Peter Brandt Predicts Bitcoin Price To Rally to $250k Despite Potential 75% Correction

TLDR

- Peter Brandt says Bitcoin broke its parabolic trendline in early November 2025.

-

He warns BTC may fall 75 percent, as in all five prior bull cycles.

-

BTC dropped below $90,000 on Dec 1, with $725 million in long liquidations.

-

Analyst van de Poppe says bull cycle remains intact despite sharp pullback.

Bitcoin’s recent drop below the $90,000 level has raised concerns about a deeper correction. Market veteran Peter Brandt has suggested that this fall could signal a much larger decline. According to him, historical data shows that each time Bitcoin broke its parabolic uptrend, the market experienced a crash of 75% or more.

Brandt explained that Bitcoin has followed this pattern through all five of its previous bull market cycles. The drop below the parabolic trendline, which had guided BTC’s rise from the 2022 lows, was identified by Brandt as a crucial signal.

Bitcoin Trendline Break Could Point to Deeper Losses

Peter Brandt noted that the dominant parabolic trend began following Bitcoin’s recovery after the FTX crash in late 2022. Bitcoin had moved steadily above that line until recent price weakness led to a break early last month. According to Brandt, this break typically precedes a prolonged correction.

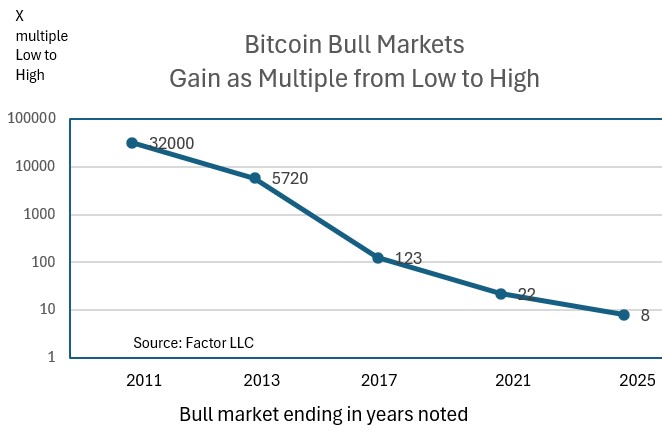

Historical data supports his position. In 2011, Bitcoin fell 86% after losing its trendline. In 2013, BTC dropped 80%. In 2017 and 2021, the declines reached 77% and 74.2% respectively. Brandt argues that if Bitcoin follows the same trajectory from a recent peak of $103,000, the price could fall to around $25,750.

Brandt also repeated a broader theory that he calls exponential decay. He said that each Bitcoin bull run has shown lower momentum than the one before, and that gains at the top of each cycle have slowed over time.

Brandt said that falling to $50,000 would not end the long‑range upside. Instead, he said that the next cycle peak could reach $200,000 to $250,000, yet only after a deep correction. In his earlier post, he noted:

Analysts Split on BTC Market Outlook

While Brandt remains cautious, other analysts see the recent dip as a standard pullback rather than a cycle-ending event. Michaël van de Poppe said the overall bull cycle still appears to be in progress. He cited low retail activity and the absence of extreme market conditions.

Van de Poppe believes that Bitcoin could retest the $90,000 to $94,000 range and possibly push higher. He said that no indicators currently suggest a final peak has been reached. This view contrasts with Brandt’s position but reflects ongoing debate among market participants.

Benjamin Cowen also pointed to historical similarities with the 2019 cycle. He noted that ALT/BTC pairs may follow a delayed pattern even after Bitcoin tops out. Cowen added that a quick altcoin rally may not follow and warned that further declines in ALT/BTC pairs could occur.

Liquidations and Macro Factors Add Pressure

Bitcoin’s sharp fall came as over $725 million in long positions were liquidated in 24 hours. Market data suggests that a combination of low trading volume and heavy leverage contributed to the steep decline. Some observers linked the price move to currency shifts, including the Japanese yen spike.

The price of Bitcoin had reached as high as $103,000 before the recent correction. The latest drop below $90,000 has put the asset at a key support zone. Traders are now watching closely to see if the market continues downward or begins to recover.

Brandt maintained his stance despite other views. He acknowledged that at some point the pattern may change but said he would not bet against it without clear evidence.

The post Peter Brandt Predicts Bitcoin Price To Rally to $250k Despite Potential 75% Correction appeared first on CoinCentral.

You May Also Like

Modernizing Legacy E-Commerce Platforms: From Oracle ATG To Cloud-Native Architectures

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse