Sei token rises on Xiaomi partnership for pre-installed crypto wallets

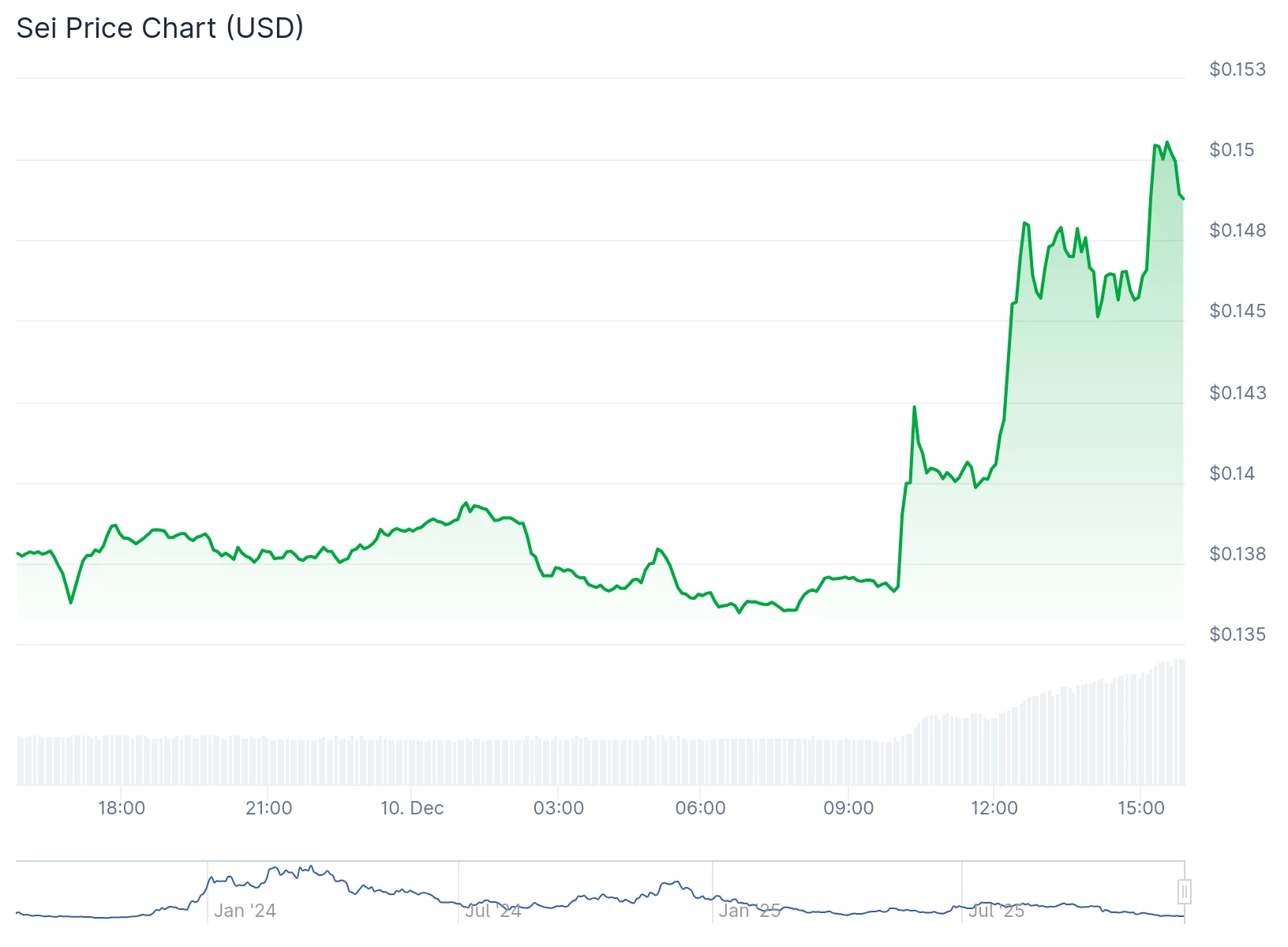

The Sei token, native to the layer-1 blockchain network Sei, gained value on December 10, following the announcement of a strategic partnership with Xiaomi Corporation to integrate crypto wallet technology into the smartphone manufacturer’s devices.

- Sei token jumped after the network announced a partnership with Xiaomi to pre-install a Sei crypto wallet on new smartphones.

- Integration targets Europe, Latin America, Southeast Asia, and Africa, enabling dApp access and peer-to-peer transfers.

- Sei Labs and Xiaomi project tens of millions of new users, supported by Sei’s new $5M Global Mobile Innovation Program.

The token posted intraday gains while most major cryptocurrencies traded lower, according to market data. The collaboration will embed a Sei crypto wallet application directly into new Xiaomi smartphones.

Sei Labs, the development team behind the Sei blockchain, announced the collaboration with Xiaomi on December 10, 2025. The partnership aims to deliver crypto wallet functionality to Xiaomi’s global user base through a pre-installed application on the company’s devices.

The integration will feature a pre-installed crypto wallet on new Xiaomi smartphones distributed outside mainland China and the United States, according to the announcement. Initial rollout targets include Europe, Latin America, Southeast Asia, and Africa.

Xiaomi holds over 36% of the smartphone market in Greece and over 24% in India, according to market data. The company sold over 168 million devices in 2024, accounting for 13% of global market share. The pre-installed wallet will support onboarding through Google or Xiaomi account credentials.

The partnership will support decentralized applications, peer-to-peer transfers, and consumer-to-business transactions, according to the companies. Sei and Xiaomi plan to enable stablecoin transactions using assets such as USDC on the Sei network, with stablecoin payments scheduled to launch in Hong Kong and the European Union by the second quarter of 2026.

Jeff Feng, co-founder of Sei Labs, called the collaboration with Xiaomi a watershed moment.

“By embedding Sei’s high-performance infrastructure directly into one of the world’s most popular smartphone ecosystems, we’re not just solving the onboarding problem—we’re reimagining how billions of users will interact with digital assets in their daily lives,” he added.

Sei has committed $5 million to a Global Mobile Innovation Program, according to the announcement. The initiative will fund developers and startups building blockchain applications for consumer devices.

The partnership could onboard tens of millions of new users annually to the Sei platform, according to company projections. The integration targets wallet-based expansion in emerging markets.

You May Also Like

The USDC Treasury burned $50 million worth of USDC on the Ethereum blockchain.

Crossmint Partners with MoneyGram for USDC Remittances in Colombia