Ethereum Price Slides to $3,030 as ETF Outflows and Whale Deleveraging Dominate November

Ethereum price hurtled toward the $3,030 level on Sunday, Nov. 28, setting the asset on course to close the month with 21.4% losses.

Heavy whale sell-offs in the first half of the month inflicted the most damage, as broader crypto markets reacted to the US government shutdown and political pressure facing the crypto-friendly Trump administration.

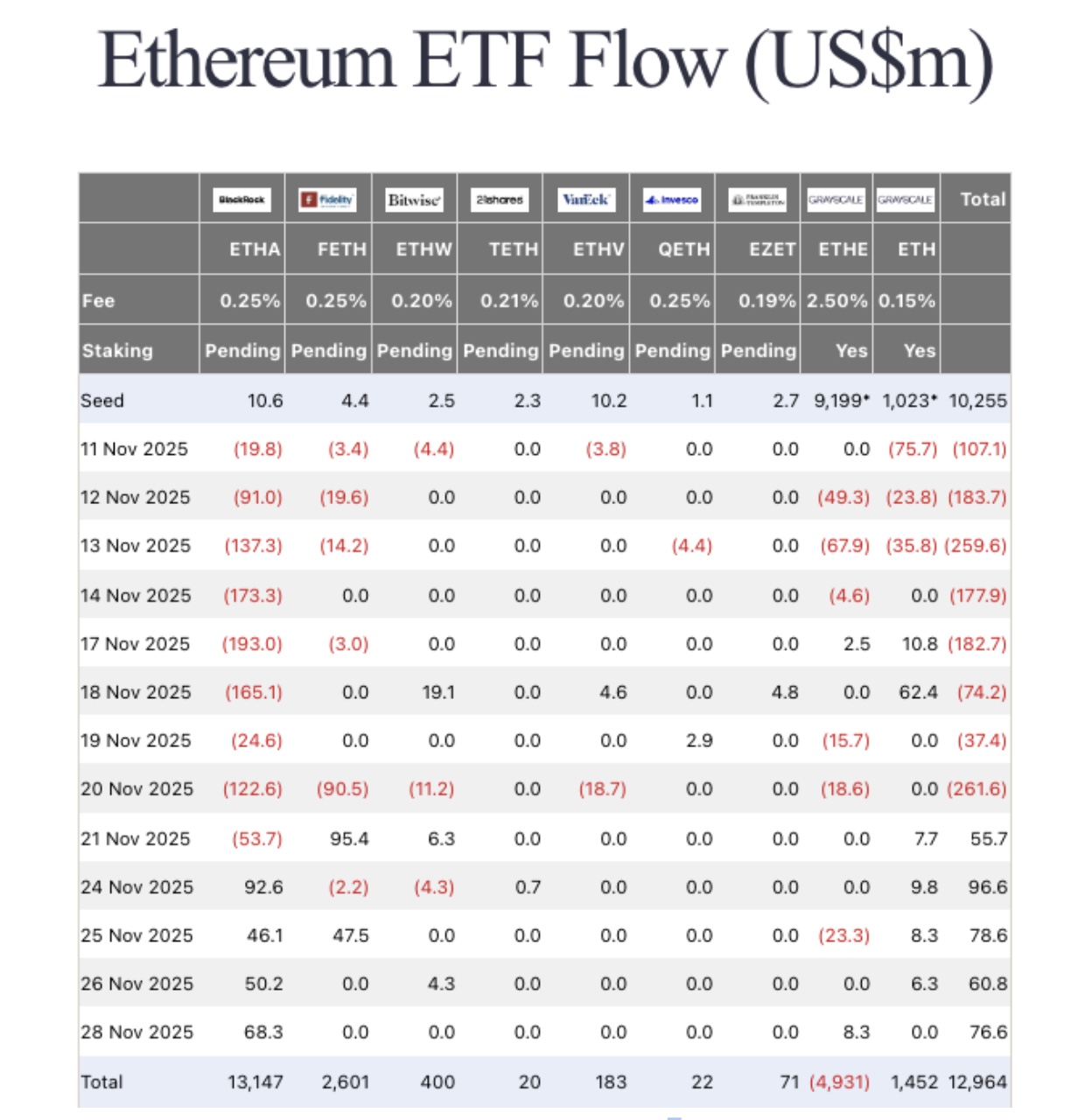

Ethereum ETF Flows Nov 2025 | Source: FarsideInvestors

US-listed Ethereum ETFs recorded $1.284 billion in outflows during an eight-day selling wave from Nov. 11 to Nov. 20. Although ETF issuers returned to net inflows in the final week, the late inflows were insufficient to offset earlier drawdowns. Farside Investors data shows Ethereum ETFs logged $368 million in inflows last week, marking a clean sweep of daily positives but failing to reverse the monthly deficit, which amounted to $1.4 billion in withdrawals for the month.

Tom Lee-led Bitmine, the largest Ethereum treasury holder, also aligned with the ETFs’ late-month accumulation trend. Bitmine added 14,618 ETH, worth about $185 million, during the final week of November, reinforcing the long-term commitment from US corporate investors as recent geopolitical tensions fade.

Derivatives Positioning Turns Bullish as Whales Deploy $700M Longs at $2,960 Support

Despite the renewed demand from whales failing to overturn Ethereum’s 21% monthly loss, derivatives market trends indicate that large investors have done enough to shift sentiment toward a constructive outlook for December.

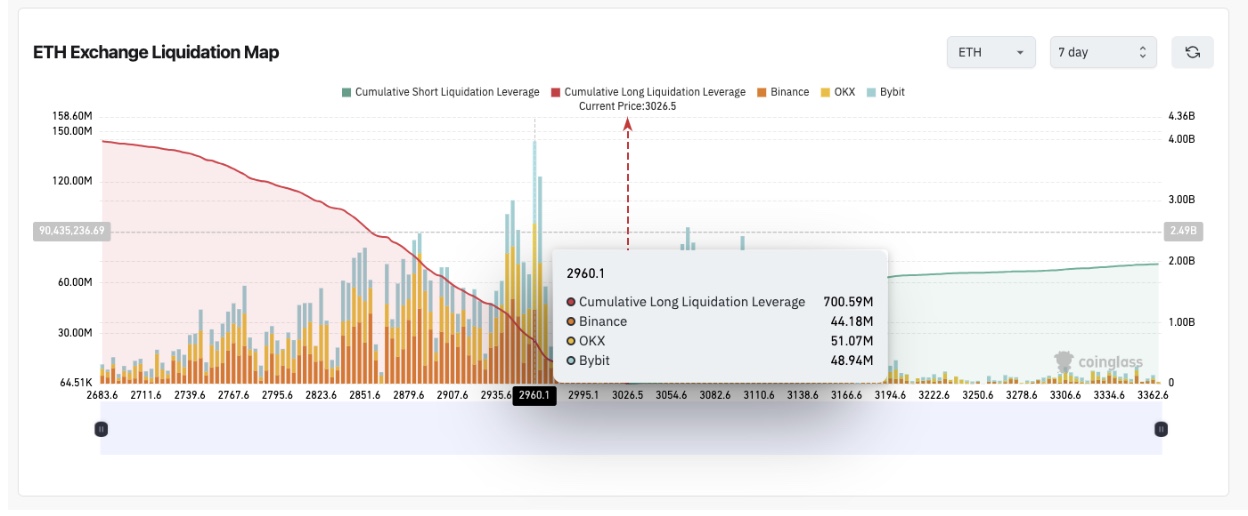

Ethereum Liquidation Map, Nov 30, 2025 | Source: Coinglass

Coinglass liquidation-map data shows bulls regained clear control over the past week, with 3.97 million active long ETH contracts outweighing the $1.9 billion in total shorts. More critically, the data reveals the $2,960 zone attracted the largest single derivatives position cluster in seven days, with more than $700 million in long exposure deployed at that level.

This cluster explains why Ethereum held the $3,000 support area despite intraday pressure triggered by Bitcoin’s rejection below $90,400 on Nov. 29. Whales appear committed to defending the zone, creating an early psychological anchor for Ethereum’s price outlook in December.

Ethereum Price Outlook for December 2025

Ethereum enters December with derivatives sentiment leaning decisively bullish. However, the liquidation map shows more than $1.3 billion of the active $1.96 billion short positions sit near the $3,100 level. That concentration introduces a tactical ceiling. ETH could struggle to break the level cleanly if bears initiate protective coverage.

Conversely, a breakout from that zone could trigger a short squeeze that could accelerate ETH toward $3,500 in the weeks ahead.

Ethereum (ETH) Technical Price Analysis | Nov 30 2025 | Source: TradingView

Technical indicators support this optimistic outlook on the ETH price. As seen below, Ethereum continues to trade above the 20-day EMA, signalling recovering near-term demand. However, the 200-day moving average still trends downward near $3,130, reinforcing the overhead resistance observed in the derivatives market.

Ethereum RSI at 51 also suggests neutral momentum with room for expansion in either direction, while a positive volume delta reading suggests buyers have the upper hand in the near term.

If bulls defend the $2,960 cluster with the same consistency seen in late November, Ethereum has a credible path to establish $3,500 as Ethereum’s primary upside target for December 2025. Meanwhile, failure to hold that support line may trigger a reversal to $2,880 and $2,820.

nextThe post Ethereum Price Slides to $3,030 as ETF Outflows and Whale Deleveraging Dominate November appeared first on Coinspeaker.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

Will Bitcoin Make a New All-Time High Soon? Here’s What Users Think