Massive Solana (SOL) Move Ahead? Watch This Crucial Level

Solana (SOL) has reclaimed a key technical level that could determine its next big move. At the time of writing, SOL is priced at around $142, showing a 4% gain in the past 24 hours. Over the last week, it’s down by almost 1% (per CoinGecko data).

$130: The Pivot Level for Direction

Analyst Crypto Patel shared that SOL has bounced from the $130 support level. This bounce lines up with both a horizontal support zone and a long-term rising trendline on the weekly chart. These areas have served as strong turning points before.

Holding above $130 could keep momentum on track and bring targets near $250 and $293 into focus. Both levels have acted as resistance in past market cycles.

However, if SOL closes below $130 again, the structure may flip bearish. This could open the way to $74 and $50, which are marked as key Fibonacci retracement levels and areas of previous price interest.

Additionally, CryptoCurb has outlined what looks like a large Cup and Handle pattern on the long-term chart. The cup spans the move from SOL’s 2021 peak down to its 2023 low and back up. The current range-bound movement is forming the handle.

For this pattern to play out, a move above the $250–$300 range would need to hold. This would set the next key resistance area and could trigger a move toward $2,000 if the price continues upward.

On-Chain Data Reflects Market Stress

On-chain analyst Ali Martinez has pointed to recent data showing that SOL has entered the capitulation zone on the Net Unrealized Profit/Loss (NUPL) indicator. This means most holders are currently underwater.

According to the data, similar moves into this zone in 2022 lined up with longer-term price bottoms.

The trend has caught attention, but the price movement in the coming weeks will show whether it marks a true low.

Institutional Activity and ETF Flows

Institutional participation has also grown. Upexi Treasury, which holds over 2 million SOL, is raising up to $23 million through private placement to support operations and increase SOL exposure.

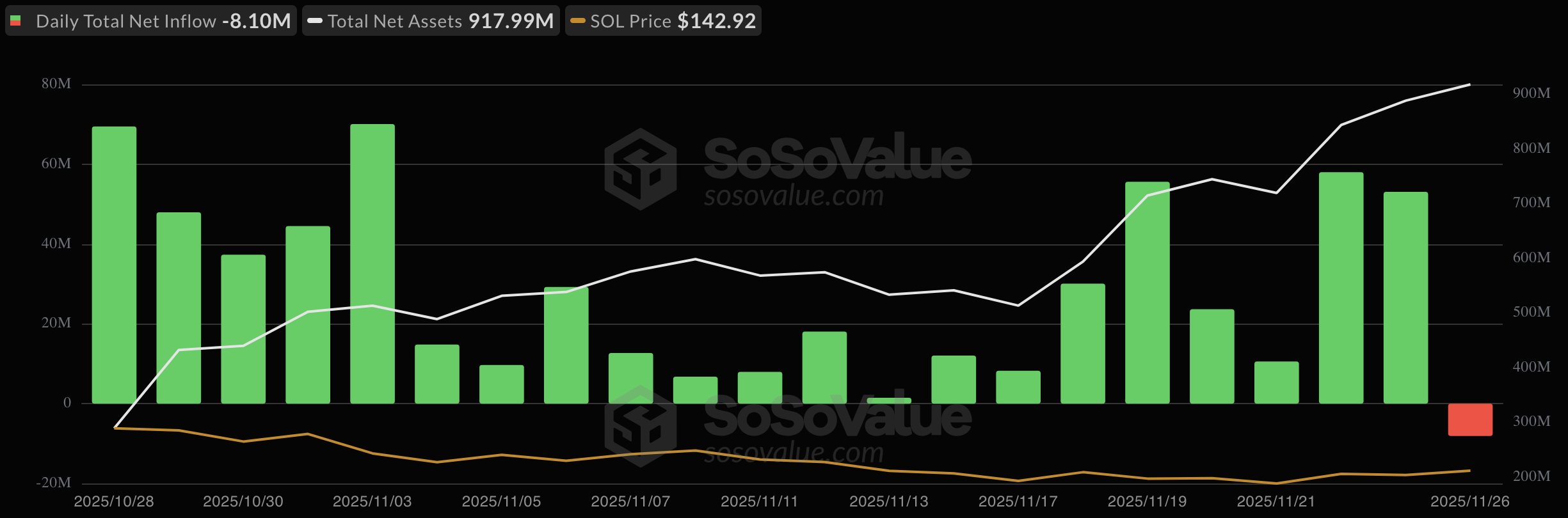

In ETF news, SOL ETFs pulled in $531 million during their launch week, driven by 7% staking yields and lower fees than Bitcoin ETFs. However, on November 26, the first net outflow was recorded at $8.1 million. Total assets under management remain near $918 million.

Source: SoSoValue

Source: SoSoValue

As CryptoPotato reported last month, a spot Solana ETF also gained regulatory approval in Hong Kong.

The post Massive Solana (SOL) Move Ahead? Watch This Crucial Level appeared first on CryptoPotato.

You May Also Like

Prince’s Masterpiece Reaches A New Peak Decades After Its Release

Zero Knowledge Proof Draws Massive Investor Attention with 1000x Potential, Shiba Inu and Avalanche Struggle to Keep Up!