Will PI Rebound In The Week Ahead? ChatGPT With Pi Network Price Predictions

Pi Network’s native token has proven in recent months to defy the overall market trend. For example, it actually posted some gains during November when BTC, ETH, XRP, and other larger-cap altcoins dropped by double digits.

In contrast, the overall market started to recover at the start of December, with bitcoin climbing past $94,000 and ETH surging beyond $3,200 at one point. PI, though, lagged and couldn’t produce similar increases. Just the opposite, it’s actually down by 12% in the past week and now sits inches above $0.22.

Consequently, we asked ChatGPT about its take on the matter and whether the following week will be more positive for PI.

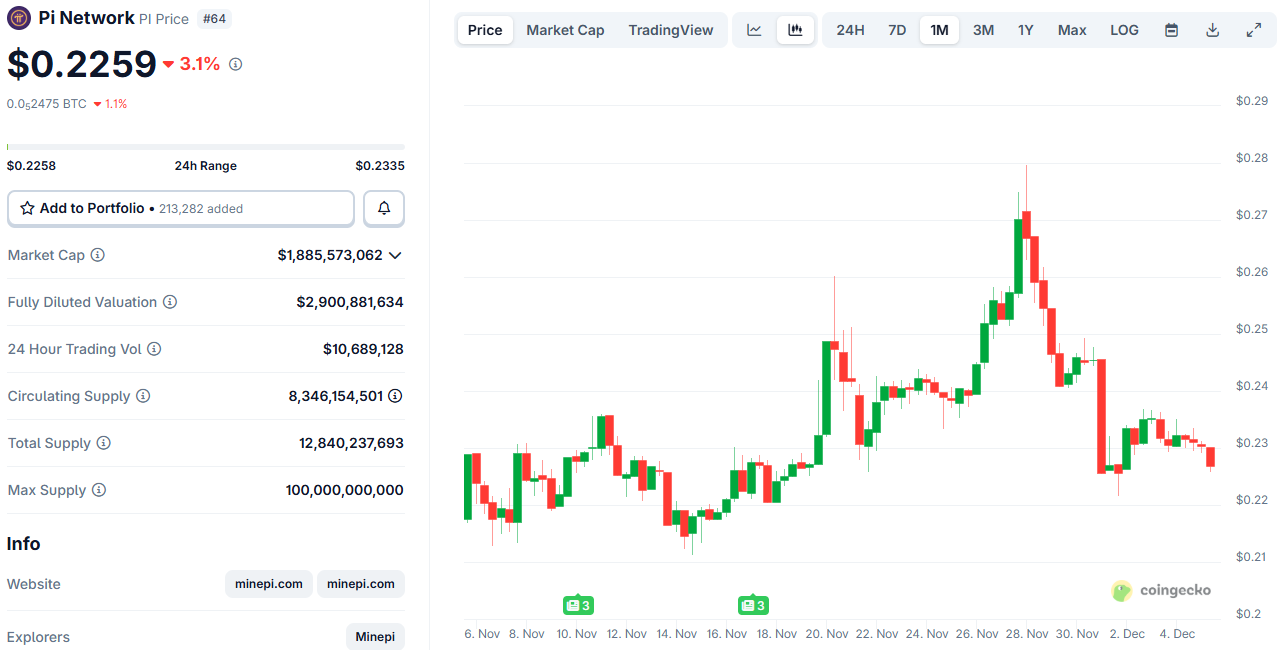

Pi Network’s PI Price on CoinGecko

Pi Network’s PI Price on CoinGecko

Technical Side

OpenAI’s solution offered some grim perspective for the PI bulls. It noted that the overall trading volumes have declined lately, which, coupled with the asset drop from $0.28 to $0.225 as of now, shows that the trend structure has turned bearish for the short-term, but it “has not broken the macro support.”

Despite the ongoing decline, Pi Network’s token remains well above the October all-time low of $0.172. It needs to rebound from the first crucial support at $0.21-$0.22, which would mean that “the broader recovery structure remains intact.” If it breaks below it, though, then it can test the October lows once again.

Should it bounce, PI’s first main obstacle is situated at $0.24-$0.25, which seems like a tall task given the overall trend in the past week. In fact, ChatGPT warned that PI is likely to stay below that level as long as there’s no major update coming to shake things up a bit.

Most Likely Scenario

After categorizing a breakout past $0.25 as the least probable scenario, ChatGPT outlined that a bear case – meaning a drop below $0.20 – is also quite unlikely, unless the overall market structure doesn’t collapse. If the market conditions remain identical, it believes PI will trade sideways in the following week with a lower boundary of $0.22 and an upper one at $0.24.

The post Will PI Rebound In The Week Ahead? ChatGPT With Pi Network Price Predictions appeared first on CryptoPotato.

You May Also Like

‘European SEC’ proposal sparks licensing concerns, institutional ambitions

Legal experts are concerned that transforming ESMA into the “European SEC” may hinder the licensing of crypto and fintech in the region. The European Commission’s proposal to expand the powers of the European Securities and Markets Authority (ESMA) is raising concerns about the centralization of the bloc’s licensing regime, despite signaling deeper institutional ambitions for its capital markets structure.On Thursday, the Commission published a package proposing to “direct supervisory competences” for key pieces of market infrastructure, including crypto-asset service providers (CASPs), trading venues and central counterparties to ESMA, Cointelegraph reported.Concerningly, the ESMA’s jurisdiction would extend to both the supervision and licensing of all European crypto and financial technology (fintech) firms, potentially leading to slower licensing regimes and hindering startup development, according to Faustine Fleuret, head of public affairs at decentralized lending protocol Morpho.Read more

BlackRock boosts AI and US equity exposure in $185 billion models