LiquidChain ($LIQUID) Bridges Bitcoin, Ethereum & Solana Like Never Before – Best Crypto to Buy?

A shift in multi-chain liquidity often starts quietly, then reshapes how value moves across blockchain networks. That idea sits at the center of LiquidChain ($LIQUID) as it builds a shared layer that connects Bitcoin, Ethereum, and Solana without the friction that slows most cross-chain systems.

Current platforms still rely on isolated pools and slow transfer routes, and this creates delays that affect trading and application performance. LiquidChain approaches the problem with a unified model that brings liquidity into one coordinated system.

This design places the project inside ongoing discussions about the next strong crypto presale and a practical altcoin to buy with real functionality attached.

What Makes LiquidChain a Strong Crypto to Buy for Cross-Chain Activity

LiquidChain focuses on unified liquidity built inside a Layer 3 structure. Liquidity from Bitcoin, Ethereum, and Solana becomes reachable in one place. This reduces barriers that usually limit multi-chain systems.

The shared layer supports fast routing for decentralized exchanges, trading tools, and payment platforms. Applications do not need to create separate pools or wrapped asset systems. This keeps activity smooth and simple, which helps developers reduce costs and improve speed across chains.

The network also uses a batching system that organizes transactions efficiently. This process helps maintain predictable settlement and avoids the fragmentation that often slows cross-chain transfers. These features strengthen LiquidChain’s position as a crypto to buy for users searching for reliable multi-chain access.

Another key point comes from the project’s clear framework. Each part of the system, including validators, liquidity routes, and settlement logic, is explained in its documentation.

This transparency gives the network a strong base and supports long-term development across Web3 applications.

How $LIQUID Supports the Network’s Economic Structure

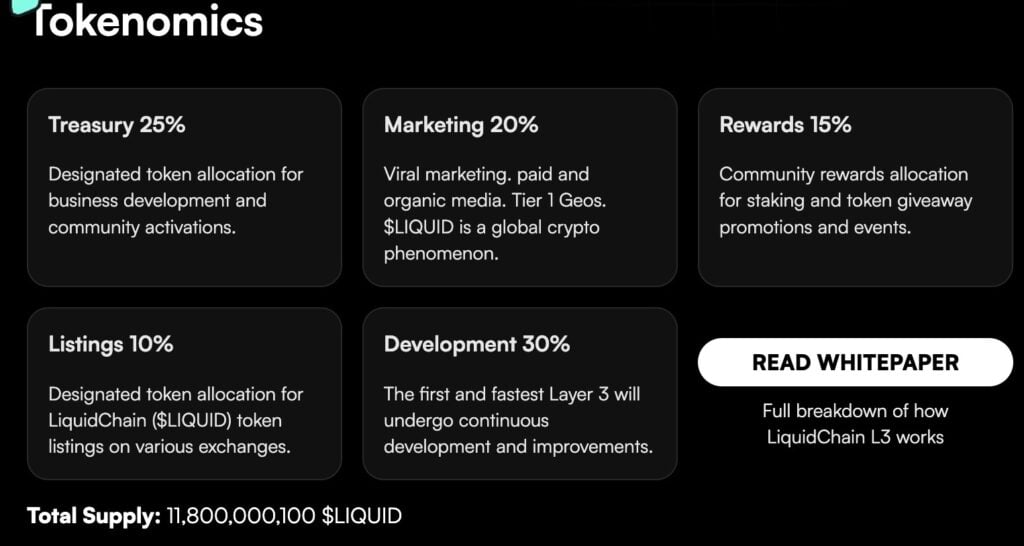

LiquidChain uses the $LIQUID token to support activity inside the system. The token helps manage fees, validator incentives, and network usage.

This structure connects value to network performance and not only to speculation.

Validators help secure the system, and incentives encourage steady participation. The tokenomics layout also includes fee-based rewards, which help maintain smooth operations and reliability for all connected chains. These mechanics keep the ecosystem active and provide constant utility for the token.

The controlled distribution model supports stable development. It avoids unnecessary pressure on the market and gives the project space to grow during early and mid-stage adoption. These factors place LiquidChain inside the conversation about the most utility-focused altcoin to buy during periods of network expansion.

Inside the LiquidChain Presale and Early Staking Structure

The current crypto presale for LiquidChain lists the $LIQUID token at $0.01235. Interest grows around projects that show real use, and LiquidChain aligns with that trend through its focus on cross-chain liquidity. The presale supports development phases described in the project’s roadmap and introduces new participants to the system.

LiquidChain also provides staking features, with estimated rewards currently listed at over 15,000% during early phases. Staking helps secure transaction flow and keeps validators active inside the network.

This creates strong support for operational stability and gives the system the structure it needs to handle multi-chain activity.

The combination of a clear token model, ongoing crypto presale activity, and early staking incentives places LiquidChain in discussions surrounding useful crypto to buy during new market cycles. Cross-chain liquidity remains one of the strongest areas of development across blockchain, and LiquidChain positions itself directly in that space.

Visit LiquidChain Presale

How LiquidChain Positions Itself for the Next Stage of Web3 Growth

LiquidChain prepares for major milestones that include expanded validator networks, support for more blockchains, and broader integration for decentralized platforms.

Each step aims to strengthen the shared liquidity layer and support faster operations across the largest networks.

The system fits well into today’s multi-chain environment, where asset isolation continues to hold back growth. A coordinated liquidity layer offers a clean solution, and LiquidChain’s design responds to real needs inside DeFi. The crypto presale, staking system, and technical foundation work together to create a solid base for future development.

As the market looks for the next altcoin to buy with meaningful usage, LiquidChain stands out for its focus on efficient cross-chain operations and practical network structure. The project is positioned well for observers who follow long-term progress in unified liquidity systems.

Discover the future of crypto presales with LiquidChain:

Presale: https://liquidchain.com/

Social: https://x.com/getliquidchain

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Pump.fun CEO to Call Low-Cap Gem to Test New ‘Callouts’ Feature — Is a 100x Incoming?

This U.S. politician’s suspicious stock trade just returned over 200% in weeks