Follow the Money: Over $210M in Ventures, YZi Labs Activities, and DeFi in the Spotlight

Between December 1 and 6, 2025, Incrypted recorded 41 investment deals, with 20 totaling over $224 million. These included traditional venture fundraising, token sales, accelerators, and more. We provide more details in our weekly digest.

Infographic by Incrypted.

Infographic by Incrypted.

During this period, 15 projects received funding from venture capital companies. In particular:

- $50 million — Gonka. The decentralized network for high-performance computing based on artificial intelligence (AI) has announced the receipt of capital from Bitfury in an undisclosed round. This is the first investment from their new $1 billion ethical technology fund. The project has already brought together more than 6,000 H100 graphics processing unit (GPU) equivalents running real-world AI workloads without the cost of staking or consensus.

- $50 million — Digital Asset. The company raised funds in a strategic funding round with participation from BNY, Nasdaq Ventures, S&P Global, and iCapital. The investment will boost the development of Canton Network, a blockchain optimized for financial transactions with flexible privacy settings.

- 25 million — Portal. The non-custodial interconnect protocol team reported receiving an undisclosed round of investment from JTSA Global. The platform uses BitScaler and atomic swaps, allowing the exchange of bitcoin, Ordinals, and Runes between different L1s and L2s.

- 20 million — Ostium Labs. The decentralized blockchain exchange Arbitrum has closed a Series A round with investments from Coinbase Ventures, GSR Investments, Wintermute, General Catalyst, and Jump Trading. The funds will be used for scaling.

- 17 million — Fin. The payment infrastructure company has raised funds in a Series A investment round from Pantera Capital, Sequoia Capital, Samsung Next, and other investors. The company focuses on high-value payments and cryptocurrency transfers to bank accounts, providing a fast connection between the crypto segment and traditional finance.

- $15 million — Bitstack. The mobile app received a Series A investment from Y Combinator, Plug and Play, and Stillmark. The app allows users to automatically save in bitcoin, and the funding will help scale the product in Europe.

- $8 million — Zoo Finance. The deFi platform has closed a strategic round with investments from Signum Capital, CGV, Bitrise Capital, and other participants. It will expand the liquidity and utility of the Berachain ecosystem by developing next-generation DeFi tools.

- 5 million — Axis FDN. The decentralised platform for coordinating AI agents received capital in an undisclosed round from OKX Ventures, GSR Investments, CMS Holdings, and Galaxy Ventures. The project creates the synthetic asset xyUSD, which brings institutional-grade yields to DeFi.

- 5 million — DeepNode AI. The AI infrastructure protocol has received funds first in a seed and later in a strategic round from Blockchain Founders Fund, Side Door Ventures, IOBC Capital, and others. The project unites model creators, validators, node operators, and users into a single open network.

- 4 million — Altura. The DeFi yield platform has attracted investment in the seed round. Investors include Ascension, InnoFinCon, and Moonfare. The platform implements delta-neutral DeFi strategies such as arbitrage, staking, and liquidity provision, providing stable, market-neutral returns.

- $4 million — AIAV. The platform announced that it has received capital in a seed round with investments from Animoca Brands, DuckDAO, Castrum Capital, and others. The project develops tools for creating, managing, and monetizing autonomous AI agents on the blockchain.

- 3 million — True North. The company closed a pre-seed round with investments from GSR Investments, SNZ Holding, cyber.Fund, and others. The funds will be used to develop an AI platform for investing in cryptocurrencies that runs on the blockchain.

- $2.3 million — LayerBank. The online bank reported receiving investments in a seed round of funding with the participation of DV Chain, Taiko Labs, Coin Bureau, Rootstock, Torab Torabi, and Future Trends. It issues interest-bearing “lTokens” for deposited assets and supports cross-network liquidity and revenue opportunities.

- 1 million — Haiku. The DeFi protocol has received capital in a pre-seed round from Big Brain Holdings, Daedalus Angel Syndicate, Auros Global, and other investors. The project is aimed at creating new financial instruments and liquidity.

- $900,000 — PathPulse.ai. The decentralised road intelligence network received investments during a pre-seed round of funding, where Brinc, Aptos Labs, CoinGecko Ventures, and others participated.

A number of other projects raised funding but did not disclose the amount of investment.

AnChain.AI, a Web3 security company, has attracted strategic investments from Amino Capital, Emmanuel Vallod, and Cris Conde to strengthen its technological development. The company uses AI tools for investigations and risk analysis in blockchain ecosystems.

OpenEden has received strategic funding from Lightspeed Venture Partners, P2 Ventures, XRP Ledger, Selini Capital, Gate Ventures, and other investors. The funds raised will accelerate the development of the infrastructure that integrates real assets into DeFi and expands access to tokenised financial products.

Futures insurance company Websea has secured a strategic investment from Hony Capital, one of the largest traditional private equity players with assets of over RMB 100 billion (over $14 billion). The funding will allow the company to strengthen compliance and risk management, scale global development, and accelerate the construction of the WBS ecosystem.

The decentralised VIXO Protocol has received a strategic investment from Alpha Capital to develop a system of collateralised stablecoins with the ability to be private and independently minted. The investment will help to expand the protocol’s functionality and increase the sustainability of the private decentralised sustainable finance model.

The XMAQUINA DePIN project has raised strategic funding from Borderless Capital, Waterdrip Capital, vVv, and Clairvoyant Labs to scale its robotics infrastructure. The project tokenises autonomous robots, allowing users to receive a share of the revenue from their work in the real world.

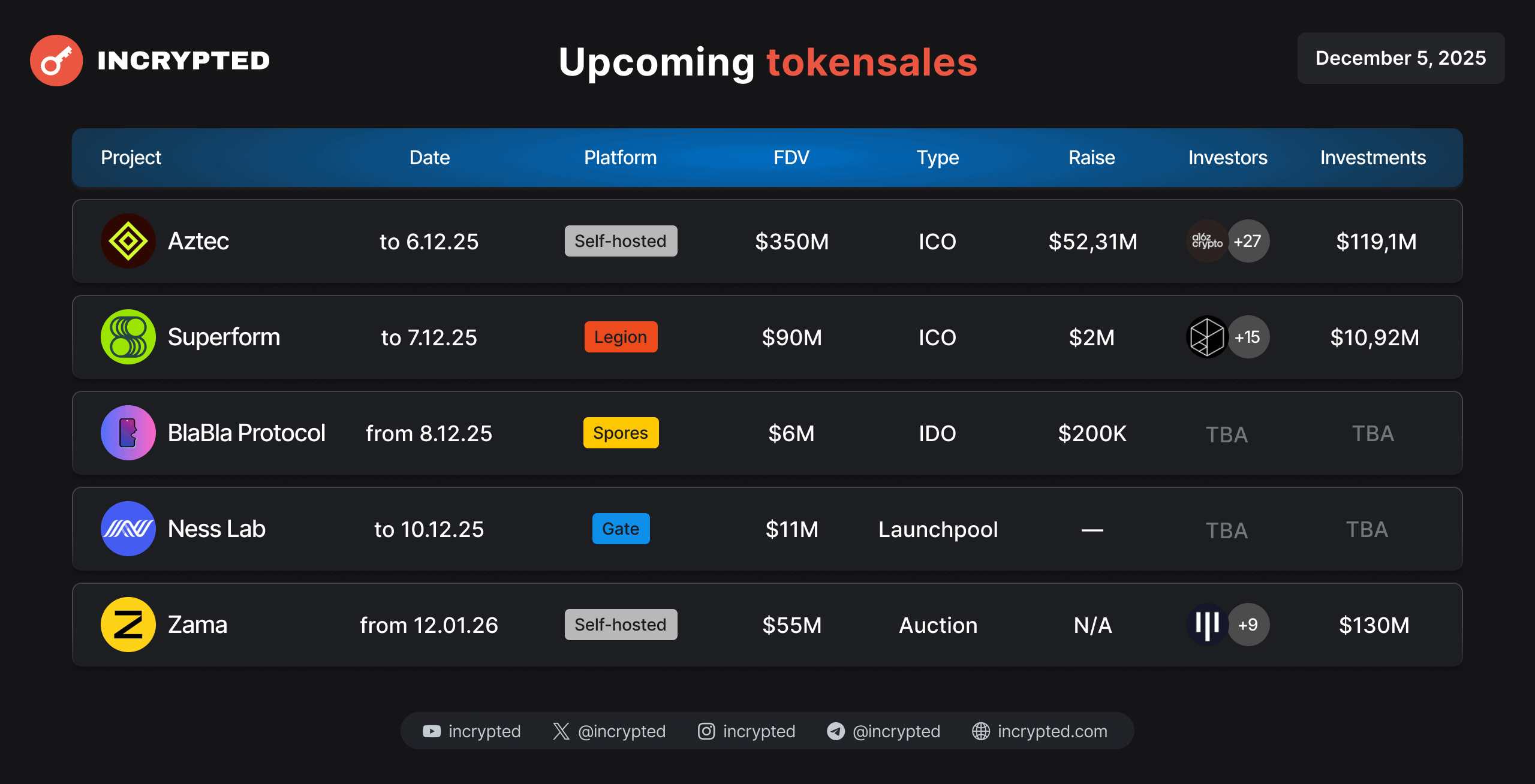

This week, four projects held public token sales, namely:

- $5.57 million — HumidiFi — a decentralized exchange based on Solana that uses a patented automated market maker architecture.

- 3 million — Reya — an EVM-compliant L2-rollup built on Arbitrum Orbit and designed to support decentralized exchange applications.

- 1.5 million — Makina — a protocol that provides a non-custodial infrastructure for automated, risk-managed, and multi-chain yield strategies through tokenized safes with real-time exposure control.

- $600,000 — Harmonix Finance — a platform that aggregates on-chain sources of revenue into tokenized safes for stablecoins and network tokens on Hyperliquid L1, providing combined revenue and ecosystem stimulation.

In addition, you can find out about current and upcoming token sales through the relevant section on the website, where all users have access to information about active and upcoming asset sales campaigns. Our team also runs a dedicated Telegram channel and monitors the most relevant events:

Incrypted infographics.

Incrypted infographics.

Representatives of the institutional sector continue to accumulate funds to build up cryptocurrency reserves and expand their operations. Last week, one deal was recorded:

- $3.15 million — Hamak Strategy. The company, which combines gold exploration in West Africa with bitcoin treasury management, raised funds in a post-IPO debt financing from Yorkville Advisors. It is also active in Liberia under existing mineral licenses.

In the period from December 1 to 6, the market recorded four M&A deals.

Backed, a company that issues fully tokenized real-world assets (RWA) tokens, became part of the Kraken crypto exchange. These tokens reflect the value of stocks and ETFs on traditional markets. This acquisition will accelerate the development of xStocks and open up global demand for tokenized exchange-traded assets.

Gleec has acquired Komodo, expanding its blockchain ecosystem stack with a full-service smartchain platform from custom chains to open APIs. The integration of Komodo strengthens the technological capabilities of Gleec, which already has an exchange, a digital wallet and its own Gleec Coin token.

Galaxy Digital acquired Alluvial, becoming the official developer of Liquid Collective, the leading enterprise liquid staking protocol. This strengthens Galaxy Digital’s role in the digital asset infrastructure space, as Alluvial provided APIs and tools for participation in Proof-of-Stake networks.

Leading liquidity provider and market maker RockawayX and Solana-based infrastructure company Solmate Infrastructure announced the signing of a non-binding letter of intent to combine their businesses. This deal could transform the latter from a passive asset holder into a full-fledged infrastructure and DeFi management company.

This week, the venture capital firm YZi Labs (formerly Binance Labs) held an accelerator funding round to support projects. They have received investment to develop their solutions at the intersection of AI, Web3, predictive markets, DeFi, bitcoin liquidity, robotics, and the gaming industry, among others:

- 4D Labs, which creates a scalable infrastructure for AI spatial models and high-quality 3D data. The team is shaping key standards for the age of spatial computing, providing the foundation for future AR/VR and 3D applications;

- 42.space, which empowers predictive markets by enabling the trading of assets linked to real-world events. The platform combines the simplicity of a liquid token with the final settlement mechanics of a prediction market, paving the way for new financial instruments;

- AllScale, which creates a self-managed neobank for cross-border business transactions. The solution is designed to significantly reduce costs and bureaucracy for small and medium-sized businesses operating in global markets;

- Bento.fun, which forms a social layer for predictive markets through micro duels in messengers. Bento turns ordinary fan disputes into gamified online interactions, increasing engagement with a wide fan base;

- Frontrun is a wallet for traders with optimised opportunity discovery, analysis, and execution. The product is targeted at high-frequency traders who need speed, accuracy and cross-network efficiency;

- Help.fun, which offers a crypto platform for launching non-profit tokens. It increases the transparency of charitable funding and ensures fair participation through anti-bot mechanics;

- Hertzflow is an open marketplace with leverage for any asset, targeting traditional derivatives traders. The project aims to turn tens of millions of Web2-trading users into active participants in the online ecosystem;

- MeleeMon, which offers a mobile competitive game using stablecoins in the betting mechanics. By combining familiar gameplay with a transparent online economy, the project opens a new niche for competitive Web3 games;

- Sats Terminal is a bitcoin-based liquidity protocol with support for EVM networks. Thanks to early B2B successes and deep integration with the Runes ecosystem, the team is rapidly scaling its presence in bitcoin lending;

- Saturn Labs, which creates stablecoin with a yield of over 10%, is backed by a credit instrument based on the first cryptocurrency. Saturn aims to set a new standard for transparent reserves in the stablecoin sector by combining RWA mechanisms with an institutional guarantee;

- Predict.fun is a predictive marketplace that integrates DeFi liquidity to reduce capital inefficiencies. The product aims to turn forecasts into a mass tool accessible even to those with no DeFi experience.

- Trellis Robotics, which offers an AI-enabled robotics software platform for inspecting industrial facilities in hard-to-reach areas. The technology significantly reduces risks for personnel and optimises the cost of critical infrastructure inspection.

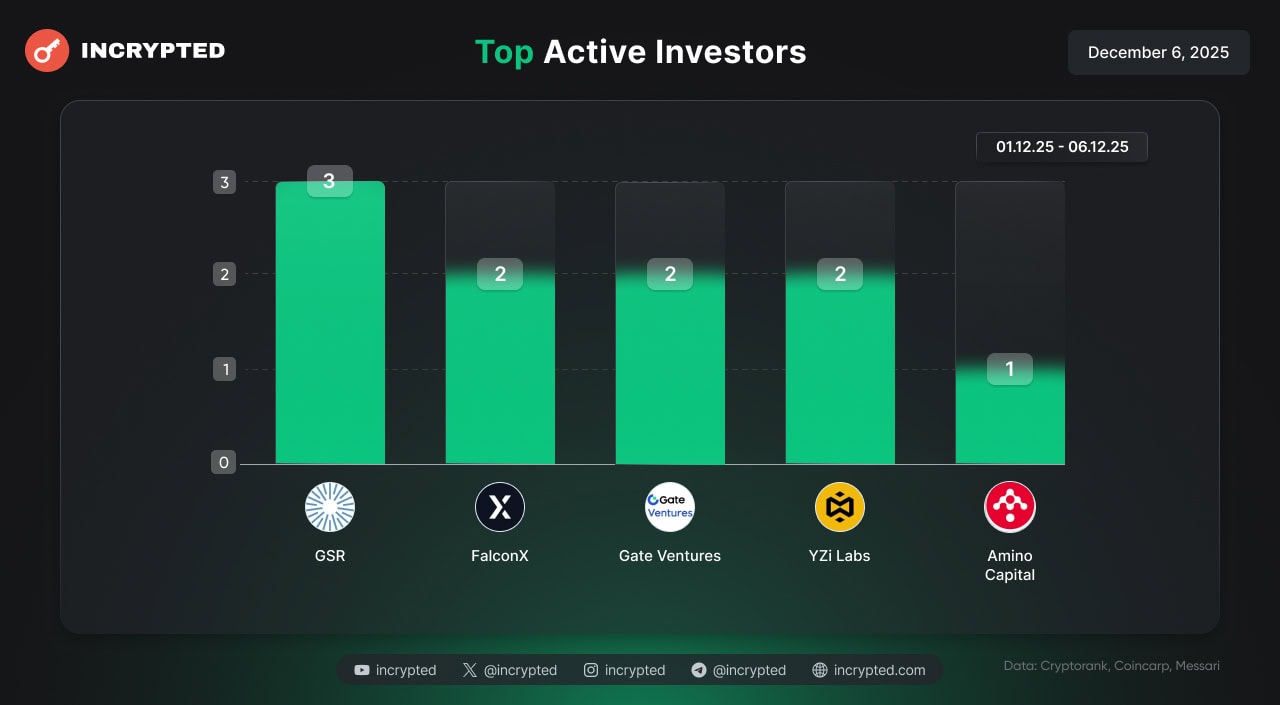

The most active investors of the week were GSR, FalconX, Gate Ventures, YZi Labs, and Amino Capital, according to CryptoRank.

Infographic by Incrypted.

Infographic by Incrypted.

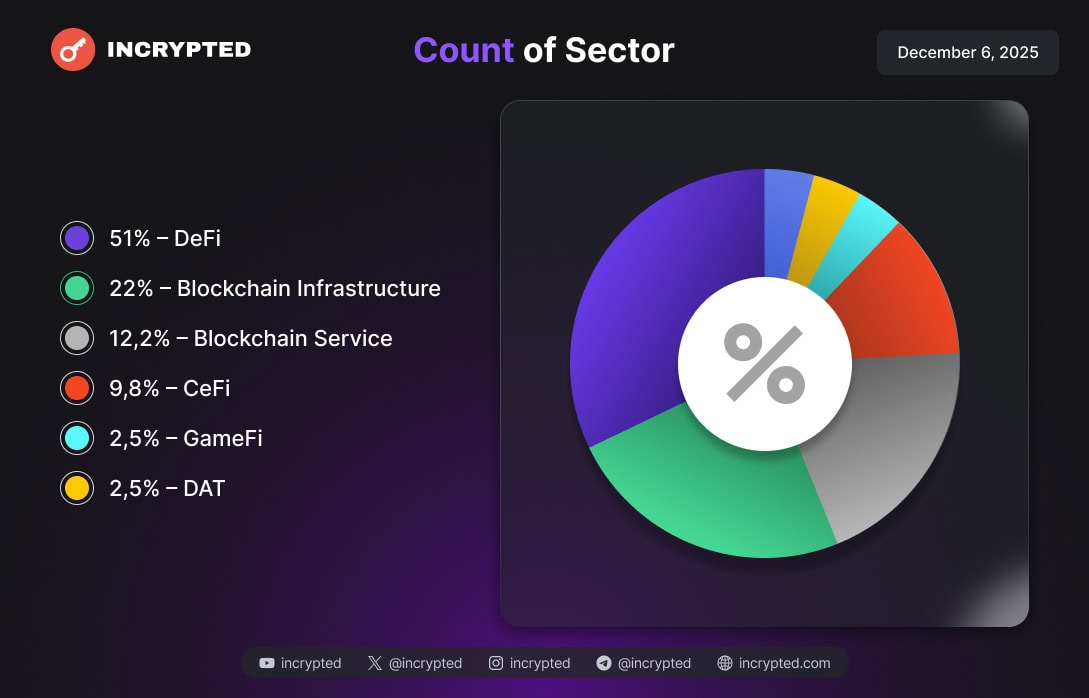

In the period from 1 to 6 December, projects from such segments as DeFi, blockchain infrastructure, blockchain services, CeFi, GameFi, and DAT attracted funding. Investors focused on DeFi.

Infographic by Incrypted.

Infographic by Incrypted.

As a reminder, in November, Web3 projects attracted about $3.6 billion in investments.

Follow the materials on Incrypted to keep abreast of new investments in developing the digital world.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

TRM Labs Becomes Unicorn with 70M$: BTC Fraud Risk