently withstood a large distributed denial-of-service attack. Traffic peaked near 6 terabits per second and lasted more than a week.

Network activity continued without disruption, according to SolanaFloor data. The incident supports confidence in the asset backing the Upexi Solana treasury.

Broader Market Context

The attack placed Solana alongside major infrastructure providers like Google Cloud and AWS. Validators absorbed the traffic without performance issues.

This resilience contrasts with earlier periods of congestion. Network stability remains a positive factor for the Upexi Solana treasury despite price volatility.

Conclusion

Upexi’s planned capital raise underscores its long-term bet on digital assets. The Upexi Solana treasury offers potential upside but carries clear risks.

Market reaction shows growing caution toward crypto-based balance sheets. Future performance will depend on both token prices and investor confidence.

Also Read: Solana Liquidity Is Crashing But Analysts Say a Major January Rebound Is Coming

Appendix: Glossary of Key Terms

Shelf Registration: This is a regulatory filing that enables a company to issue securities not in one offering, but over time.

Solana (SOL): It is a high-throughput blockchain network utilized in decentralized applications and the transfer of digital assets.

Corporate Crypto Treasury: This is a balance-sheet model in which companies retain cryptocurrencies as reserve assets.

Staking Rewards: This is a token earned by staking crypto assets to aid in securing a blockchain network.

Paper Loss: Hypothetical loss of the unrealized loss, which is caused by the decrease in the price of the holdings without selling them.

Market Dilution: This is defined as the decrease in the share ownership of the existing shareholders as a result of the issuance of new securities.

DDoS Attack: A network attack that floods the network with traffic to interrupt the regular functions.

FAQs About Upexi Solana Treasury

1- What is the Upexi Solana treasury

It refers to Upexi’s strategy of holding Solana tokens as a core treasury asset and staking them for rewards.

2- How much Solana does Upexi hold

The company holds about 2.1 million SOL, valued at roughly $262 million.

3- Why did Upexi file to raise $1 billion

The filing gives flexibility to raise capital for general corporate purposes and potential treasury expansion.

4- Why did Upexi shares fall

Investors reacted to dilution risk and continued exposure to crypto market volatility.

References

CoinTelegraph

CryptoNews

Read More: Upexi Solana Treasury Strategy Tested as Shares Slide 7.5% After $1B Shelf Filing">Upexi Solana Treasury Strategy Tested as Shares Slide 7.5% After $1B Shelf Filing

You May Also Like

The Channel Factories We’ve Been Waiting For

What is the Outlook for Digital Assets in 2026?