Yorkville SPAC Files S-4, Taps New CEO/CFO for Trump Media Group CRO Strategy

Yorkville Acquisition Corp. has filed a confidential Form S-4 with the U.S. Securities and Exchange Commission, marking a major step toward completing its proposed business combination with affiliates of Trump Media & Technology Group and Crypto(.)com.

The filing comes as the SPAC appoints two public-company veterans, Steve Gutterman as chief executive officer and Sim Salzman as chief financial officer, ahead of the launch of a new digital-asset treasury company focused on the Cronos (CRO) ecosystem.

Yorkville’s MCGA SPAC Moves Forward, Names New CEO and CFO

According to the filing, the SPAC, which trades on Nasdaq under the ticker MCGA, said it advances its proposed business combination with affiliates of Trump Media & Technology Group and Crypto(.)com.

Once the transaction closes, the company will be renamed Trump Media Group CRO Strategy and continue trading under the symbol MCGA, short for “Make CRO Great Again.”

Alongside the filing, Yorkville announced the naming of two veteran executives to lead the entity. Both executives will begin transitioning into their roles as the deal approaches completion, which is expected in the first quarter of 2026.

The business combination seeks to establish a publicly traded digital-asset treasury focused on accumulating and managing large reserves of Cronos (CRO), the native token of the Cronos blockchain ecosystem.

Under the arrangement, founding partners, including Trump Media, Crypto(.)com, and Yorkville, will contribute assets to build a company centered on CRO acquisition, platform integration, and long-term treasury growth.

Yorkville CEO Kevin McGurn said the new appointments provide the leadership required for what he described as a high-value opportunity for shareholders.

Executives from Crypto(.)com and Trump Media echoed that message, citing the incoming team’s experience in digital assets, capital markets, and large-scale corporate transactions.

Gutterman brings decades of public-company leadership experience, including a recent stint as CEO of Gryphon Digital Mining, where he oversaw a corporate turnaround and eventual sale to American Bitcoin.

Earlier in his career, he held senior roles at ETRADE Financial and ETRADE Bank. Salzman also previously held senior finance roles at Gryphon, Marathon Digital Holdings, Corner Bar Management, and the Las Vegas Monorail Company.

CRO Treasury Plans Advance Despite 34% Price Slide and $38M Unrealized Loss

The CRO-focused entity they will lead has been taking shape for months. The strategy was first announced in August 2025, outlining a plan to position the company as the first major publicly traded CRO treasury.

Initial funding commitments include roughly $1 billion worth of CRO tokens, $200 million in cash, $220 million in warrants, and a $5 billion equity line of credit from Yorkville affiliate YA II PN, Ltd.

If executed as proposed, the company would manage one of the largest single-asset crypto treasuries in the market, with nearly all reserves allocated to CRO.

The structure mirrors a corporate treasury model similar to Strategy’s long-running accumulation of Bitcoin, but applies the concept to the Cronos ecosystem.

The company intends to acquire CRO, stake its holdings through Crypto(.)com Custody, and generate a yield estimated at around 6% annually. It also plans to run a validator node on Cronos to further support network functions while compounding rewards.

Meanwhile, Trump Media has been integrating CRO more deeply into its own platforms. Over the past several months, the company has replaced plans for an in-house utility token with a system that converts Truth Social “gems” into CRO via Crypto.com’s wallet infrastructure.

CRO-based payments for subscriptions and platform features are planned for future releases.

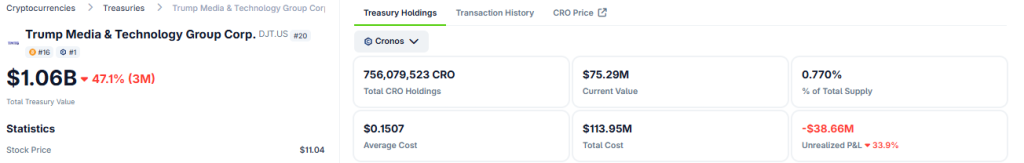

Trump Media has also purchased hundreds of millions of CRO tokens directly. In September, it closed a $105 million agreement with Crypto.com to acquire 684.4 million tokens at an average price of about $0.153.

Source: CoinGecko

Source: CoinGecko

CRO’s market performance has been volatile during these developments. Trump Media Corp. currently holds 756 million CRO, valued at approximately $75 million, showing an unrealized loss of about $38.7 million amid a 34% price decline.

The token is trading around $0.099, down 32% over the past month.

You May Also Like

WOW Summit Partners with Hong Kong Sevens: Five Memorable Days of Web3, Sports, and Excitement!

First Multi-Asset Crypto ETP Opens Door to Institutional Adoption