When AI meets RWA, how can on-chain real estate Propy create an efficient disintermediation model under the trend of artificial intelligence?

Author: Weilin, PANews

The tokenization of real-world assets (RWA) is one of the fastest growing sectors in this crypto cycle. According to rwa.xyz, as of March 10, the on-chain asset value of real-world assets reached $17.925 billion, a significant increase of 95.64% over the past year, compared to $9.162 billion in the same period last year.

RWA is bringing more possibilities to the crypto world, and at the same time, artificial intelligence and RWA are also being organically combined. For example, the blockchain-based real estate RWA project Propy has effectively increased its profit margin to 40% by adopting AI technology, realizing 7x24 hours of online property rights transactions, and bringing the high efficiency, transparency and security unique to the crypto world.

Propy: AI empowers real estate transactions and creates an efficient disintermediation model

RWA's leading real estate project Propy supports real estate asset chain, smart contracts and real estate tokenization, realizing the convenience and security of cross-border real estate transactions. Propy has three core products, namely Propy real estate trading platform , Propy property rights and custody services , and PropyKeys . Propy is committed to innovating the traditional real estate industry with blockchain technology to solve the pain points of too many intermediaries, slow processes, and possible fraud in transactions.

Among them, PropyKeys is based on Ethereum Layer 2 network Base to realize the tokenization of real estate. In March last year, PropyKeys was officially opened to the public. Users can mint and store on-chain addresses corresponding to physical properties and property certificates through the PropyKeys app. PropyKeys has now officially exceeded 300,000 minting addresses worldwide.

Propy uses artificial intelligence technology, becoming a noteworthy example of the combination of AI and blockchain. Real estate professionals can now say goodbye to time-consuming manual data entry and easily close deals, saving valuable time and energy.

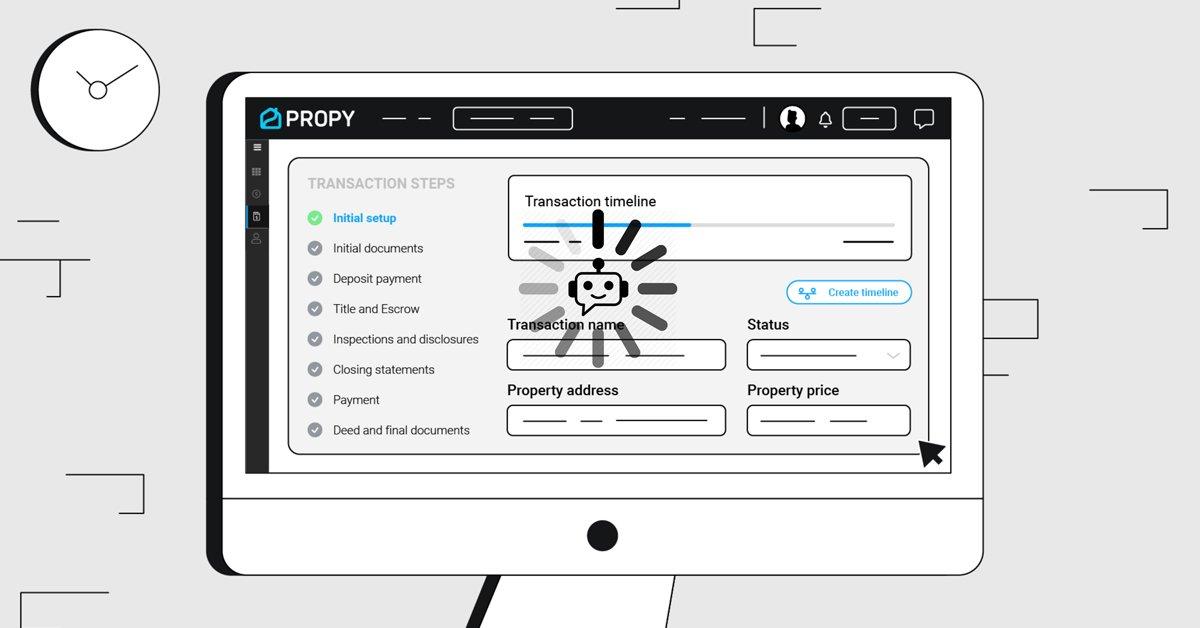

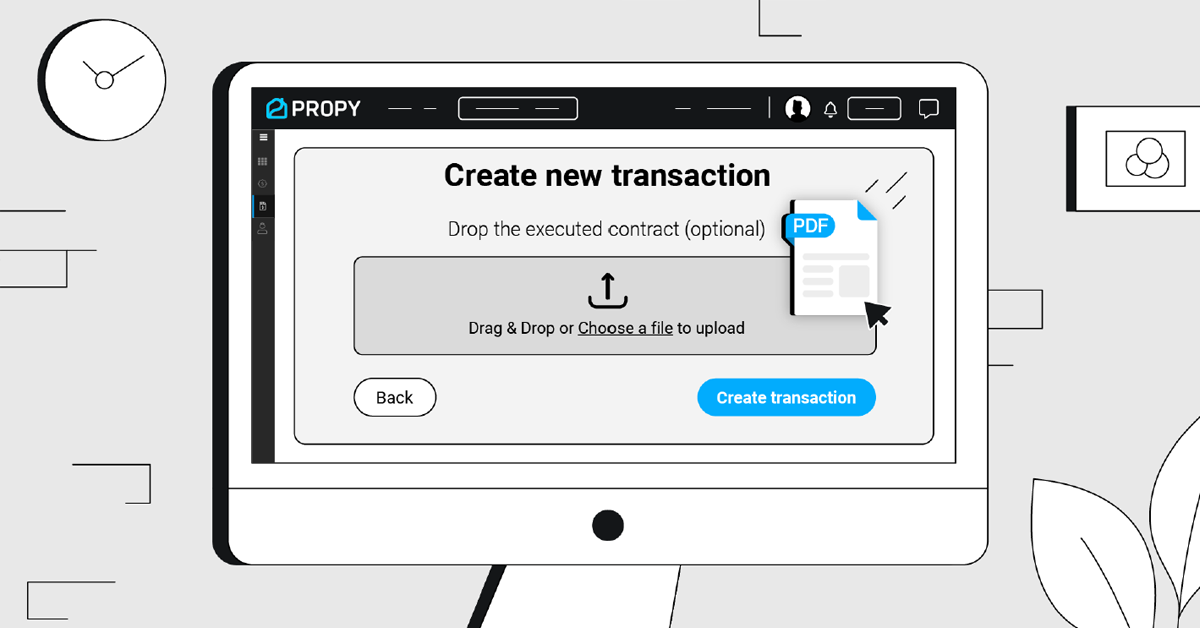

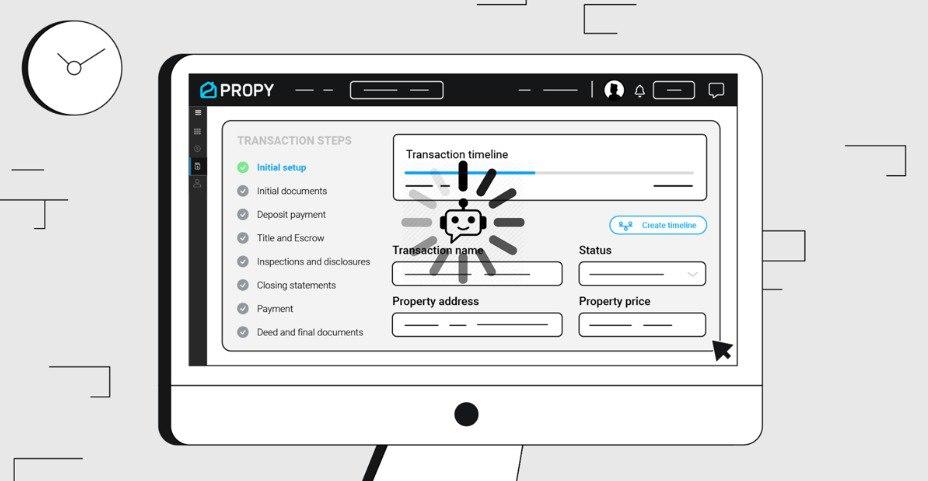

In order to provide the most advanced tools, the Propy platform has created a transaction timeline to help agents, sellers, and buyers clearly understand the timing of each transaction step. Managing the transaction timeline is a breeze with Propy AI, which automatically reads the home purchase agreement, generates a transaction tracker for the user, and initiates the settlement process.

It also intelligently adds deadlines to each stage of the transaction, guiding all parties involved to know when to pay the first and second deposits, when to complete loan approval, etc. - all in an instant. Say goodbye to cumbersome paperwork and endless information communication, now real estate transactions have become more efficient and convenient.

Recently, Propy also launched an online marketing campaign Own Your Tomorrow, where investors and users can win different numbers of PRO tokens by sharing promotional videos, registering and inviting friends, and recommending friends to use the crypto escrow service (Crypto Escrow). Users can learn more here .

As the leader in the real estate RWA track, Propy continues to promote the implementation of innovative ideas. In January of this year, Propy launched a new loan product that supports the mortgage of crypto assets to purchase Hawaiian apartments. The starting price of the apartment is 250,000 USDC. As an on-chain RWA asset, buyers can skip the traditional 30-day transaction process and achieve almost instant transactions by paying cryptocurrencies. On February 2, Propy announced the successful sale of this Hawaiian real estate asset-through multiple on-chain quotes, and finally completed the transaction through the first Bitcoin-backed loan. In October 2024, Propy also launched a cryptocurrency third-party custody service based on the Coinbase Prime platform and services. These latest developments further provide high-quality services for real estate assets to be put on the chain and for fast, efficient and secure transactions, becoming the latest adoption scenario for the combination of RWA and AI.

AI+RWA trend is rising, and real estate may become a key application field

From a broader perspective, the RWA track that Propy has been deeply involved in is gradually becoming a new engine for the crypto market, releasing a steady stream of growth momentum. The core concept of RWA is to digitize various assets in the traditional financial market (such as bonds, real estate, stocks, artworks, private equity, etc.) and convert them into tokenized assets that can be traded, mortgaged or borrowed on the chain through blockchain technology. This process not only enhances the liquidity of assets, but also reduces the friction costs in the traditional financial market, such as long transaction settlement time, high intermediary costs, and limited liquidity.

Now, a new RWA development trend is attracting more and more capital and market attention - the organic combination of artificial intelligence and RWA. It can involve the following aspects: AI-driven asset valuation, risk management and predictive analysis, the application of AI in smart contract automation, AI-driven liquidity optimization, AI-enabled security and fraud detection, improving investor experience through personalization, and the application of AI in compliance and regulatory monitoring, etc.

By observing the dynamics in the crypto market, we can find that recently, many RWA projects have integrated artificial intelligence technology on a larger scale, although the combination of the two is still in its early stages. According to the analysis of venture capital and digital asset fund Decasonic , while tokenization has long promised to improve liquidity and achieve decentralized access, the addition of AI further accelerates the real-time optimization, risk assessment and automation process, making RWA assets more dynamic and efficient.

AI+RWA track is dynamic, and the trend of industry-specific RWA tokenization is becoming more and more obvious

In recent years, the AI+RWA market has been moving towards enhancing liquidity and improving efficiency. For example, Ondo Finance received $95 million in BlackRock BUIDL asset allocation in 2024 and began to explore AI-driven yield optimization to improve the return on its tokenized treasury bonds.

AI is also leveraging large data sets, including market trends, weather patterns, regulatory dynamics, etc., to improve the valuation accuracy of RWA assets. For example, MakerDAO's expanding RWA asset exposure may be using AI for yield analysis, while AI-driven real-time valuation models are also constantly optimizing the accuracy of asset pricing.

In addition, the trend of industry-specific RWA tokenization is becoming more and more obvious, and the general tokenization model is gradually giving way to solutions for specific industries. For example, Agrotoken tokenizes agricultural products such as soybeans on Algorand. At the same time, AI is also optimizing the yield management of tokenized stablecoins, such as Superstate's $USDM, whose assets are backed by government bonds and provide a return rate of 5% APY.

Changes in the macro-regulatory environment are expected to promote the deep integration of AI integration and RWA, further accelerating this process. In the United States, the Trump administration supports digital assets and has issued executive orders on cryptocurrencies, including the lifting of the ban on crypto banking, the reform of SAB121 accounting rules, and even the establishment of a US strategic Bitcoin reserve, where BTC will be held as a reserve asset. At the same time, the Trump administration has invested $500 billion in AI research and infrastructure construction to promote the development of a new generation of AI+blockchain solutions.

In Asia, with the popularity of DeepSeek, artificial intelligence has once again ignited the enthusiasm of the technology market. The encryption industry is also expected to achieve further breakthroughs and growth with the help of cutting-edge technologies such as artificial intelligence.

With the rapid growth of asset value on the RWA chain and the deep integration of AI+RWA technology, the real estate sector is becoming an area worthy of attention. As a pioneer in this field, Propy uses AI to optimize transaction processes, improve efficiency, and attract user participation through innovative marketing activities. In the future, the combination of AI and blockchain may further accelerate the digital transformation of the real estate market and provide global investors with a more transparent, efficient and secure transaction experience.

You May Also Like

Is Hyperliquid the new frontier for innovation?

Stronger capital, bigger loans: Africa’s banking outlook for 2026