BitMine Buys Another $150 Million ETH Amid Wider Market Slowdown

BitMine boosted its ETH holdings past 3% of supply, buying $150M more while many treasuries cut activity in November.

BitMine continued its heavy ETH buying streak during a month when many treasury firms cut activity.

The company lifted its holdings past 3% of circulating supply after another major round of purchases. This raised new questions about its long-term plan, the condition of the DAT sector and how company leaders see future demand for Ethereum.

BitMine Raises Its ETH Treasury During Market Strain

BitMine added another $150 million worth of ETH this week. The new purchase came from two large transactions made through BitGo and Kraken.

On chain data from Arkham showed that BitMine gathered 18,345 ETH from BitGo and 30,278 ETH from Kraken. These moves arrived only a few days after earlier buys that had already grown their balance.

A week earlier, the company bought more than 14,000 ETH to strengthen its holdings. Monday brought another surge when BitMine added more than 96,000 ETH to its treasury.

The combined purchases lifted its slice of Ethereum’s supply to more than 3%.

Tom Lee has said that BitMine wants to reach 5% of the total supply. The firm sees Ethereum as a central player for settlement, tokenisation, and various financial services.

So far, that view has helped guide its strategy during months of volatile market activity.

Growing Treasury Amid Pressure On Its Stock

BitMine’s pursuit of a larger ETH position has not translated into steady stock gains. The company’s shares, traded under BMNR, fell more than 80 percent from an earlier peak.

That slide showed weaker confidence among investors who track crypto exposed firms.

The drop took place even as BitMine’s treasury reached about $12 billion. The company also held about $2.8 billion in unrealised losses due to earlier price swings. These numbers have affected debates around the firm’s heavy buying pace and long term plan.

Market watchers continued to follow how BitMine balanced its growing ETH exposure with the strain on shareholder sentiment.

Some analysts also noted that fluctuations in crypto-focused equities made it difficult for firms like BitMine to maintain market confidence even while building on-chain reserves.

Related Reading: Tom Lee’s BitMine Buys Another $70 Million ETH

DAT Purchases Sink After Large August Peak

Treasury buying across ETH DATs dropped in November. Data from Bitwise showed that the group bought about 370,000 ETH during the month.

That number was far below the August level of 1.97 million ETH. The decline reached 81% during a short stretch of time.

Many small treasuries faced serious stress as mNAV levels fell and premiums shrank.

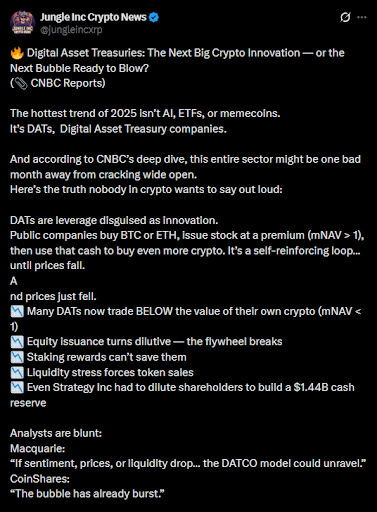

DAT strength appears to have weakened across the board | source: X

DAT strength appears to have weakened across the board | source: X

Some firms even approached insolvency as their buying power weakened. mNAV readings across several companies slipped further between 10 and November as premiums narrowed and many treasuries struggled to maintain earlier buying patterns.

Purchases are still larger than the monthly supply, although the gap shrank this season. Several DAT managers expressed that the pace of buying in earlier months was no longer sustainable.

This trend separated BitMine from the rest of the field as the company continued to accumulate, even during a period of stalled activity.

The post BitMine Buys Another $150 Million ETH Amid Wider Market Slowdown appeared first on Live Bitcoin News.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC