Zcash (ZEC) Sinks by 27% Weekly: Crash to $200 Coming Next?

The cryptocurrency market rebounded substantially over the past week, but Zcash (ZEC) has not followed the overall green wave.

Instead, its price has plummeted by approximately 27% within that timeframe, and several analysts now predict it is poised for a much more substantial collapse.

Is the Bull Run Over?

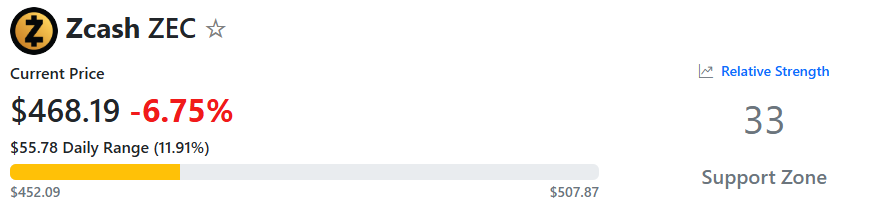

Currently, ZEC trades at roughly $470, representing a solid retreat from the local high above $730 reached earlier this month. Recall that the asset was at the forefront of gains in October and most of November, but the bears seem to have regained control recently.

ZEC Price, Source: CoinGecko

ZEC Price, Source: CoinGecko

While the native token of Zcash was the subject of very bullish price predictions during its bull run, the landscape has changed the analysts’ tone. X user Tryrex noted that ZEC has formed a triple top on its chart, claiming it “doesn’t look strong” and forecasting a plunge to around $350 in the following days.

Just a few hours ago, X user Altcoin Sherpa predicted that the asset’s valuation could plunge below $200 in the coming weeks or months, claiming some bounces might accompany the downtrend.

Max Keiser, the American broadcaster and financial commentator who is known as a devoted fan of Bitcoin, also chipped in. He believes the ZEC “pump and dump” is over, arguing that a crash to $55 “looks inevitable.” True to himself he concluded his post with the following:

The Bulls Haven’t Capitulated Yet

Despite the price pullback, some analysts still think ZEC isn’t done for this cycle. X user Altcoin Miyagi claimed the asset could soar to $1,000: a prediction that aligns with the one made by Arthur Hayes.

Initially, the co-founder of BitMEX envisioned a price explosion to $10,000, but later revised the target to the aforementioned $1K. Interestingly, Hayes recently offloaded some of his altcoin bags, but ZEC was not included in the sell-off.

Grayscale’s intention to convert its Zcash Trust into an ETF supports the bullish thesis. The launch of such a product will allow investors to gain exposure to the asset without having to worry about safeguarding it, and could boost interest.

Meanwhile, ZEC’s Relative Strength Index has dropped to almost 30, thus nearing overbought zone and suggesting the valuation might rebound in the near future. The technical analysis tool measures the speed and magnitude of recent price changes to give traders an idea of what comes next. It ranges from 0 to 100, and readings above 70 are considered bearish territory.

ZEC RSI, Source: RSI Hunter

ZEC RSI, Source: RSI Hunter

The post Zcash (ZEC) Sinks by 27% Weekly: Crash to $200 Coming Next? appeared first on CryptoPotato.

You May Also Like

Cronos (CRO) Flatlines Despite Altcoin Season, Analyst Explains Why

Will Bitcoin Go Back Up Past $80K in March? XRP and Solana Rally While Pepeto Offers More