MetaPlanet CEO Reveals Strategy-Style ‘MARS’ Plan to Supercharge Bitcoin Buying

Tokyo-listed Metaplanet is preparing to roll out a new preferred-share structure modeled on Strategy’s widely watched Bitcoin funding vehicle, as the company doubles down on its push to expand its corporate Bitcoin treasury.

The plan was confirmed this week by Metaplanet CEO Simon Gerovich during remarks at the Bitcoin for Corporations Symposium, where he appeared alongside Strategy Chairman Michael Saylor.

Gerovich told attendees that shareholders will vote later this month on launching a new capital instrument called MARS, short for MetaPlanet Acquisition and Reserve Strategy.

He described it as the company’s version of Strategy’s STRC preferred stock, specifically designed to raise capital dedicated to buying more Bitcoin.

Metaplanet Details Structure of ‘Mars’ Bitcoin-Backed Preferred Equity

Metaplanet formally outlined the structure earlier in November when its board approved two new classes of preferred equity known internally as Mars and Mercury.

The Mars shares are structured as senior, non-dilutive Class A preferred stock. They sit above both Mercury shares and common equity in Metaplanet’s capital stack, carry no conversion rights, and provide holders with a senior claim on dividends and assets.

Proceeds from these shares are intended to be directed toward Bitcoin accumulation as part of Metaplanet’s long-term treasury strategy.

Mars shares are also designed to pay adjustable monthly dividends.

The dividend rate is structured to rise when the stock trades below par and fall when it trades above that level.

This mechanism is intended to reduce price volatility while offering steady income to investors seeking Bitcoin-linked exposure without direct equity risk.

STRC Delivers 10% Returns as Metaplanet look to mirror it

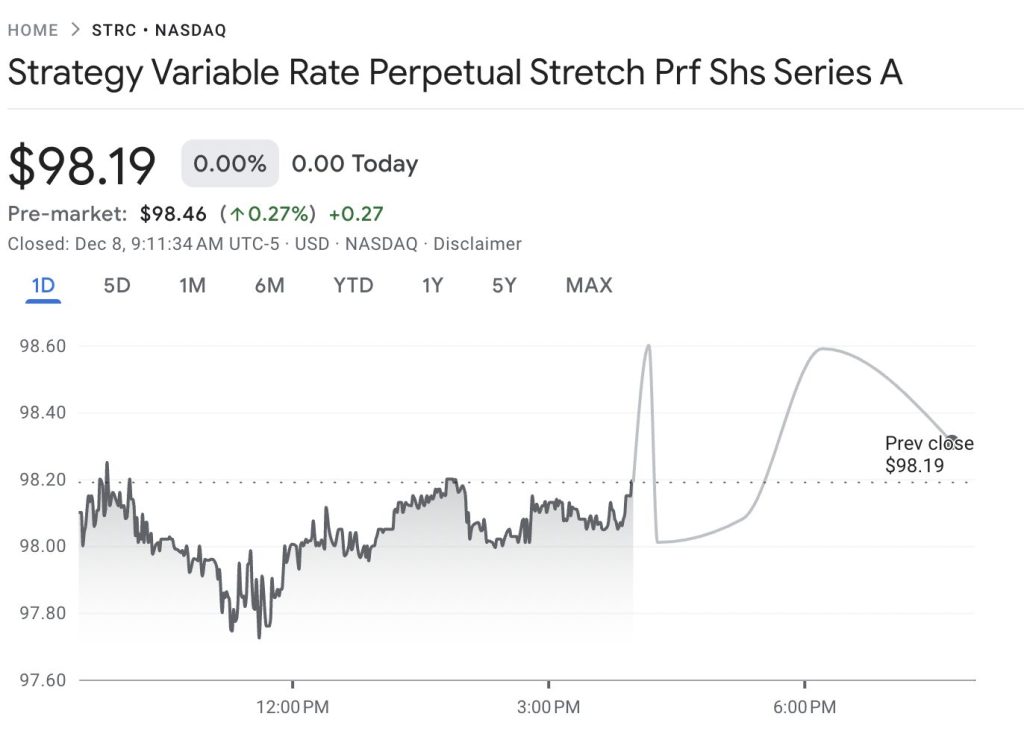

The structure mirrors Strategy’s STRC stock, a variable-rate perpetual preferred share launched in July 2025.

STRC currently trades near $98 and pays an annualized dividend of about 10.75%, with an effective yield close to 11%.

The dividend is adjusted monthly to keep STRC trading near its $100 target price.

Source: Google Finance

Source: Google Finance

Strategy uses proceeds from STRC and other preferred programs to fund Bitcoin purchases.

Since launch, STRC has returned just over 10%, while remaining far less volatile than Strategy’s common stock or Bitcoin itself.

Strategy’s approach has driven an aggressive expansion of its Bitcoin treasury. By late 2025, the company held 650,000 BTC after adding tens of thousands of coins throughout the year.

About 21,000 BTC were purchased using STRC IPO proceeds alone.

Additional purchases in October and November lifted total holdings beyond 641,000 BTC at the time, funded through various preferred offerings and at-the-market share sales.

Metaplanet Turns to Buybacks as Japan’s Bitcoin Treasury Trade Cools

Metaplanet appears to be adapting that same funding blueprint to Japan’s market conditions.

The company has already issued Mercury Class B preferred shares, which combine quarterly fixed dividends with the option to convert into common stock.

On Nov. 20, Metaplanet approved the issuance of 23.61 million Mercury shares through a third-party allocation, raising about ¥21.25 billion, or roughly $135 million.

The conversion price was set well above the company’s market price, limiting immediate dilution.

At the same time, Metaplanet has relied heavily on debt secured by its Bitcoin holdings.

In late November, the company disclosed a new $130 million loan backed entirely by BTC under a previously announced $500 million credit facility.

As of its latest treasury update, Metaplanet holds 30,823 BTC valued near $2.7 billion, with an average acquisition cost of $108,070 per coin.

With Bitcoin trading below that level, unrealized losses stood at roughly $636 million.

The timing of the Mars announcement comes during a slowdown across corporate Bitcoin treasuries. DefiLlama data shows that digital asset treasury inflows dropped to $1.32 billion in November, the lowest monthly total of 2025.

Notably, In November alone, Strategy shares fell more than 35%, while Metaplanet’s stock dropped over 20% as Bitcoin slid nearly 25% from October highs.

You May Also Like

Top 3 Price Prediction for Ethereum, XRP and Bitcoin If Crypto Structure Bill Passes This Month

Will XRP Price Increase In September 2025?