Despite Bearish Signals, Looming Santa Rally for Bitcoin Boosts Best Crypto to Buy

Takeaways:

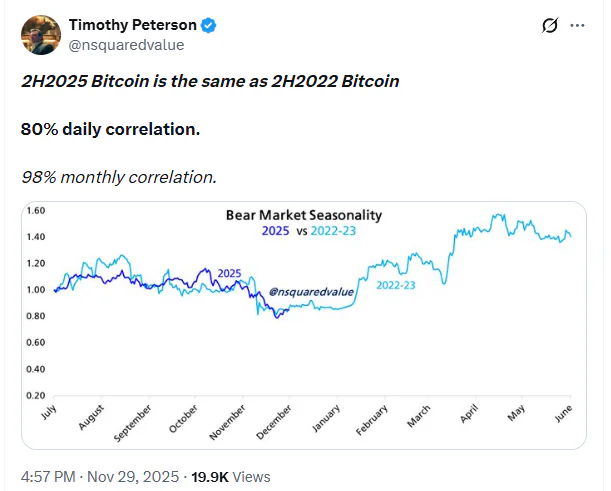

- Bitcoin’s muted daily price action mirrors 2022 conditions, and historically, compressed volatility has often preceded sharp year-end reversals as sentiment and capital flows rebound.

- Bitcoin Hyper’s SVM-driven Layer 2 introduces high-throughput DeFi, NFTs, and gaming to the Bitcoin ecosystem while maintaining settlement security on the base layer.

- PEPENODE’s mine-to-earn memecoin design uses gamified virtual mining and tiered node incentives to attract retail participation when broader risk appetite improves.

- Ripple’s XRP benefits from regulatory clarity and institutional integrations, providing exposure to rapid cross-border payment infrastructure as traditional finance scales on-chain adoption.

Bitcoin has been grinding sideways with eerily muted daily candles, echoing the 2022 bear market’s slow bleed.

Source: X Post

Source: X Post

With 2022’s similarity, volatility is compressed, liquidity is patchy, and most traders are chopping themselves up trying to front‑run the next big move. Yet history shows sentiment can flip violently into a year‑end ‘Santa rally’ once flows return.

That combination of weak price action and optionality to the upside is exactly when narrative matters most. If Bitcoin catches a bid into late December, capital tends to rotate quickly into assets that solve real infrastructure problems, not just whatever pumped yesterday on social media.

That’s where the next leg of risk will likely flow if a rally ignites.

Below are three very different contenders for that spot on your watchlist: a Bitcoin Hyper ($HYPER), a PEPENODE ($PEPENODE), and XRP ($XRP) that just cleared a major regulatory overhang.

1. Bitcoin Hyper ($HYPER) — The First Ever Bitcoin Layer 2 With SVM

Bitcoin Hyper positions itself as the first Bitcoin Layer 2 to integrate the Solana Virtual Machine (SVM), aiming to deliver execution that’s faster than Solana while anchoring security to Bitcoin.

The core idea: keep Bitcoin as the conservative settlement layer but offload smart contracts and high‑throughput activity to a dedicated SVM-based chain.

That lets it target extremely low‑latency confirmations and low fees, while offering SPL‑compatible tokens adapted for the L2 environment.

The design unlocks what Bitcoin has historically lacked: scalable programmability. Developers can deploy DeFi primitives like swaps, lending, and staking in Rust, build NFT platforms, or launch gaming dApps that need sub‑second responsiveness and cheap interactions, all while settling economic finality back to Bitcoin’s battle‑tested base layer.

From a market standpoint, the presale momentum is notable. The Bitcoin Hyper presale has raised $28.8, with tokens priced at $0.013355, putting it firmly in large‑cap presale territory rather than a micro‑cap punt.

For yield‑seekers, staking is central to the token design: high‑APY rewards (exact rate undisclosed) are slated to go live immediately after TGE, with a 7‑day vesting period for presale stakers and ongoing rewards tied to community and governance participation.

If a Santa rally drags liquidity into Bitcoin narratives, a functioning SVM Layer 2 expanding BTC’s utility is a clear beneficiary.

Join the $HYPER presale today

2. PEPENODE ($PEPENODE) — World’s First Mine‑to‑Earn Memecoin

If Bitcoin Hyper is the infrastructure bet, PEPENODE ($PEPENODE) is the speculative social‑layer play. Branded as the world’s first mine‑to‑earn memecoin, it treats node participation like a gamified mining game rather than dry staking, aiming to turn retail engagement into an on‑chain mini‑economy.

It’s designed to tap into the psychology that made early mining farms and yield farms addictive, but with memecoin branding and simpler UX.

From a traction standpoint, the PEPENODE presale has already raised $2.2M, with tokens priced at $0.0011731. That pricing leaves more room for volatility both ways, which is exactly what traders often look for when risk appetite returns and memecoins start to outperform majors during late‑cycle rallies. Don’t get left behind; learn how to buy PEPENODE in 5 easy steps.

While the current staking APY is 578%, the key thesis is less about concrete yield math and more about narrative and engagement: if mine‑to‑earn catches on as a meme and the dashboard experience is sticky, PEPENODE could take off.

Check out the PEPENODE presale.

3. Ripple (XRP) — Institutional Rail for Fast Cross‑Border Payments

Ripple’s XRP takes a very different role in a potential Santa rally: not a new narrative, but a matured one that just got fresh regulatory clarity. XRP is designed as a digital asset for fast, low‑cost cross‑border payments and to provide on‑demand liquidity for banks and payment providers.

Recent technical upgrades include an EVM sidechain and expanded smart‑contract capabilities, giving developers a path to DeFi and tokenization atop the existing payments network.

Crucially, Ripple settled its long‑running SEC case in 2025 and has since leaned into institutional expansion, including acquisitions such as Rail and partnerships like BNY Mellon custody for $RLUSD.

That combination of regulatory clarity and infrastructure deals has helped XRP achieve a top‑three market‑cap position (excluding stablecoins).

In a scenario where Bitcoin grinds higher and institutions re‑engage, XRP offers exposure to the inner workings of global payments rather than pure speculation. It’s less about outsized multiple‑X upside and more about capturing renewed flows as traditional finance experiments with tokenized value transfer rails.

Learn more on the official Ripple site.

Bitcoin Hyper stands out as the direct bet on unlocking smart‑contract scale for Bitcoin itself, while PEPENODE and XRP target, respectively, retail speculation and institutional payments rails.

This publication is sponsored and written by a third party. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own researchs.

The post Despite Bearish Signals, Looming Santa Rally for Bitcoin Boosts Best Crypto to Buy appeared first on Coindoo.

You May Also Like

Taiko Makes Chainlink Data Streams Its Official Oracle

Kalshi Prediction Markets Are Pulling In $1 Billion Monthly as State Regulators Loom

![[Pastilan] End the confidential fund madness](https://www.rappler.com/tachyon/2024/05/commission-on-audit-may-28-2024.jpg?resize=75%2C75&crop=301px%2C0px%2C720px%2C720px)