Altcoin Market Enters Historic Buying Zone — 5 Coins to Watch Before the Next Breakout

The post Altcoin Market Enters Historic Buying Zone — 5 Coins to Watch Before the Next Breakout appeared first on Coinpedia Fintech News

The crypto market’s spotlight remains firmly on Bitcoin, whose sharp swings have overshadowed the rest of the ecosystem. Altcoins, meanwhile, have spent most of this cycle stuck in a holding pattern—traders facing weeks of frustration, muted price action, and erratic capital rotations. But beneath this apparent calm, something is shifting. While Bitcoin displays parabolic strength, altcoins are quietly coiling for a potential breakout. Fresh technical readings now indicate that the broader altcoin market has slipped into a clear “buy zone,” hinting that accumulation at current levels could be a well-timed opportunity ahead of the next major move.

Altcoin Volume Slips Under Yearly Average

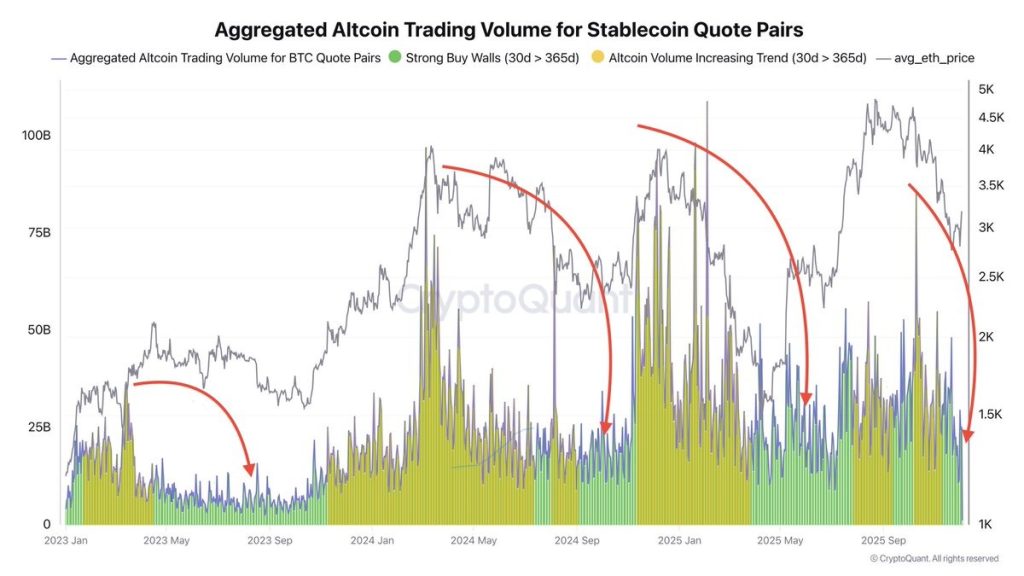

Altcoin trading volumes have dipped below their yearly average, a pattern that has often signalled attractive accumulation phases in previous cycles. While market sentiment remains cautious, this decline in activity suggests traders may be quietly positioning for a broader altcoin recovery as volatility starts to compress.

Source: X

Source: X

The chart shows a clear pattern: Whenever aggregated 30-day altcoin trading volume falls below the 365-day average, the market enters a cooling phase where traders reduce activity, sentiment turns cautious, and prices become compressed.

Historically, these low-volume compression phases have

- Marked late-stage pullbacks within broader bull cycles

- Provided multi-week accumulation windows

- Preceded sharp rebounds once volume expanded again

- Offered favorable risk-reward for DCA strategies

The altcoins are currently in one such period again, suggesting that they may be closer to the beginning of their next expansion phase than the end of a decline.

Top 5 Altcoins to Consider Before a Potential Breakout

Currently, the crypto markets are largely concentrated on Bitcoin as the traders look out for the price marking new highs in the future. Once the attention shifts back on altcoins, they are set to begin a strong rally. Below are the top altcoin picks that can be considered before the upcoming breakout.

Ethereum (ETH)

Ethereum is the anchor of the altcoin market and is approaching a major support retest with rising L2 activity. Historically, once the volume returns to Ethereum, altcoins see major recoveries, and a strong ETH price move triggers an Altseason.

The ETH price has held well above key support zones around $3,800 to $4,000, consolidating larger bases while staking and institutional interest increase. With major EMAs flattening and a base forming, Ethereum is poised for a breakout to new highs in the coming days.

Solana (SOL)

Solana is one of the strongest large-cap narratives with high developer activity, and the consumer apps are outperforming. It has a very strong liquidity compared to the other altcoins and historically displayed faster recoveries after a volume compression.

After earlier weakness near $120 to $150, the SOL price has begun stabilising and forming bullish chart patterns. If the crypto $220 to $240 zone opens up, higher targets with a moderate target close to $300 by the end of 2025.

Chainlink (LINK)

Chainlink often leads to mid-cap breakouts in bullish cycles. The demand for oracles has been constantly on the rise with RWAs and institutional players. It always shows relatively strong strength even during market corrections.

LINK has shown strength in Oracle and data infrastructure demand, though somewhat muted compared to L1 tokens. The short-term target for Chainlink price is around $30 to $40, depending on the upcoming breakout, while the long-term target extends to $75 to $80.

Avalanche (AVAX)

Avalanche is positioned well for institutional adoption with subnet expansions and real-world asset integrations. It tends to rebound once the volume spikes, as it maintains its ecosystem momentum despite the muted market tone.

The AVAX price has been consolidating above the support at around $9 to $12, with a potential breakout into higher ranges. The base target is around $25 to $30 by the year-end if the price manages to surge above the resistance, and in case of a bull run, a rise beyond $60 to $65 could be imminent.

Polygon (MATIC)

This crypto is known for strong fundamentals, and after Polygon 2.0, the ecosystem has revamped aggressively. With the growing demand for scaling, the POL price is expected to provide a long-term upside.

If the POL price manages to break above $1.2 to $1.5 by the end of 2025, the bullish case for the token could elevate the levels beyond $2.

Conclusion

Altcoin volumes dipping below their yearly average have historically signalled the start of an accumulation phase, not the end of a cycle. If the broader bullish structure remains intact—and many indicators still suggest it does—this period may present one of the cycle’s more strategic windows to accumulate high-conviction altcoins.

While breakouts may not happen immediately, volume trends suggest the setup is building. For investors positioning for 2025, selective DCA into strong assets like ETH, SOL, LINK, AVAX, and MATIC could offer compelling long-term opportunities.

You May Also Like

Tom Lee, 2026’yı “Ethereum Yılı” İlan Etti: Fiyat Tahminini Paylaştı!

How to earn from cloud mining: IeByte’s upgraded auto-cloud mining platform unlocks genuine passive earnings