Data Analysts Say Ozak AI’s Market Cap Could Cross $5 Billion by 2027 With Ongoing Utility Expansion

Ozak AI continues to create waves in the crypto industry, as analysts project that its market valuation can exceed $5 billion by 2027 with expanding AI utility and adoption potential. Currently priced at $0.014 in its last presale phase, the project is preparing for a $1 exchange listing. With growing investor confidence and developing use cases, investors are eager to see if Ozak AI’s spectacular growth can continue, and the prediction could come true in future years.

Final Presale Sparks Rising Investor Interest Ahead of Listing

Ozak AI’s last presale, Phase 7, is currently running at $0.014, and the project has raised about $4.86 million as a result of greater investor interest. The market’s trust in Ozak AI’s vision and methodology is evidenced by the continual increase in funding.

This enhanced early investor participation, demonstrating confidence in the project’s AI-powered predictive analytics platform. Their participation demonstrates a high level of excitement about the project’s planned exchange offering, which will be priced at $1. Even those who enter now might make more than 71x in value, and the very early buyers who acquired $OZ token at $0.001 could be 1000x up.

Youtube embed:

Ozak AI ($OZ) Project Review | A Look at Its AI-Driven Financial Platform

AI Technology, Utilities & Partnerships Drive Ozak AI’s Growth

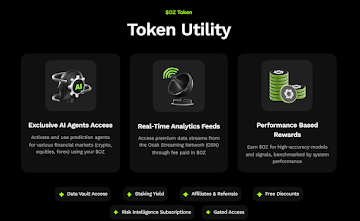

Ozak AI is built on a strong technology foundation that aims to revolutionize financial intelligence. The system starts by using the Ozak Streaming Network (OSN) to continuously collect real-time market data. Most importantly, its connection with DePIN (Decentralized Physical Infrastructure Networks) enables the spread of data processing among worldwide nodes, ensuring security.

Also, the platform offers a private Data Vault to store all the activities and data safely with single access. The Custom Prediction Agent function allows users to create personalized AI agents that properly match their specific trading strategies. Their insights can be shared with others and could earn passive income in $OZ rewards.

Ozak AI has reached strategic agreements with many networks, among them the recent ones are with Meganet to improve its platform for decentralized edge compute and shared bandwidth for quick prediction outputs, as well as with Phala Network to provide a private and secure network for trusted AI workflows.

Analysts Predict $5B Market Cap By 2027

Analysts are highly optimistic about Ozak AI, estimating that the project’s market capitalization would exceed $5 billion by 2027.

They highlight Ozak AI’s unique combination of real-time predictive analytics, decentralized data processing, and safe AI frameworks as significant drivers of long-term success. Furthermore, with the AI business currently worth trillions of dollars, Ozak AI is positioned to acquire a large market share.

As the project prepares for its $1 exchange listing, new investors who enter now in Phase 7 may see significant gains as the project seeks to consolidate its position as one of the largest participants in the expanding AI Crypto field.

For more Details about Ozak AI, visit the links below.

Website: https://ozak.ai/

Twitter/X: https://x.com/OzakAGI

Telegram: https://t.me/OzakAGI

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

The post Data Analysts Say Ozak AI’s Market Cap Could Cross $5 Billion by 2027 With Ongoing Utility Expansion appeared first on Live Bitcoin News.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

Breaking: CME Group Unveils Solana and XRP Options