66% of 2025 BTC Short-Term Holders in Profit – Surprising Market Insight

Bitcoin Short-Term Holders Maintain Profits Despite Negative Year-to-Date Performance

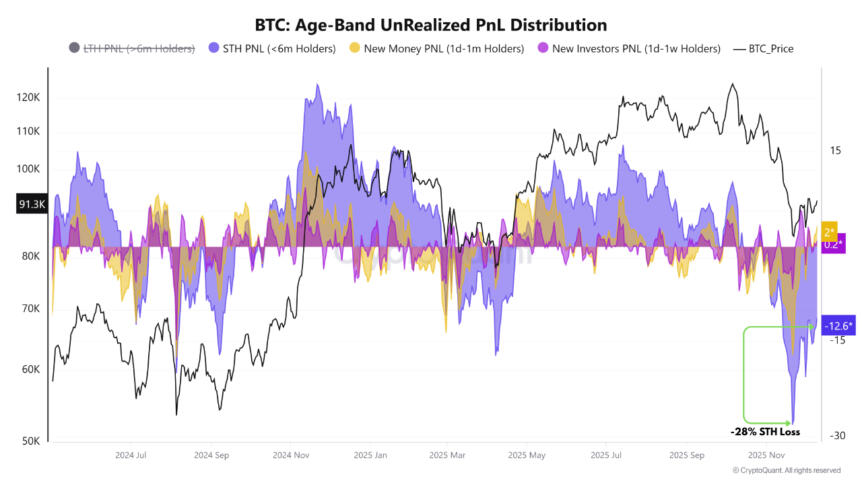

Despite Bitcoin’s significant decline this year, with prices struggling to sustain above $100,000 and registering negative returns, short-term holders have demonstrated resilience by remaining profitable for the majority of 2025. An analysis of on-chain data reveals a nuanced market structure that counters the apparent weak performance, shedding light on investor behavior and potential market stability.

Key Takeaways

- Bitcoin short-term holders experienced profit in 66% of the days in 2025, even amid declining prices.

- The realized price of around $81,000 served as a critical sentiment pivot, separating phases of panic from recovery.

- Unrealized losses narrowed from -28% to -12%, indicating diminishing capitulation and market exhaustion.

- The market’s recent rebound above the realized price suggests potential stabilization and future growth.

Market Dynamics and On-Chain Insights

The volatility observed throughout 2025 can largely be attributed to the behavior of Bitcoin’s one-to-three-month short-term holder cohort. As illustrated in recent analyses, Bitcoin’s price repeatedly oscillated around its realized price, creating alternating waves of profitability and losses as reflected in the Net Unrealized Profit/Loss (NUPL) metric. Early in the year, Bitcoin remained above this cost basis for nearly two months, providing short-term holders with their initial sustained profits.

However, during the February and March decline, prices dipped below the realized price, dragging short-term holder NUPL into deep red territory and marking one of the year’s longest periods of losses. Momentum shifted again from late April through mid-October, when Bitcoin’s recovery caused broad green zones in the data, reflecting over 172 days of predominantly profitable activity among short-term investors. Despite broader bearish sentiments, these recoveries kept short-term profitability higher than market narratives suggested. Recently, in late October, the price slipped back below the realized price, initiating a 45-day period of losses coinciding with increasing red NUPL regions.

Bitcoin short-term realized price and NUPL ranges. Source: CryptoQuantThis pattern indicates that short-term holder profitability in 2025 was driven more by the frequency of Bitcoin reclaiming its realized price than by its overall directional trend. Frequent rebounds above this level allowed many traders to exit with profits, even within a negative YTD environment. Currently, the rebound towards approximately $92,500 has reduced unrealized losses from -28% to -12%, signaling easing selling pressure and decreasing emotional exhaustion among holders.

Bitcoin age-band unrealized profit and loss distribution. Source: CryptoQuant

Bitcoin age-band unrealized profit and loss distribution. Source: CryptoQuant

Interacting near the $81,000 realized price remains a critical psychological support, with new investors entering close to breakeven. Should Bitcoin sustain these levels and improve short-term profitability, the current correction phase could be nearing its end, paving the way for a new expansion cycle.

This article was originally published as 66% of 2025 BTC Short-Term Holders in Profit – Surprising Market Insight on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

XRP Ignites As Spot Volume Skyrockets

Bitcoin-themed tram rolls out in Milan, Italy