Will Walrus, a decentralized storage project that has raised $140 million, become the DeepSeek moment of the SUI ecosystem?

Author: Frank, PANews

The decentralized storage protocol Walrus recently completed a financing of US$140 million. This round of financing was led by Standard Crypto, with participation from institutions such as a16z crypto and Electric Capital, making it the largest financing amount among recent on-chain projects.

Decentralized storage is an old story, but in the current market environment, it has still been able to obtain such a large amount of financing, which has triggered discussions in the industry. From Walrus's perspective, it is not only an attempt to reshape the decentralized storage track by reducing costs by a hundredfold, but also a new layout of Mysten Labs to upgrade Sui's performance and optimize token economics.

Walrus may reduce the cost of decentralized storage by 100 times

According to official information, Walrus is a decentralized storage and data availability protocol that aims to provide secure and efficient storage solutions for large files and unstructured data. It was developed by Sui's development team Mysten Labs and built on the Sui blockchain, with the goal of innovating data management in decentralized networks.

In terms of technical features, Walrus' core technology is error correction code (erasure coding) technology, which divides data into smaller unit fragments (slivers) and distributes them on multiple storage nodes. This method can restore data even when up to two-thirds of the nodes fail, ensuring high availability and reliability.

The more important practical significance of this innovation may be in terms of cost. Relying on error-correcting code technology, Walrus's replication factor is reduced to 4~5 times, which significantly reduces storage costs and is close to the efficiency of centralized cloud services. In comparison, Filecoin's replication factor is about 25 times, and Arweave is as high as 100-1000 times. Based on this calculation, Walrus' storage cost may be 80-100 times lower than Filecoin and Arweave. In addition, due to file segmentation restrictions, Walrus is also suitable for applications that require large amounts of data, such as AI data sets and media files.

According to SuperEx estimates, Arweave's annual storage cost for 1TB of data is about $3,500, Filecoin's cost ranges from $200 to $1,000, and Walrus only costs $50.

As of March 23, data shows that Walrus' test network has stored about 80TB of data, with a total number of addresses exceeding 13.45 million. In addition, 109 projects are running on the test network, many of which are native projects of Walrus. The project types are mainly small games, and well-known institutions such as Tusky, Decrypt Media, and Chainbase have been attracted to cooperate.

Sui Ecosystem's "Turbocharger", 1EB storage target = 15% SUI token burning

Of course, in today's market environment, it seems difficult to gain high recognition from capital with just the narrative of technological innovation. For Walrus, another reason for the huge financing may be that it came from Mysten Labs. As the development team of the Sui network, Mysten Labs completed a financing amount of US$336 million before the launch of the Sui network. The lead investor of Walrus, Standard Crypto, as well as institutions such as a16z crypto and Electric Capital, have also appeared on the list of investors of Sui.

In the statement when Walrus was launched, it can be seen that the launch of Walrus originated from the need to upgrade the storage problem of Sui network. After Walrus went online, it reduced the storage pressure of Sui network by providing efficient decentralized storage solutions.

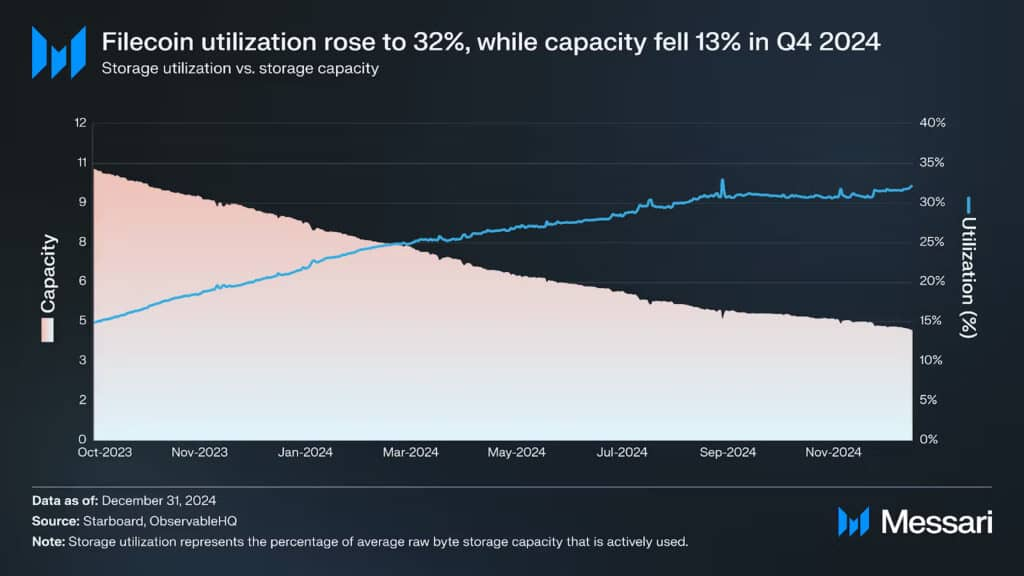

In addition, according to SuperEx's report, each blob stored by Walrus needs to create a metadata object on Sui, which consumes SUI tokens as gas fees. If Walrus usage increases to 1EB (exabyte), it is estimated that about 240 million SUI (15% of the current circulation) may be consumed each year, indirectly affecting the network economy. In the fourth quarter of 2024, Filecoin's total storage capacity will be about 4.2EB.

Mysten Labs also announced in March that it had acquired Parasol, a Web3 gaming infrastructure startup. Combined with the performance improvement of Walrus, Sui Network may focus on AI and gaming next.

This massive influx of capital seems to remind the market that decentralized storage is still a market with potential. According to a report by Codex.Storage in December 2024, the decentralized storage market will see further market expansion in 2025 as AI expands and more and more companies adopt hybrid cloud.

$80 million worth of airdrops have been distributed via NFT

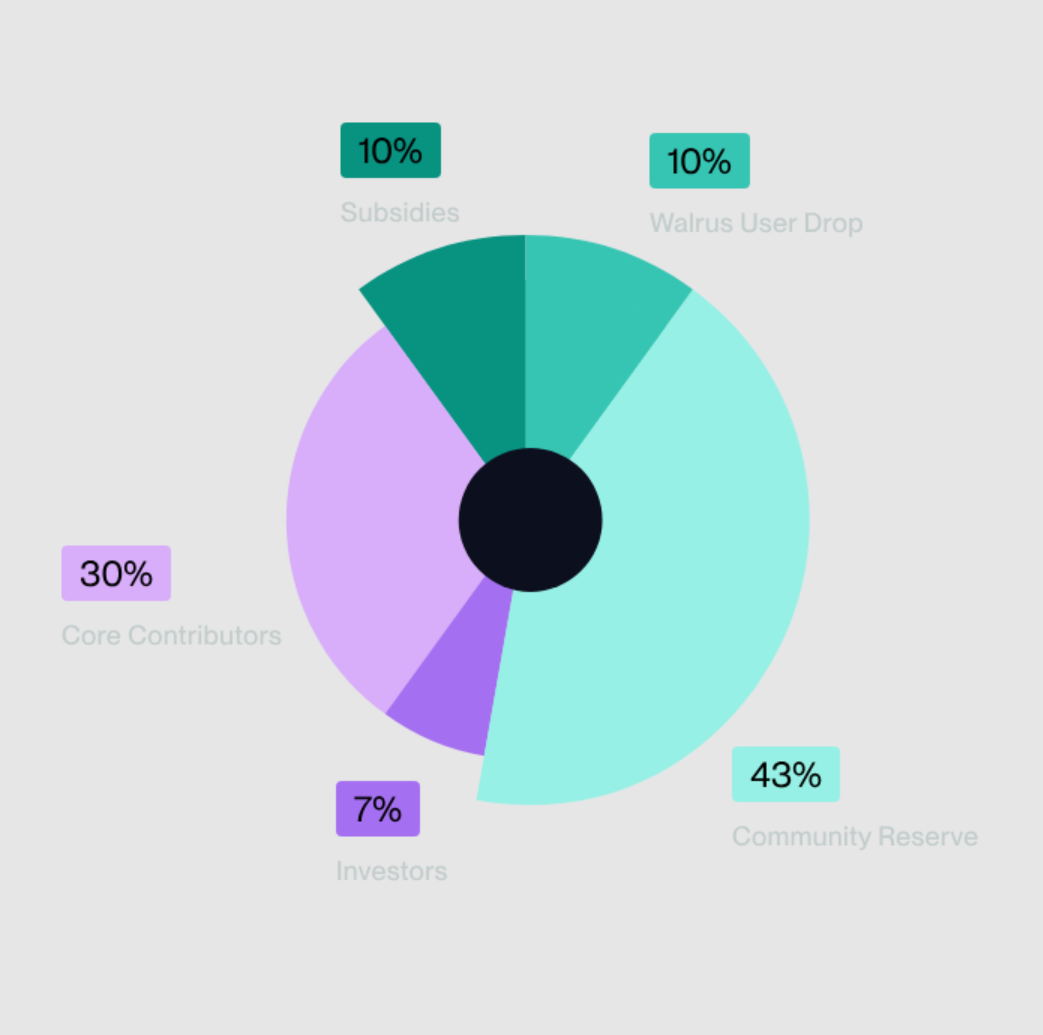

The huge amount of financing also makes the market believe that Walrus may become another major airdrop. WAL is the native token of Walrus, with a maximum supply of 5 billion and an initial circulation supply of 1.25 billion. Walrus' official announcement shows that more than 60% of WAL will be used for the community. But a careful study shows that this does not mean that the initial airdrop ratio will be high. It is reported that a total of 10% of the tokens will be used for user airdrops, of which 4% will be allocated before the mainnet is launched, and 6% will be allocated after the mainnet is launched. In addition, 43% of the tokens are used for community reserves. This part of the funds is used for the long-term development and growth of the Walrus ecosystem, including community funding and planning, developer support, Walrus core research, incentive programs, community activities, hackathons and other ecological projects. It is managed by the Walrus Foundation and the mainnet is expected to be launched on March 27.

Investors will receive a total of 7% of the shares, which will be unlocked 12 months after the mainnet is launched. Based on the calculation that the 7% token share corresponds to the $140 million financing, the cost of a single WAL obtained by investors is about $0.4. The valuation of WAL has reached $2 billion, compared to the current full circulation market value of Filecoin, which is about $6 billion.

Currently, 4% of the tokens before the mainnet launch have been distributed to users participating in the testnet in the form of NFTs, and the remaining 6% of the airdrop shares will be distributed through community incentives and ecological participation after the launch.

While the Web3 world is still exploring the ultimate form of the storage track, Walrus has opened up a new path with the technical combination of "error correction code + low replication factor". This is not only a revolution in storage costs, but also a paradigm breakthrough in the self-iteration of the Sui ecosystem - by converting storage consumption into an economic engine for SUI tokens, Walrus is weaving a multi-dimensional value network covering data storage, on-chain interaction, and AI training.

As the 1EB storage target is pushed forward, this behemoth that consumes 15% of circulating tokens may become the best driver of Sui public chain growth. In 2025, when AI data demand is surging, can Walrus' 100-fold cost advantage leverage the $100 billion cloud storage market? The answer may be hidden in the storage curve when the mainnet is launched.

You May Also Like

Polymarket signals 98% chance Fed will keep rates steady in January meeting

BlackRock boosts AI and US equity exposure in $185 billion models