Solana’s Path to $700 Looks Bullish; Ozak AI’s 2026 Forecast Appears More Explosive

Solana is gaining strong momentum as expanding ecosystem activity, rising developer engagement, and rapidly growing adoption push its long-term trajectory toward the possibility of a $700 breakout, yet analysts increasingly argue that Ozak AI holds an even more explosive outlook for 2026, with the AI-native project entering the market at a far earlier stage, backed by millisecond-speed prediction engines, cross-chain intelligence systems, autonomous AI agents, and a surging Ozak AI Presale that has already raised over $4.8 million, giving it a uniquely steep growth curve that many believe could outperform even Solana’s aggressive bullish path.

Solana Strengthens Its Uptrend

Solana continues to bolster across market charts as community pastimes, developer participation, and ecosystem demand all push closer to new highs. Its increasing footprint in DeFi, gaming, patron apps, and tokenization keeps it firmly placed as one of the quickest-rising massive-cap properties in the space.

Yet whilst Solana builds strong momentum closer to a multi-hundred-dollar potential breakout, an increasing number of analysts are turning their consciousness to Ozak AI, the AI-local small-cap project whose 2026 projections show a much steeper upside curve. With early adoption rising unexpectedly via the booming Ozak AI Presale, many accept as true that with its long-term trajectory, it may want to dwarf the gains of even top performers like Solana.

Solana, presently trading near $143, is maintaining one of the cleanest bullish structures in the market. Strong buy zones at $136, $129, and $122 keep taking in dips, signaling continual confidence from each retail investor and institutional desk. These help tiers have stabilized price action at some point of pullbacks, allowing SOL to hold its uptrend while getting ready for better objectives.

For Solana to start a sustained pass in the direction of its subsequent primary milestone, it ought to destroy the key resistance zones of $147, $155, and $166, key resistance zones that have traditionally precipitated effective rallies when cleared. With growing throughput, new dApps scaling into millions of customers, and worldwide developer traction increasing, Solana’s fundamentals guide the long-term possibility of reaching the $700 region at some stage in a high segment of the cycle.

Why Ozak AI’s Forecast Surpasses Even Solana’s Bullish Trajectory

However, analysts note that Solana’s large-cap status naturally limits its maximum achievable multiplier. This is where Ozak AI separates itself. As a small-cap AI-native project entering the early growth stages, Ozak AI offers a much greater asymmetrical upside. The project introduces a cutting-edge Web3 intelligence layer built on millisecond-speed prediction engines, cross-chain AI analytics, and a lightning-fast 30 ms signal framework powered by its partnership with HIVE. These high-performance systems are designed for real-time data processing, automated strategy execution, and rapid-response market intelligence—features that position Ozak AI as a foundational layer for next-generation crypto ecosystems.

Through its integration with SINT, Ozak AI also incorporates autonomous AI agents capable of analyzing blockchain data, making strategic decisions, automating workflows, and executing voice-driven commands. This level of functionality moves Ozak AI beyond the speculative category and into a true AI infrastructure offering, giving it a competitive advantage many early-stage projects lack. As AI becomes the dominant theme of the next crypto expansion, analysts argue that Ozak AI is positioned to outperform most altcoins—including large caps—in raw percentage gains.

Ozak AI Presale Momentum

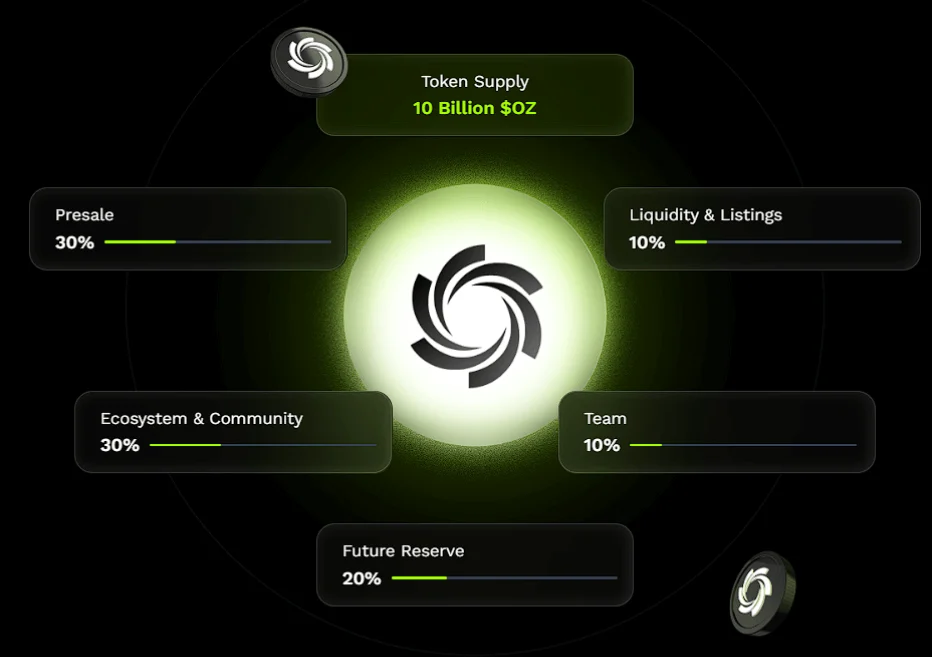

The accelerating Ozak AI Presale, now surpassing $4.8 million raised with over a million tokens sold, further validates the project’s rising momentum. Investors are recognizing its potential early, and the rapid growth mirrors the early accumulation patterns of tokens that later delivered 50x–100x returns in previous cycles. Backed by Perceptron Network’s 700K+ nodes, HIVE’s high-speed AI systems, and SINT’s agent intelligence architecture, Ozak AI enters the market with real utility that can scale immediately post-launch—a rarity for new crypto projects.

Solana may be on a credible path toward $700 as its ecosystem grows and adoption accelerates, but Ozak AI’s early-stage valuation and AI-driven architecture give it a far more explosive long-term forecast. With analysts projecting some of the steepest multipliers of the upcoming cycle, Ozak AI is emerging as the standout project poised to deliver generational-scale returns by 2026 — making it one of the most closely watched names in the market right now.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides a technology platform that specializes in predictive AI and advanced data analytics for financial markets. Through machine learning algorithms and decentralized network technologies, Ozak AI enables real-time, accurate, and actionable insights to help crypto enthusiasts and businesses make the correct decisions.

For more, visit:

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi

This article is not intended as financial advice. Educational purposes only.

You May Also Like

XRP Ignites As Spot Volume Skyrockets

Vitalik Buterin Reveals Ethereum’s Long-Term Focus on Quantum Resistance