Crypto assets may soon help owners secure mortgage loans, but traders wonder if this is a wise step

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto holders may now have an easier time acquiring mortgages after William Pulte, director of the FHFA, gave a direction that could see lenders considering cryptocurrency assets during the mortgage application process.

- The FHFA has directed Fannie Mae and Freddie Mac to consider cryptocurrency in mortgage risk assessments, potentially making home loans more accessible to crypto holders.

- While crypto-backed mortgages offer convenience and avoid forced conversion to fiat, extreme volatility raises serious risks for borrowers who use digital assets as collateral.

- Wider acceptance could help crypto owners access fairer financing, but practical limits such as strict collateral requirements and narrow token eligibility remain major hurdles.

On June 25, the regulator in charge of Fannie Mae and Freddie Mac ordered the housing giant to take crypto into consideration as an asset for single-family mortgage loan risk assessments. In an X post, Pulte stated that this move was in accordance with President Trump’s vision of making the US the crypto capital of the world.

While Fannie Mae and Freddie Mac don’t issue mortgages, they can set rules on the kind of mortgages they are willing to buy. Imagine someone getting a mortgage yet not needing to convert their cryptocurrency into US dollars. This means that they still get to enjoy the benefits of crypto and get the mortgage as well. But the biggest question remains: Is it really a wise choice to take on a mortgage while considering crypto for risk assessment?

The volatility of cryptocurrency

Truth be told, crypto is one of the most volatile assets. Today, the asset could be trading at a yearly low, and within a few hours, it is on an all-time high. Take Bitcoin price today, for instance. Between October 6 and November 18, BTC has gone from an all-time high of $124k down to $90k. Conversely, within a year, Bitcoin’s price had soared from $61k to over $107k.

A few months ago, experts were saying that by the end of 2025, the token would have surpassed the $200k mark. However, the latest news is that the token might be crashing soon. Such kind of volatility is even higher than currency pairs and stocks. Well, the dramatic movements work in both ways, up and down, meaning that they could work for crypto owners or against them.

Well, using such a token as collateral for mortgages would mean that homeowners would not need to convert their coins back to dollars with the hope that future prices would go up. However, the inverse is also true. It would be quite devastating if the prices plummet and the homeowner’s crypto stash is liquidated. This means that price movements would have to be monitored in an excessive manner in order to prevent a disaster.

The practicality of crypto as a source of funding

The truth is that crypto-backed mortgages are not a new phenomenon, since there are companies that already deal with that. For example, the fintech Milo offers crypto mortgages, letting buyers use their digital assets as collateral and secure up to 100% financing, without having to sell their Bitcoin or Ethereum. However, here is the catch. Most crypto mortgage providers need customers to provide 100% collateralization. This means that if the house someone is eyeing is worth $400,000, they would need to pledge at least $400,000 worth of coins.

When fiat currency is used, applicants are only needed to make between 5% and 10% cash deposits. In fact, Federal Housing Administration (FHA) loans can go as low as 3.5%. This means that someone can find other sources to get the rest of the money and make monthly repayments.

Another point of consideration is knowing that lenders mostly accept BTC and ETH. Some might go further and accept stablecoins like USDT and USDC. However, that’s just it. If someone has a stash of DOGE or SOL, then they would not get dropped in the application process as soon as they start. The only consolation would be if Fannie Mae and Freddie Mac increased the number of tokens that would be worth looking at during the application process.

Benefits of accepting crypto for mortgages

However, for balance sake, it’s important to acknowledge what crypto owners currently face as they get to own property. For one, people are still skeptical about digital currencies because of the minimal information available on them. Add to their volatile nature, and many lenders try to steer away from the assets. For the crypto owners who want to venture into real estate, it becomes a hard task since they have to change their assets into fiat.

It’s even hard to think that in some countries, lenders penalize applicants if their statements contain any transactions involving crypto. Although it is not a fine, applications are more likely to be rejected. The main reason is that lenders view crypto as hard to trace and also very volatile. Others associate the digital currencies with shady business, reducing the chances of approving loans. However, this is an unfair mindset that needs to be changed.

With the government approving crypto-backed mortgages, it will become easier for crypto owners to get fair chances of owning property. They could be seen as being in a much better financial position to meet their payments.

So far, the order by the FHFA has not yet specified which tokens will be accepted. However, the asset must have evidence, and it should be stored on a US-regulated centralized exchange and subject to the applicable laws. Whether this will work or not, people are very eager to see what might happen when crypto is allowed to be used as collateral for mortgages in the US.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

You May Also Like

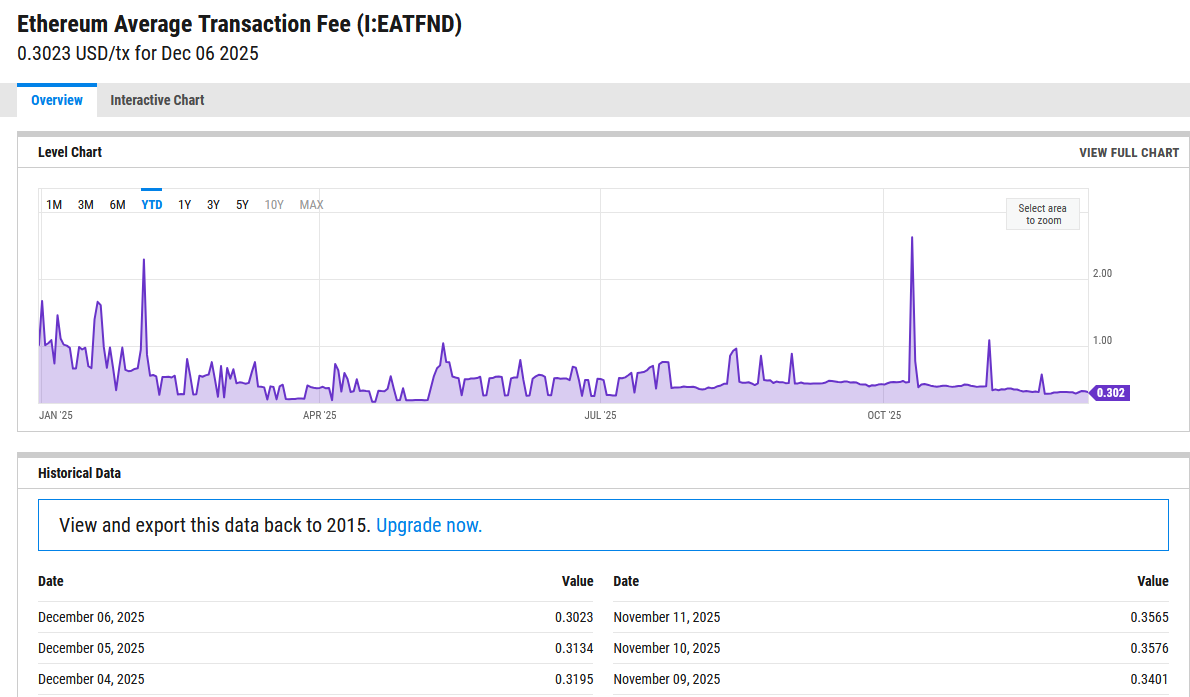

Vitalik Buterin Proposes Onchain Gas Futures to Stabilize Ethereum Fees

Trading Moment: Markets Enter a Key Week Ending the Year, Bitcoin Holds Key Level at $86,000