Digital economy contributed 11.8% to Nigeria’s real GDP in Q3 2025

The Digital Economy sector contributed 11.8% to Nigeria’s Real Gross Domestic Product (GDP) during the third quarter of 2025. This shows that the industry performed lower compared to the 14.4% contribution in the second quarter of 2025.

According to a report released on Monday by the National Bureau of Statistics (NBS), the digital economy sector contributed N6.7 trillion to the nation’s real GDP of N57 trillion in Q3 2025.

Notably, the Nigerian Digital Economy sector comprises the Information and Communication (I&C) and the Financial Institutions (FI) sectors. The industry has remained a top contributor to the Nigerian economy, driven by telecoms players and the banking industry.

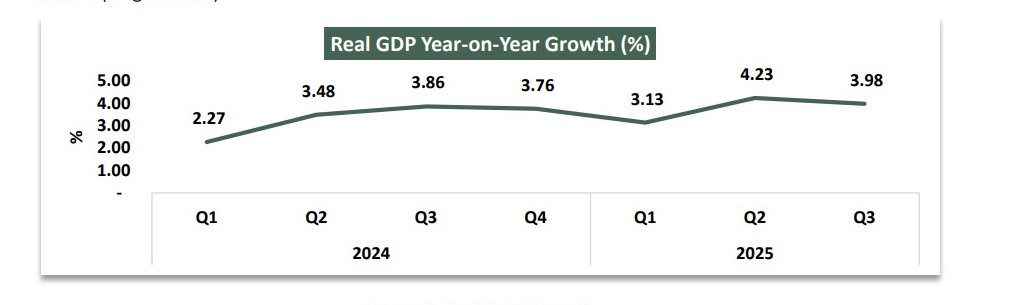

In an overview, Nigeria’s real GDP grew by 3.98% which is lower than 4.23% (N51.20 trillion) in Q2 2025. However, the growth rate is higher than the 3.86% recorded in Q3 2024.

Information and Communications (I&C)

The I&C sector, which comprises telecommunications, publishing, sound and media production, and broadcasting, contributed 9.1% to real GDP in Q3 2025, compared to 11.8% in Q2 2025. In monetary terms, the sector contributed N5.2 trillion, down from N5.72 trillion in Q2 2025.

In further breakdown, Telecommunications accounted for N4.4 trillion (84.5%), followed by Broadcasting with N430.7 billion (8.2%), and Sound and Media Production with N379.2 billion (7.2%). Publishing recorded the least contribution of N9 billion, representing 0.1% of the quota.

However, the sector during the quarter in review recorded a year-on-year growth rate of 5.78% in real terms. This is because the 9.1% is higher than the 8.95% recorded in Q3 2024.

Also Read: How Nigeria’s new digital economy bill could make government finally work like your banking app.

Financial Institutions (FI)

The FI sector, comprising financial institutions and Insurance, contributed 2.7% to real GDP in the third quarter of 2025. This, in monetary terms, revealed that the sector saw N1.5 trillion, compared to the N1.75 trillion in the previous quarter.

The further breakdown shows that Financial Institutions recorded the highest contribution of N1.3 trillion (86.7%), leaving Insurance with N190.6 billion (13.3%). The quarter-on-quarter comparison shows that FI contributed 3.23% in Q2 2025, amounting to N1.65 trillion.

Year-on-year, the sector recorded growth of 19.63% in real terms, with the 2.7% in Q3 2025 being higher than the 2.30% recorded in Q3 2024.

| The Nigerian Digital Economy in Q3 2025 | ||||

| Information and Communications | Financial Institutions | Total | ||

| Telecommunications | N4.4 trillion (84.5%) | Financial Institutions | N1.3 trillion (86.7%) | |

| Publishing | N9 billion (0.1%) | Insurance | N190.6 billion (13.3%) | |

| Sound and Media Production | N379.2 billion (7.2%) | |||

| Broadcasting | N430.7 billion (8.2%) | |||

| Total | N5.2 trillion | N1.5 trillion | N6.7 trillion | |

| % to Real GDP | 9.1% | 2.7% | 11.9% | |

According to industry players, the Digital Economy sector is poised to increase its contribution to real GDP. This comes amid potential investment in the telecoms industry, which houses major players such as MTN, Airtel and Globacom.

In addition, the Minister of Communications, Innovation and Digital Economy, Dr Bosun Tijani, mentioned in early 2025 that the digital economy sector has the potential to generate $18.3 billion by 2026. Also, he recently noted that the National Digital Economy Bill, 2025, is a catalyst for Nigeria’s ambitious $1 trillion economy target.

You May Also Like

Crypto Market Cap Edges Up 2% as Bitcoin Approaches $118K After Fed Rate Trim

Vitalik Buterin Reveals Ethereum’s (ETH) Future Plans – Here’s What’s Planned