President Trump Demands Immediate Rate Cuts as December 10 Meeting Nears

The post President Trump Demands Immediate Rate Cuts as December 10 Meeting Nears appeared first on Coinpedia Fintech News

U.S President Donald Trump has once again put the Federal Reserve under pressure. He just said immediate rate cuts are a requirement for the next Federal Reserve Chair.

With the next Fed meeting just 1 day away, the timing of Trump’s ultimatum is adding even more heat to an already tense economic moment. How does the crypto market react to this?

Trump’s Rate Cut Demand for the Next Fed Chair

According to a report from Solid Intel, Trump wants the next Federal Reserve leader to guarantee lower interest rates as a core condition for the job. Trump has always said high rates slow the economy, but this time he is making it a strict condition.

By calling rate cuts a “non-negotiable” condition, no rate-cut commitment, no appointment.

This demand raises a big concern. The Federal Reserve is supposed to work independently and be free from political pressure.

If a chair is pushed to cut rates, it can hurt market trust, create volatility, and weaken confidence in the U.S. dollar.

All Eyes on the December 10 Fed Meeting

Meanwhile, attention is already on the Federal Open Market Committee meeting scheduled for December 10. Market indicators like CME FedWatch show nearly 90% odds of a 25-bps rate cut, supported by cooling inflation (2.7% core PCE) and 4.4% unemployment.

Interestingly, Betting platforms like Polymarket and Kalshi show odds of 94–95%, aligning with forecasts from JPMorgan, Standard Chartered, and Nomura.

Impact on Bitcoin and Crypto

Lower interest rates often support risk assets like cryptocurrencies. The last rate cut in October 2025 helped ease market pressure, but Bitcoin, which hit a peak of $126,000 in October, has now fallen to around $90,251, down nearly 23%.

If the Fed signals deeper cuts ahead, risk assets like bitcoin could see a strong reaction, either relief or more volatility, depending on Powell’s tone.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

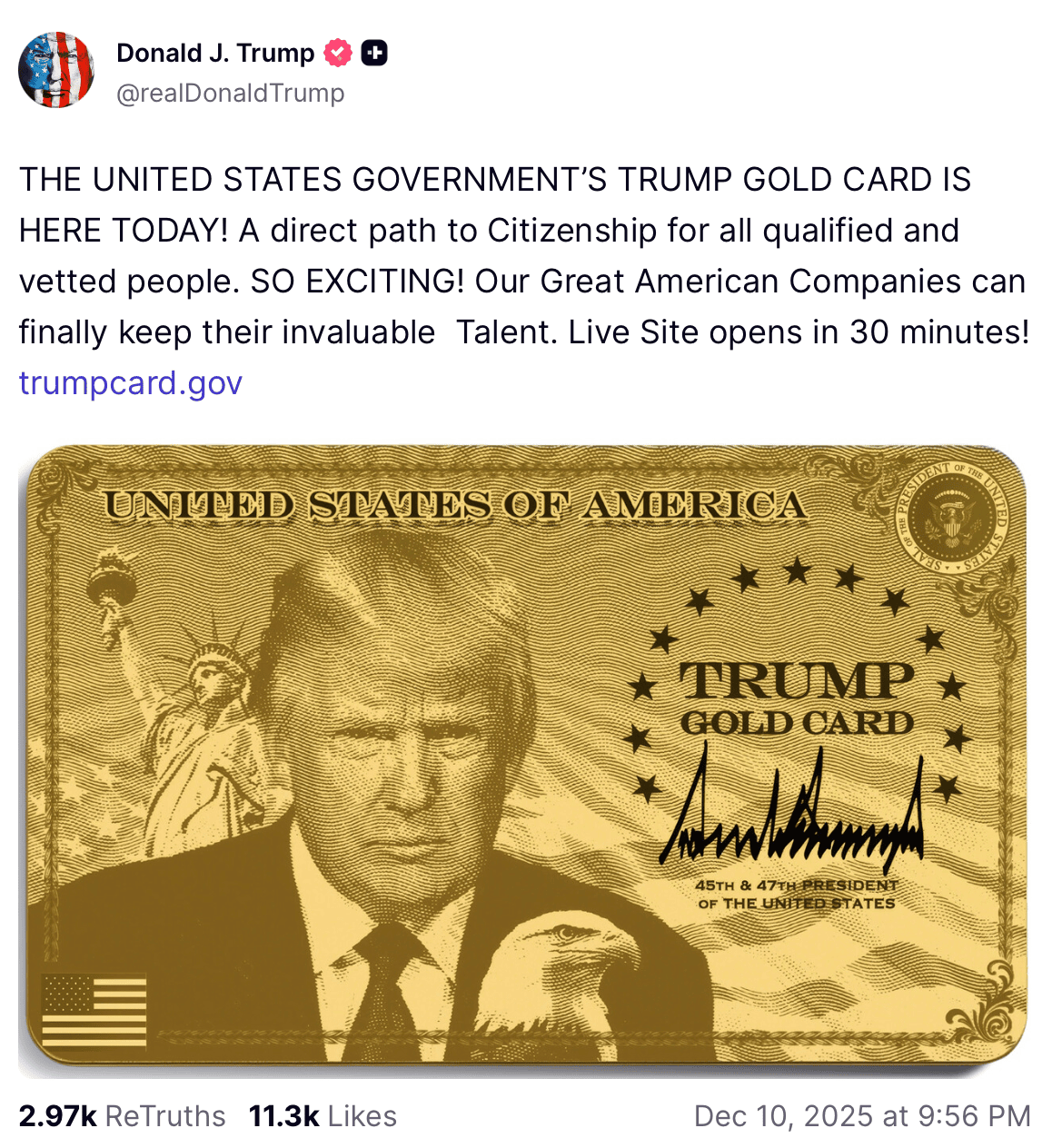

Trump Announced the Launch of the Trump Gold Card