Bitcoin (BTC) Risks 80% Drop? Peter Brandt Flags Parabolic Collapse

Bitcoin is trading near $89,800 following a week of mild losses. The asset is down slightly in the past 24 hours and 2% over the last 7 days. While the price action remains above the $89,000 mark, technical analysts are raising caution as long-term indicators begin to shift.

Among them, veteran trader Peter Brandt has warned that Bitcoin may be at risk of an extended decline if historical patterns repeat.

Parabolic Breakdown Signals Deeper Correction

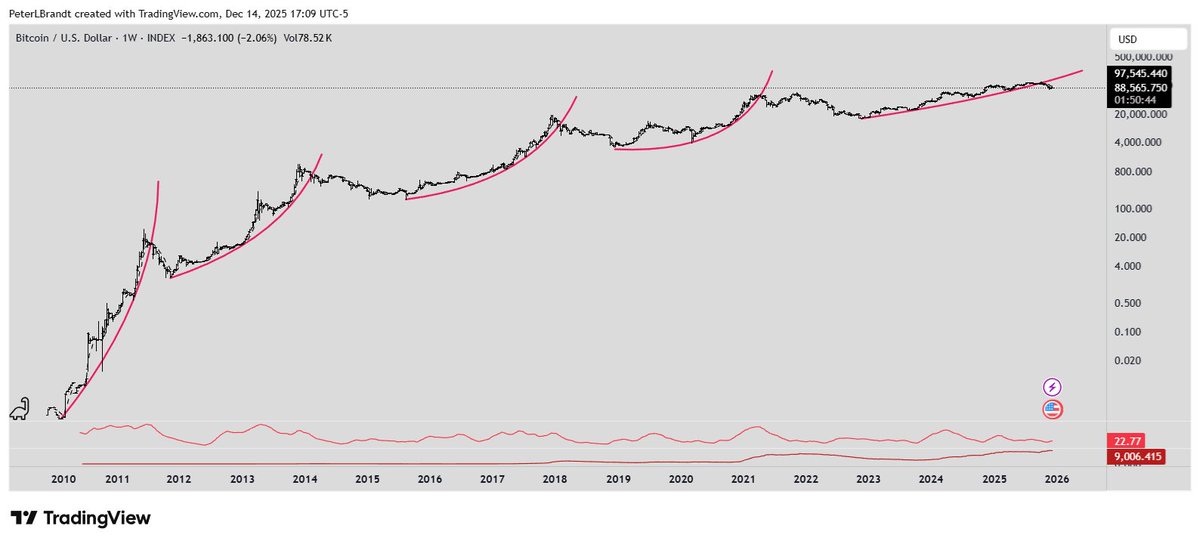

Peter Brandt has shared a chart suggesting Bitcoin has broken below its current parabolic trend, similar to previous cycle tops. According to the veteran trader, each of BTC’s bull cycles has ended with a violation of a steep parabolic curve. When these curves broke in the past — in 2011, 2013, 2017, and 2021 — the asset dropped more than 80%.

Bitcoin (BTC) Price Chart 15.12. Source: Peter Brandt/X

Bitcoin (BTC) Price Chart 15.12. Source: Peter Brandt/X

Brandt wrote, “The violation of previous parabolas has all declined <80%,” and noted that the current parabolic advance has now been breached. He also stated that a drop to 20% of the all-time high would place Bitcoin near $25,240. While not a forecast, the historical comparison raises caution among traders tracking long-term patterns.

Furthermore, other analysts have pointed to bearish shifts in technical signals. Ali Martinez shared that the SuperTrend indicator on the weekly Bitcoin chart has turned negative. The last time this occurred, the asset dropped 60% over several months. Martinez noted,

Aristotle Investments also mentioned that Bitcoin has broken down from a bear flag pattern. Historically, such patterns have led to 75% declines from all-time highs. The firm suggests BTC could retest the $60,000 to $75,000 range if the current structure plays out.

Key Resistance at $90K in Focus

Analyst Michaël van de Poppe stated that Bitcoin is currently testing a major resistance zone around $90,000. He noted that the asset closed the CME gap and recovered from a local low but remains in a consolidation phase.

A breakout above that range could push the price toward the $100,000 mark. However, he also warned that if $90K holds as resistance, Bitcoin could revisit lower levels. Support zones between $88,500 and $80,500 remain active, with $87,700 seen as a short-term bounce area. The market remains at a decision point.

Meanwhile, the crypto market is also bracing for potential volatility driven by macroeconomic events. Traders are watching for key inflation data due this week, as well as a possible rate cut by Japan’s central bank. On-chain signals show Bitcoin holding above a key support area, but some analysts suggest that recent leverage flushes may indicate manipulation without clear direction.

The post Bitcoin (BTC) Risks 80% Drop? Peter Brandt Flags Parabolic Collapse appeared first on CryptoPotato.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

Will XRP Price Increase In September 2025?