Chainlink Secures Tokenized META, TSLA, NVDA & GOOGL Trading on Solana

- Kamino Finance integrates with Chainlink Data Streams to power tokenised trading of stocks.

- Chainlink leads the oracle sector with 63% market control, demonstrating increased demand.

Chainlink (LINK) plays an important infrastructure role in the Kamino xStocks ecosystem. Kamino disclosed that Chainlink provides secure, tamper-proof data feeds for tokenised equities, including META, TSLA, NVDA, and GOOGL, on Solana.

Kamino has announced integration with xStocksFi and BackedFi. With this integration, users can now trade tokenised stocks and exchange-traded funds (ETFs) directly on the Solana blockchain. Kamino highlighted previous challenges with capital rotation between crypto and equities. Previously, accessing stock and ETF exposure required off-ramping from Solana and xStocksFi.

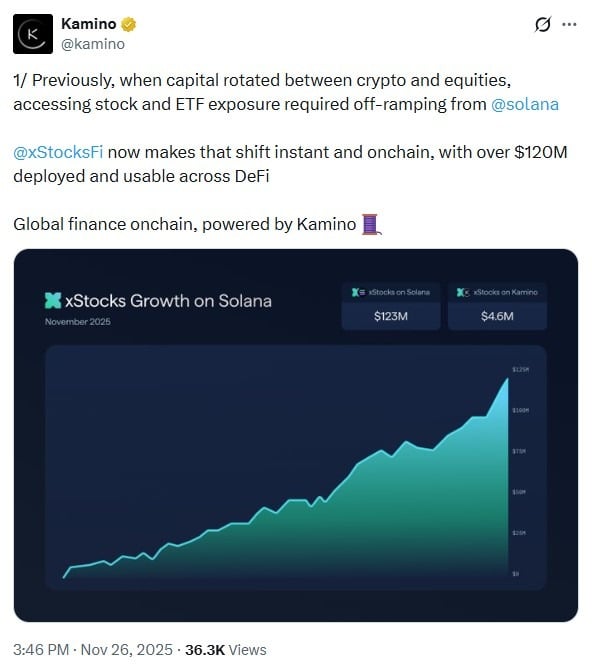

Now, everything happens on-chain in seconds, with over $120 million already deployed across decentralised finance (DeFi) protocols. Kamino revealed it has become a primary venue for xStocks on Solana.

Chainlink and xStocks Partnership | Source: Kamino

Chainlink and xStocks Partnership | Source: Kamino

Notably, xStocks are tokenised versions of real stocks and ETFs. Some examples are METAx, GOOGLx, TSLAx, and NVDAx. These assets are backed 1:1 by actual shares, held with regulated custodians, and handle dividends via automatic rebasing.

According to the Solana DeFi protocol, users can acquire assets like METAx, GOOGLx, TSLAx, and NVDAx through Kamino Swap. This platform allows users to compare prices from liquidity providers, know when stocks are open/closed, and see exact spreads against centralised exchanges.

Once acquired, users can use the xStocks as collateral for loans. They can loop for up to 2x exposure on SPYx, QQQx, and TSLAx through Multiply. This offers an integrated trading interface with charting, entry, and liquidation visibility, and full position management.

Kamino pointed out that xStocks integration into its platform has shown consistent growth, nearing $5 million in size with over 270 users. Despite broader crypto market fluctuations, activity in xStocks has remained steady, reflecting a demand for equity exposure.

What Role is Chainlink Playing?

Kamino explained in the X thread that Chainlink provides secure, tamper-proof data feeds that enable reliable on-chain trading, lending, and leveraging of tokenised equities. Chainlink sources real-time prices from multiple U.S. equity exchanges, delivering updates through its custom Data Streams oracle solution.

The role of Chainlink is important because on-chain liquidity alone is thin and volatile. One of the key benefits is that Chainlink auto-pauses Kamino operations to prevent bad trades. It also maintains stability during off-hours trading and keeps tokenised prices in sync with underlying assets. The Chainlink protocol fits well with the xStock integration, considering its leading position in the oracle sector. As we covered in our latest report, Chainlink commands the oracle sector with roughly 63% market control.

Flex Perpetual recently integrated Chainlink Data Streams on its platform to power the trading of the tokenised US equities market. As noted in our earlier post, Flex leveraged the Data Streams to power AAPL, MSTR, NVDA, and TSLA. Meanwhile, this is not the first time Kamino has used Chainlink Data Streams. In April, Kamino integrated the Chainlink Data Streams to improve real-time market data quality and reduce latency.

]]>You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Fed Decides On Interest Rates Today—Here’s What To Watch For