2 Big Catalysts Pi Network (PI) Desperately Needs to Stop Bleeding

Despite the sporadic pumps, Pi Network’s native token has been on a massive decline over the past several months.

Some important metrics suggest the price may keep sliding in the near future, but one popular X user shared the recipe for stopping the free fall.

The Potential Catalysts

PI began trading at the beginning of 2025, and shortly after, its valuation exploded to $3. Currently, though, the asset trades at a mere $0.22, representing a 93% crash from the peak levels.

According to X user pinetworkmembers, PI is starting to look like “one of those charts everyone was hyped about after the move already happened.” The analyst argued that the token’s momentum is drying up, buyers are retrating, while the crowd “is getting quieter by the day.”

The anonymous market observer claimed that PI’s comeback depends on two catalysts: defending a solid support zone and finally attracting genuine interest from investors (“not just recycled hopium”).

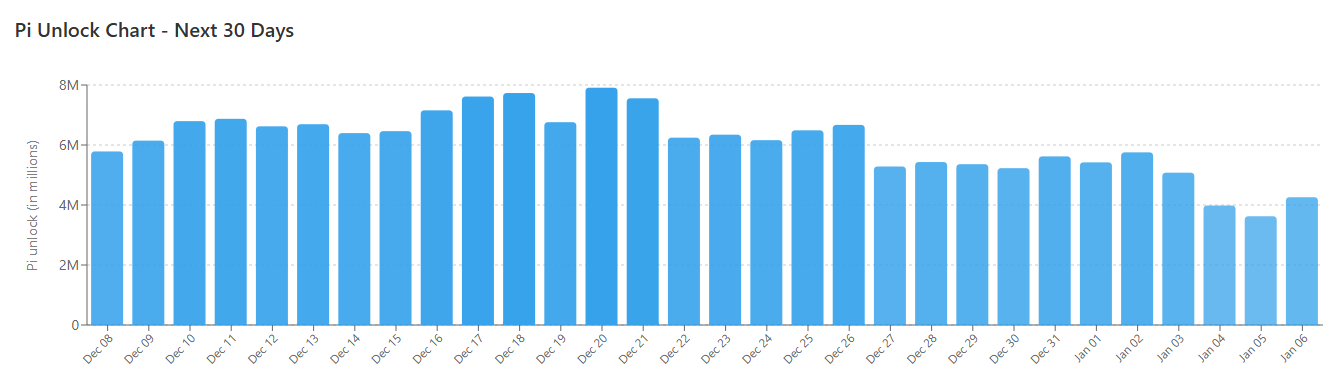

Meanwhile, the looming token unlocks spell further problems for the bulls. Data shows that over 183 million coins will be released in the next 30 days, which only increases the selling pressure. The record day is expected to be December 20, when almost 8 million PI will be freed up. The average daily unlocks for the following month are estimated to be approximately 6.1 million.

PI Token Unlocks, Source: CoinGecko

PI Token Unlocks, Source: CoinGecko

Pi Network’s Recent Updates

Contrary to PI’s price retreat, the team behind Pi Network frequently announces ecosystem upgrades. Most recently, it integrated additional AI tools, making it easier and faster for Pioneers to complete their KYC procedures.

According to some X users, the developers may introduce further updates on that front in the near future. Pi News, for instance, claimed that PI KYC validator rewards will be distributed by the end of Q1 2026.

The Core Team also shook hands with CiDi Games (a gaming platform that builds Pi-related games that users can play). The collaboration aims to broaden the real-world use of Pi Network’s native token and unlock more opportunities for the Pioneers.

The post 2 Big Catalysts Pi Network (PI) Desperately Needs to Stop Bleeding appeared first on CryptoPotato.

You May Also Like

Hyperliquid Strategies Inc. announces a $30M stock buyback program

Ethereum Price Prediction: ETH Targets $10,000 In 2026 But Layer Brett Could Reach $1 From $0.0058