UK Government to Start Tracking All Crypto Transactions

Key takeaways:

- Beginning Jan. 1 crypto exchanges will automatically share all transactional data on UK customers with HMRC.

- Robin Thatcher said he expects an increase in targeted compliance checks.

- HMRC will use this data to cross-check against information provided in self-assessment tax returns.

\

\ Starting January 1, 2026, all cryptocurrency exchanges operating in the United Kingdom must collect and share full crypto transactional data of all UK users with HM Revenue & Customs (HMRC).

This change to HMRC's rules, which currently relies on voluntary disclosure, will allow for the automatic sharing of all UK users' full transactional crypto data including personal information such as name and National Insurance number.

This comes as the HMRC implements the Cryptoasset Reporting Framework (CARF) which is the OECD's new standard for automatic, cross-border crypto data exchange between tax authorities worldwide.

\

\ HMRC says CARF will "increase tax transparency" and "help tackle tax avoidance and tax evasion" without replacing or amending existing legislation.

The UK, alongside a total of 47 jurisdictions, including Germany and France, have committed to implementing the framework by 2027 with the United States, Singapore and others expected to follow suit by 2029.

Robin Thatcher, founder of CryptoTaxHelp, said: "I think CARF is quite dangerous in terms of the volume of extra data HMRC will be handling."

"That said, I also understand why it’s happening. In my experience, we estimate that around 80 percent of people do not correctly comply with crypto tax rules."

Thatcher described the change as "a major shift," giving HMRC "vastly better visibility and the ability to focus resources on non-compliant users rather than blanket enquiries. In practice, I expect an increase in targeted compliance checks once the data starts flowing."

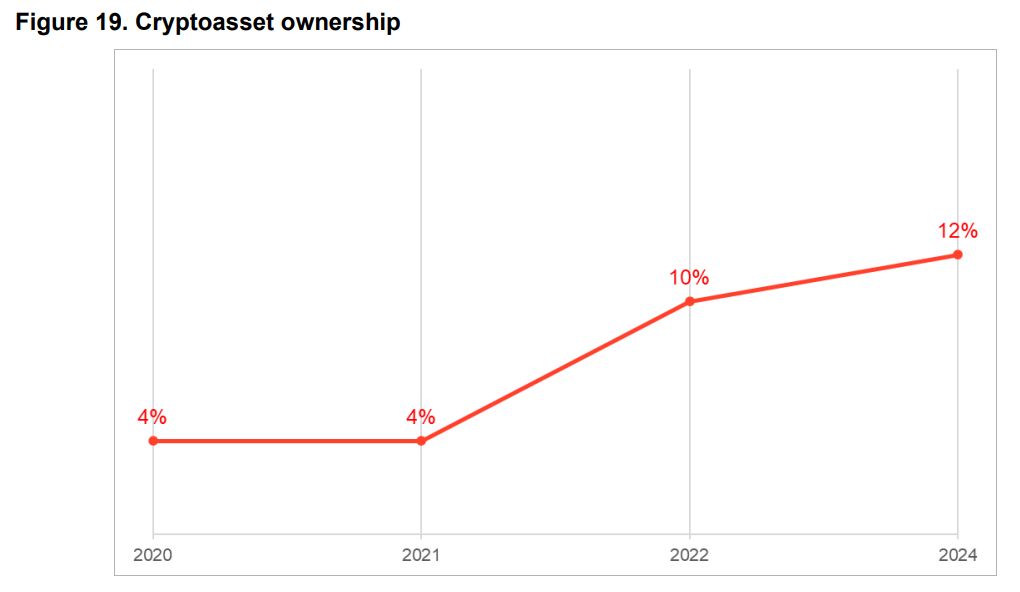

The regulation is set to affect millions of customers as "12% of UK adults now own crypto" according to FCA research in 2024.

\

\ However, "whenever regulations tighten, some users will naturally drift toward offshore or unregulated platforms" said Thatcher when asked if these new rules could discourage crypto withdrawals.

"But privacy is not illegal, and protecting personal financial data is key for anyone who values safety and sovereignty. There is a balance to be found, and I’m not convinced CARF has found it yet."

HMRC is expected to publish more detailed guidance for crypto exchanges and taxpayers before the rollout of CARF on January 1.

\

\

:::info Thank you for reading.

Disclaimer: This article is for informational and educational purposes only and should not be taken as financial advice. Always DYOR & trade intentionally.

:::

\

You May Also Like

Is Putnam Global Technology A (PGTAX) a strong mutual fund pick right now?

QNT Technical Analysis Jan 21