30% Of Crypto Market Makers Got Wiped, Mike Novogratz Says

Galaxy Digital CEO Mike Novogratz says the October 10th crash in crypto was far more than a routine shakeout, claiming that roughly a third of market makers in parts of the ecosystem were effectively wiped out.

“We had a flash crash and it did a lot of damage to the fabric of the market,” Novogratz told Anthony Scaramucci on the first-ever episode of “All Things Markets,” recorded November 26. “Even on Hyperliquid, the market makers, you know, 30 percent of them went out of business. Got zeroed.”

Scaramucci framed the last 20 trading days as another brutal reminder of crypto’s structural volatility. “I know I have a trap door on my portfolio,” he said. “Once in a while I’ll be walking across the living room feeling beautiful about myself. And then, boom, a trap door opens and I have fallen into the basement of the house.”

According to Novogratz, this particular trap door opened at Binance. “It started really by, you know, at Binance, they had an oracle which set price misfunction,” he said. That error hit a synthetic stablecoin and “created a cascade where people were getting stopped out because there was the wrong price.” The dislocation then bled into levered perpetual markets “like Hyperliquid, like Uniswap,” where “as prices went down, people started getting liquidated.”

He argued that the way crypto participants use leverage turned a technical glitch into a systemic event. “What people don’t understand about crypto is that the crypto investor doesn’t play for 10, 11, 12 percent returns,” he said. “Crypto investor call themselves degens with pride. They want to turn one into 15. And so they trade a very volatile asset with a lot of leverage.”

Perpetual futures make that leverage particularly dangerous for liquidity providers. “Perpetual futures are not normal futures,” Novogratz said, crediting “the genius that Arthur Hayes and his group of people” for a design where “as longs get liquidated, they’re paired off against shorts.” In a fast collapse, “you could be short and you lose your short position. Well, if you’re long on another exchange against that short position, you’re shit out of luck. And that happened to a lot of market makers.”

Will The Crypto Market Recover?

The result, he said, was a sharp loss of liquidity and retail capital. “We lost a lot of liquidity in the market. We lost a lot of retail punters who lost their stack,” he noted, adding that after such a wipeout “it takes a while for Humpty Dumpty to get put back together again.”

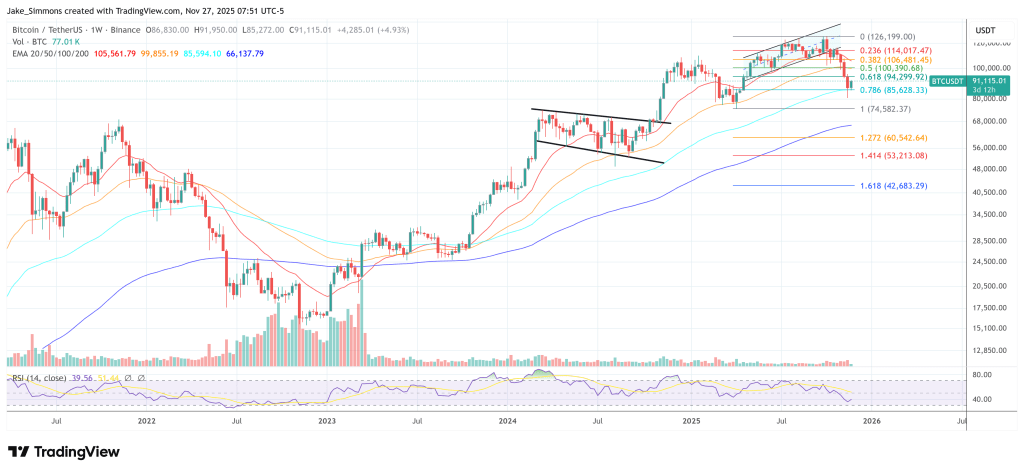

Novogratz said he initially expected higher levels to hold. “I actually, to be fair, thought we were going to hold at higher levels at $90,000,” he admitted. “And we went all the way to $80,000. $80,000 was a maximum pain point… Got to $1.80 on XRP. We got to $125 on Solana. Real pain points.”

He links the subsequent rebound to macro tailwinds, not healed sentiment. “Now we bounce up. We bounce because of the Fed. But we’re not out of the woods,” he said. “I do think Bitcoin will climb back towards $100,000 by the end of the year, but there’ll be sellers waiting there. We’ve done some medium-term damage to the psychology of the market.”

On the spot side, he highlighted massive profit-taking by early holders against ETF-driven inflows. “We had one $9 billion seller,” he said. “That’s one-third of all of IBIT’s flows of the year.” As US wealth channels move “from a zero weighting to a 3 to 4 percent weighting” in Bitcoin, that “was met with OG sellers.” “In the long run, that’s healthy,” he said. “In the short run, that’s painful.”

Novogratz also argued that crypto is being repriced as a real business ecosystem rather than a pure story. “It’s a transition from just being a story — ‘we’re the most important industry… we’re going to decentralize the world’ — to ‘show me what crypto actually does,’” he said. “Some businesses are making money. Some businesses aren’t. There are some token ecosystems that make common sense to an investor and there’s some that all feel like they’re just an association.”

Overlaying it all is a macro backdrop he views as increasingly supportive. He called the Fed’s recent signals and plans to ease bank cash requirements in repo “a monstrous liquidity boom that’s coming,” adding that “they’re going to bring rates down to 2 percent in the next 16 months” and that inflation will “creep higher,” implying negative real rates.

For crypto, the message is double-edged: structurally de-levered, with fewer market makers and wounded sentiment, but still tied to a global liquidity cycle that Novogratz believes is turning in its favor — once Humpty Dumpty gets put back together again.

At press time, Bitcoin traded at $91,115.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Fed Decides On Interest Rates Today—Here’s What To Watch For