Two Dormant Casascius Coins Unlock $179M in Bitcoin

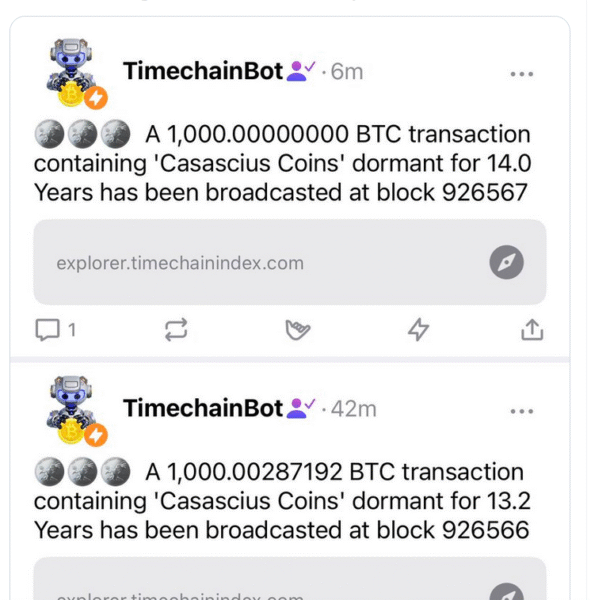

Two long-dormant Casascius coins, each holding 1,000 BTC, have been redeemed, releasing over $179 million after more than 13 years.

Two Casascius coins were recently activated, one minted in December 2011 and the other in October 2012. At the time, Bitcoin’s price was only $3.88 and $11.69, respectively. As a result, their value has increased tremendously with theoretical returns of more than 2.3 million percent. Therefore, these coins demonstrate the astounding development of Bitcoin over a decade.

Casascius Coins Show Long-Term Bitcoin Value

Casascius coins are physical metal coins that were minted from 2011 to 2013. Each coin holds a private secret key for a certain amount of Bitcoin. In order to redeem a coin, the owner peels off a tamper-evident hologram to reveal the key. As a result, they are collectibles as well as access points to natural Bitcoin. Moreover, they emphasize the way that early adopters safely kept cryptocurrency for long-term gains.

Redeeming a Casascius Coin Doesn’t Mean Bitcoin Will Flood the Market. For example, in July 2025, a 100 BTC coin owner by the alias of “John Galt” transferred his coin to a hardware wallet. However, he did not intend to sell off the Bitcoin. Similarly, recent 1000 BTC redemptions are unlikely to lead to immediate selling. Therefore, the market impact is limited due to the high value of these coins.

Related Reading: Saylor’s Strategy Won’t Be Forced To Sell Bitcoin, Even In Bad Times, BitWise CIO Says | Live Bitcoin News

Furthermore, Casascius’s coins illustrate the importance of long-term custody, as well as careful investment planning. Early Bitcoin adopters kept their holdings secure and did not sell during times of volatility. As a result, the coins now form a connection between the early history of Bitcoin and modern-day digital wallets. In addition, by redeeming them, holders can participate in today’s markets while preserving its historical significance.

Bitcoin Market Context and Volatility

Source: X

Source: X

Meanwhile, the larger market of Bitcoin remains volatile. In December 2025, the BlackRock Bitcoin ETF had the longest streak of weekly withdrawals since January 2024. Also, analysts noticed that the price of Bitcoin was diverging from the stock market and showing its unique behavior. Therefore, the predictions about the price of Bitcoin are varied and uncertain.

In addition, the redemption of Casascius coins shows the ongoing relevance of legacy Bitcoin assets. The transfer of coins to modern wallets makes it more accessible without compromising security. In addition, it is indicative of the increasing levels of sophistication for digital asset custody solutions. Due to this, early Bitcoin artifacts are now a part of a modern ecosystem where investors can safely manage, trade or hold their assets.

Casascius Redemptions Highlight Bitcoin’s Long-Term Potential

Meanwhile, these redemptions are evidence of the patience of investors and strategic planning. By retaining coins for over a decade, owners have not only reaped the improvements in currency value over time, but also the compounding effect of holding the coin. Furthermore, incorporating the legacy coins into digital wallets means a smoother engagement in today’s markets. Therefore, Casascius coins are a part of the history as well as the practical future use of Bitcoin.

In conclusion, executing a transaction to activate two 1,000 BTC Casascius coins released more than $179 million but demonstrated the long-term potential of Bitcoin. Moreover, the coins link the early history of cryptocurrencies with the modern infrastructure of digital assets. Consequently, these redemptions underscore investor discipline, the development of custody solutions, and the increased maturity of the Bitcoin ecosystem.

The post Two Dormant Casascius Coins Unlock $179M in Bitcoin appeared first on Live Bitcoin News.

You May Also Like

KindlyMD Secures A Landmark $210 Million USDT Loan From Kraken Operator

“I Wasted 8 Years in Crypto”: A Builder’s Exit Note Goes Viral Across Asia

Vivek Ramaswamy's Strive to raise $500M to buy Bitcoin

Strive, co-founded in 2022 by American entrepreneur Vivek Ramaswamy, launched a $500 million preferred stock offering to acquire more Bitcoin and Bitcoin-related products. Publicly traded asset manager and Bitcoin treasury company Strive has announced a $500 million stock sales program to raise funds for additional BTC purchases.The firm, which was co-founded in 2022 by American entrepreneur and politician Vivek Ramaswamy, stated on Tuesday that it intends to use the net proceeds from the sale for “general corporate purposes, including, among other things, the acquisition of Bitcoin and Bitcoin-related products and for working capital.”It also intends to purchase “income-generating assets” to grow the company’s business, but did not specify which. Read more