Zcash (ZEC) Ignites an 11% Jump: Bullish Revival Ahead or a Bearish Trap in Disguise?

- The 11% gain has pushed Zcash to trade at $398.

- ZEC’s trading volume has dropped by over 15%.

The negative outlook of the crypto market has resulted in a 1.14% loss, pushing the market cap down toward $3.13 trillion. With the bears staying here, the digital assets are supposed to lose momentum. All the major tokens are struck in the red waves, attempting the escape.

Notably, the overall market sentiment is lingering in fear, with the Fear and Greed Index value holding at 25. The largest assets, like BTC and ETH, are trading on the downside. Meanwhile, Zcash (ZEC) is one of the trending coins, posting a gain of over 11.78%.

ZEC’s daily low and high were noted at $347.73 and $402.16, respectively. If the ongoing upswing strengthens, the bulls will assist the price movement to hit new highs. Zcash is currently trading at around the $398.86 mark, with its market cap at $6.56 billion.

Besides, the daily trading volume of the asset has dropped by over 15.18%, reaching the $1.19 billion zone. The Coinglass data has reported that the market has experienced an event of liquidation of $7.08 million worth of Zcash in the last 24 hours.

Where Is Zcash Headed From Here?

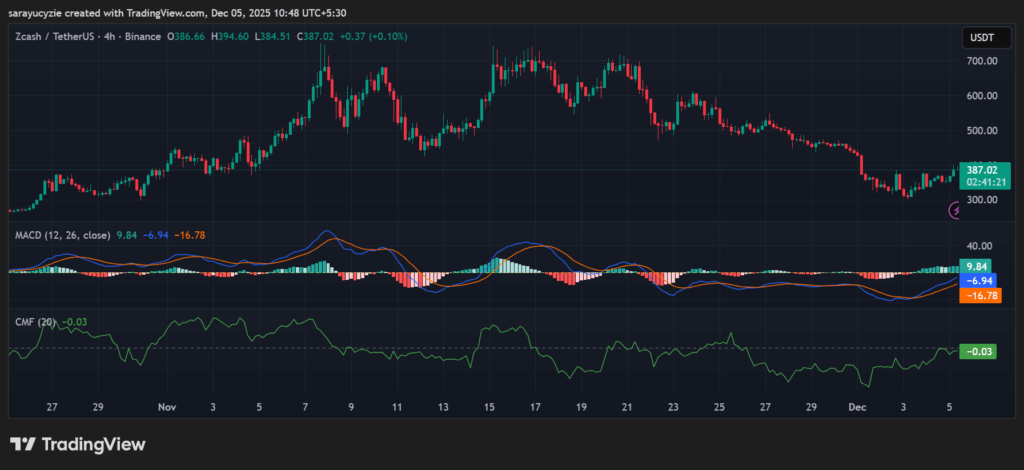

Zcash’s Moving Average Convergence Divergence and signal lines are below the zero line, showing overall bearish momentum. But the MACD is trying to cross above, indicating an early bullish shift, even though the broader trend remains weak.

ZEC chart (Source: TrdaingView)

ZEC chart (Source: TrdaingView)

In addition, the Chaikin Money Flow (CMF) indicator at -0.03 suggests slightly bearish money flow, but it is very close to the neutral zone. The selling pressure is weak in the ZEC market, not strong enough to confirm heavy distribution.

Assuming the Zcash price falls to its nearest support level at $390.37, a potential downside correction might take place. Eventually, the bears may trigger the emergence of a death cross and send the price to $382.49 or even lower.

Upon a reversal, the price of the asset might climb to the resistance at around $406.87. If the upside pressure gains more traction, the bulls initiate the formation of the golden cross, likely driving the Zcash price above the $414.75 range.

Moreover, the daily Relative Strength Index (RSI) at 53.90 signals a neutral to slightly bullish momentum. ZEC is not overbought or oversold, and a drop below 50 could shift the momentum. Zcash’s Bull Bear Power (BBP) reading of 50.18 is strong, hinting that the bulls are having a clear dominance in the market. Also, the buyers have a solid advantage.

Top Updated Crypto News

Critical Security Flaw Discovered in Solana Seeker Smartphone Chip

You May Also Like

Maryland Man Sentenced for Allegedly Aiding North Korea’s US Company Infiltration and Sensitive Data Access

Tropical Depression Wilma lingers off Eastern Samar