What Awaits Bitcoin Price in 2026? Analysts See ‘Mixed’ Signals

Key Takeaways:

- Bitcoin ends 2025 below $100,000, with price action failing to confirm expectations of a late-year rally.

- Market signals remain “mixed”, with no clear indication of whether the current move is a temporary correction or the start of a broader bearish phase.

- On-chain data shows long-term holders remained in net distribution after the autumn price drop, pointing to continued caution rather than renewed accumulation.

- Institutional demand weakened after October, with Bitcoin ETF flows turning negative amid macroeconomic uncertainty and shifting risk appetite.

- At the same time, wallets holding 100 to 1,000 BTC increased accumulation following the October decline, suggesting large players remain active at current levels.

- Analysts view 2026 less as a fresh cycle and more as a later phase of the post-halving period, shaped by macro conditions rather than a single market narrative.

- In This Article

-

Bitcoin Price Signals ‘Mixed’ ExpectationsA ‘Soft’ Bear Market?Whales Are Still HereConclusionKey Crypto & Macro Events to Watch in January 2026

- In This Article

-

Bitcoin Price Signals ‘Mixed’ Expectations

-

A ‘Soft’ Bear Market?

-

Whales Are Still Here

- Show Full Guide

-

Conclusion

-

Key Crypto & Macro Events to Watch in January 2026

Bitcoin failed to deliver the rally many had expected in October. November followed without a clear upside move, and the traditional “Christmas rally” materialized either. This raises a familiar question: have old metrics stopped working, or have market cycles themselves changed?

Bitcoin has now lost the $100,000 level. At this stage, it remains unclear whether the current move is a temporary pullback before renewed growth or the beginning of a gradual shift toward a broader bearish phase.

In 2025, Bitcoin set several new all-time highs (ATHs). BTC climbed above $126,000 but never reached the widely anticipated $130,000 mark. The local low for the year stands at $74,000. The key question now is whether Bitcoin could revisit those levels or manage to hold above $80,000 as a base for further growth.

In this Cryptonews report, we examine how Bitcoin is approaching the end of 2025 and what this positioning may signal for 2026.

Bitcoin Price Signals ‘Mixed’ Expectations

Cryptonews has previously noted that market sentiment shifted after the October crypto sell-off but remained mixed. Price action suggests a local downtrend, yet there is no clear dominance of bears over bulls. At the same time, bullish momentum also appears limited.

Bitcoin’s recent price action reflects these “mixed” expectations. Abbass Abdul Sater, Head of Sales at Capital.com, told Cryptonews that a wide range of factors continues to shape Bitcoin’s performance, making market sentiment more complex and harder to interpret this year:

Abdul Sater notes that several scenarios remain on the table. One of them points to slower growth in 2026, reflecting broader economic conditions:

He also highlights the limits of cycle-based expectations, stressing that Bitcoin remains closely tied to macroeconomic conditions:

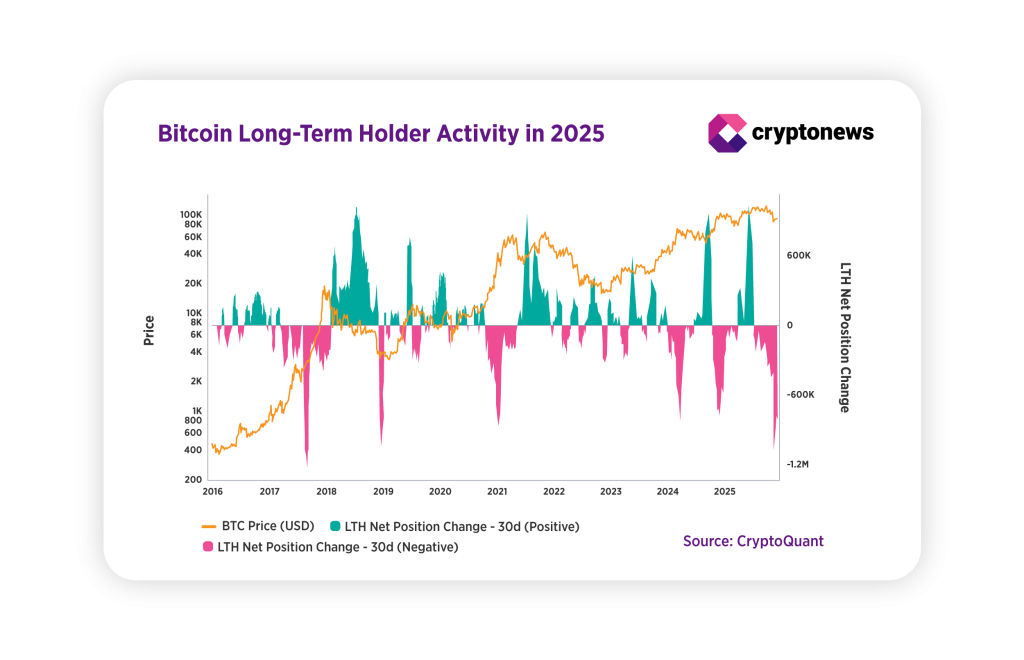

On-chain data supports the view that expectations around Bitcoin remain “mixed”. Since autumn 2025, long-term holders have stayed in net distribution. Following Bitcoin’s price drop, the LTH net position change remained predominantly negative, indicating continued reductions in holdings rather than renewed accumulation. Despite periods of price stabilization, long-term holder behavior did not return to sustained positive territory.

A ‘Soft’ Bear Market?

Analysts at CryptoQuant believe Bitcoin entered a bearish phase following the October drop. One indicator they point to is the decline in capital inflows. Earlier in the year, strong demand was driven by institutional participation, including Bitcoin ETFs and corporate Bitcoin treasuries. The U.S. presidential election also added interest in crypto. Paradoxically, these same factors now appear to be weighing on Bitcoin price and the broader market.

Bitcoin ETF holdings data shows capital outflows after October, similar to what was observed in February and March. This time, however, the picture is complicated by weak macroeconomic data and uncertainty around interest rates. The decline is visible but remains moderate. Political uncertainty has also contributed, pushing investors, including large players, toward lower-risk positioning.

Leo Fan, co-founder of Cysic, told Cryptonews that the impact of the broader economic environment on Bitcoin became much more pronounced this year, catching many investors off guard:

Whales Are Still Here

On-chain data shows a sharp increase in activity among Bitcoin wallets holding between 100 and 1,000 BTC following the October drop. During this period, one of the strongest spikes in net accumulation this year was recorded, pointing to a meaningful rise in aggregate Bitcoin holdings within this group.

This does not mean that Bitcoin price is set for a rapid reversal. The market likely needs time to absorb the correction and remain in an accumulation phase. At the same time, the data does not point to capitulation. Despite declining ETF flows, metrics suggest the market has not entered a final distribution phase.

The behavior of so-called “sharks” indicates that these holders may not view current levels as the end of the cycle or may still be positioning for another growth phase.

As Abdul Sater adds:

Conclusion

As Bitcoin moves toward 2026, the outlook remains unclear. The market is neither clearly bullish nor fully bearish, and there is still no single trend driving price action. Data, institutional flows, and investor behavior all point to a period of adjustment rather than a strong directional move.

Rather than a sharp rally or a deep downturn, Bitcoin price looks set to trade in a range. With questions over whether that range will form near current levels or further down. Its performance increasingly reflects broader economic conditions and shifts in risk appetite, rather than purely crypto-specific cycles.

As Abbass Abdul Sater explains:

Key Crypto & Macro Events to Watch in January 2026

January 5

• S&P Global Services PMI (December) – USD

• ISM Manufacturing PMI (December) – USD

• ISM Manufacturing Prices (December) – USD

January 7

• CPI (YoY) (December) – EUR

• ADP Nonfarm Employment Change (December) – USD

• ISM Non-Manufacturing PMI (December) – USD

• ISM Non-Manufacturing Prices (December) – USD

• JOLTS Job Openings (November) – USD

January 9

• Average Hourly Earnings (MoM) (December) – USD

• Nonfarm Payrolls (December) – USD

• Unemployment Rate (December) – USD

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice.

You May Also Like

House Judiciary Rejects Vote To Subpoena Banks CEOs For Epstein Case

Propel to Report Q4 and Full Year 2025 Financial Results and Announces Dividend Increase