Is it a good time to buy the bottom of Bitcoin? Let the data chart speak for itself

Author: Crypto Stream

Compiled by: Tim, PANews

Is now the best time to buy the dip in Bitcoin?

The market plunged 10% overnight, completely offsetting the rising effect of the US strategic cryptocurrency reserve. Retail investors are panic selling and market sentiment has dropped to freezing point. But the actual situation may be better than it seems. Here are my market views:

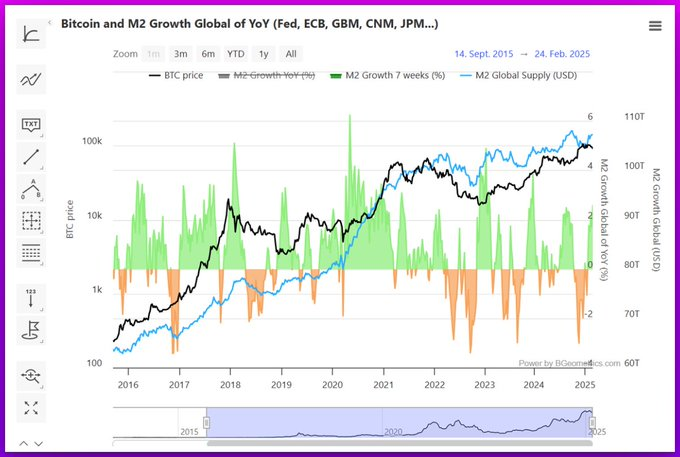

Why can the global M2 money supply drive Bitcoin's rise?

Bitcoin is extremely sensitive to changes in the global money supply. As the "most sensitive asset" to liquidity changes (a term coined by global liquidity research firm CrossBorder Capital), experts estimate that its correlation with money supply is as high as 40%.

Analysis of the current trend of M2 money supply:

The M2 supply has bottomed out around January this year. Historical data shows that the impact of M2 on Bitcoin prices has a lag effect of 40-70 days. This means that its bottoming-out liquidity will most likely drive Bitcoin up in the medium term, and this transmission mechanism may take effect as soon as 20 days later.

Analysis on the impact of tariff policies on the market

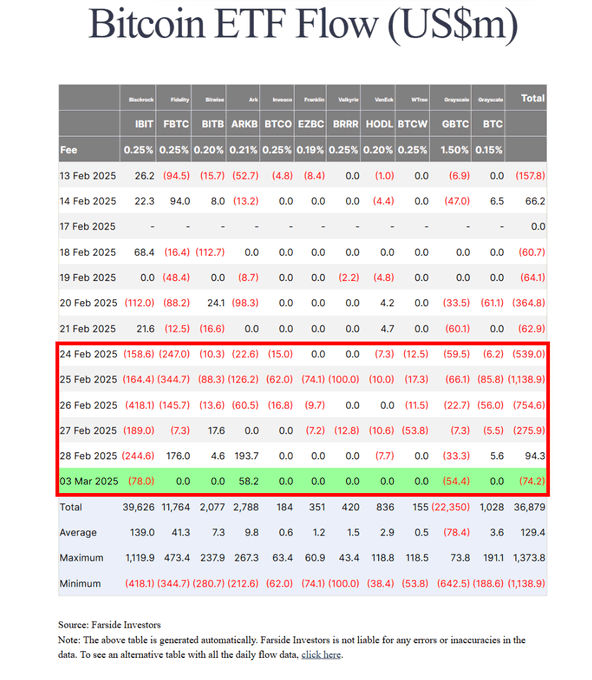

Trade war fears are hitting the market, and the decline in US risk appetite is a significant negative for risk assets. But I think the impact of tariffs has been fully digested by the market, and the primary verification indicator is the flow of ETF funds:

ETF fund flows and changes in market expectations

The outflow of ETF funds has slowed down significantly. Institutional investors have basically completed pricing in the impact of tariffs last week, and it is expected that there will be no larger-scale withdrawal of funds this week. It is worth noting that there are signs of bargain-hunting inflows in the market.

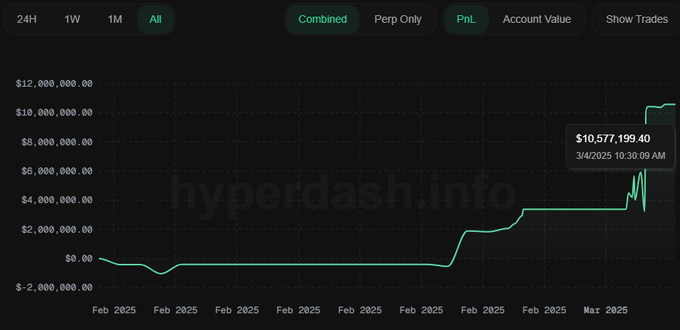

Selling crowd analysis

The current selling pressure mainly comes from two groups: retail investors who sell in panic, and institutional players who are well prepared. It is worth noting that retail investors may have misjudged expectations of policy delays.

Technical Analysis of CME Futures Gap

Another potential negative factor is the CME Bitcoin futures gap. This phenomenon refers to the gap between the Bitcoin spot price and the futures opening price when the CME exchange is closed for the weekend. Although the gap does not necessarily trigger an immediate sell-off, the common psychological expectation of traders that the gap must be filled will increase short-term selling pressure. It is worth noting that the technical gap was filled on March 4, and this influencing factor has been eliminated from the current price equation.

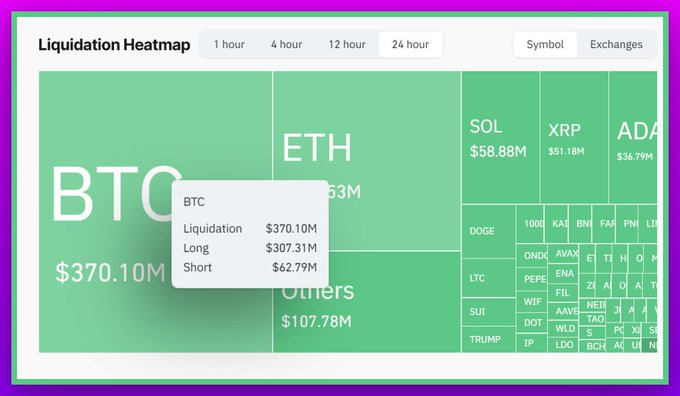

Based on the above analysis, we can summarize the three core driving factors that led to yesterday's price fluctuations:

• Insiders shorted after the announcement

• Long positions are forced to close

• A large influx of new short positions

Finally, I think there are not many negative factors left at the moment, and we can focus on the positive news that may come on March 7.

BTC prices have fallen back to pre-announcement levels, and I think buying at current levels offers an excellent risk-reward ratio.

You May Also Like

Flora Growth Announces $401M Funding to Boost AI Zero Gravity (0G) Coin Treasury

Highlights: Flora Growth announces $401M PIPE financing round aimed at establishing an AI Zero Gravity (0G) coin treasury. DeFi Development Corp. led the fundraising exercise with strong support from other companies. Flora Growth will rebrand to ZeroStack following the successful completion of the PIPE financing round. One of the world’s leading decentralised artificial intelligence (AI) treasury companies, Flora Growth, has announced the pricing of a $401 million private investment in public equity (PIPE) round. According to a September 19 press release, the move aims to fund the firm’s treasury strategy centred on AI Zero Gravity (0G) tokens. Upon completion of the PIPE round, Flora Growth will rebrand to ZeroStack, while still maintaining its current market ticker symbol, FLGC. Notably, the financing round is expected to close on or before September 26, 2025, pending customary approvals. Flora Growth Corp. (NASDAQ: FLGC) announced a $401 million PIPE financing led by Defi Development Corp., Hexstone Capital, and CSAPL. 0G Co-Founder Michael Heinrich will become Executive Chairman. The deal is expected to close on September 26. The company will adopt $0G as its… — Wu Blockchain (@WuBlockchain) September 19, 2025 Flora Growth Announces $401M PIPE with Strong Backing from Leading Crypto Firms DeFi Development Corp. (DFDV), the first treasury firm focused on Solana (SOL), led the financing round with a $22.88 million investment. Other partners included Hexstone Capital, Dispersion Capital, Blockchain Builders Fund, Carlsberg SE Asia PTE Ltd (CSAPL), Abstract Ventures, Salt, and Dao5. The fundraising exercise has already generated $35 million in cash commitments and $366 million worth of in-kind digital assets. Flora Growth sold its common shares and pre-funded warrants to investors at $25.19 per share. The company also pegged 0G tokens contribution at $3 per coin, adding that investors paying either cash or 0G tokens will also receive pre-funded warrants, exercisable once shareholder approval is granted. A big NASDAQ company (Flora Growth) just announced they’re raising $401 million. ︎ They plan to buy and hold $0G tokens as part of their company’s savings/treasury. Flora’s deal values $0G at around $3 per token for their planned purchase. Right now $0G is trading below… pic.twitter.com/qhOa3uT5ii — Jimmywontgiveup(Ø,G) (@jimmywontgiveup) September 20, 2025 Flora Growth Plans to Hold SOL in Its Treasury Flora Growth noted that it plans to hold part of its treasury in SOL. Joseph Onorati, the CEO of DeFi Development Corp., spoke on the partnership.“We’re thrilled to partner with FLGC on this fundraiser and look forward to driving a deep collaboration between 0G and Solana,” the CEO stated. Daniel Reis-Faria, Flora Growth’s incoming Chief Executive Officer (CEO), also spoke on the company’s latest initiative. He explained that the move encompasses financial restructuring and support for adopting AI infrastructures. The CEO commented: “This treasury strategy offers institutional investors equity-based exposure, enabling transparent, verifiable, large-scale, cost-efficient, and privacy-first AI development.” A Brief 0G Token Overview, Highlighting Reasons for Flora Growth’s Interest 0G is gaining significant traction, which has made experts describe the token as a breakthrough in decentralised AI. 0G’s model trained a 107 billion AI parameter model, representing a 357x improvement over Google’s DiLoCo research, challenging the idea that huge centralised data centres are needed for such projects. The 0G network proved that a decentralised network is highly effective for cost-effective computations, with transparent and privacy-first solutions. Unlike other AI blockchains, 0G integrated its computation, storage, and training marketplace into one platform, attracting Web2 and Web3 developers. In related news, Crypto2Community reported that Brera Holdings, an Ireland-based company, completed a $300 million PIPE financing round for a Solana-focused treasury on September 19. The fundraising program was led by Pulsar Group, a blockchain advisory firm based in the UAE. It received strong backing from the Solana Foundation, RockawayX, and ARK Invest. Like Flora Growth, Brera Holdings also rebranded to Solmate. eToro Platform Best Crypto Exchange Over 90 top cryptos to trade Regulated by top-tier entities User-friendly trading app 30+ million users 9.9 Visit eToro eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.