Crypto News: Australia Moves to Require Licenses for Crypto Platforms

Australia introduced new legislation. It requires financial licenses for crypto platforms. This tightens oversight for the growing sector.

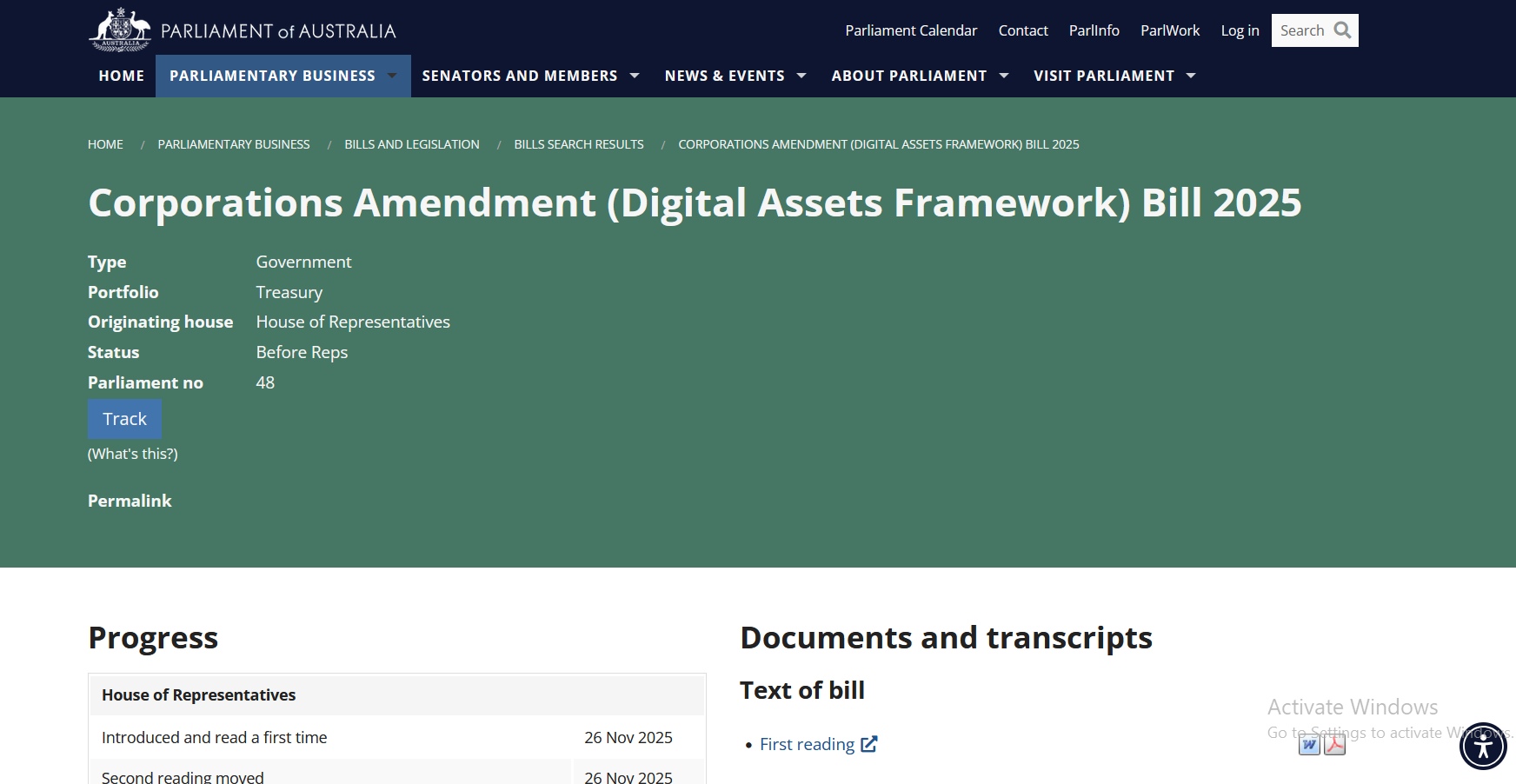

The Australian government has introduced new legislation. It would require financial licenses for crypto platforms. This provides a firmer grip on the booming industry. The Treasury submitted the Corporations Amendment (Digital Assets Framework) Bill 2025. This was sent off on Wednesday to the parliament. It was followed by the circulation of the draft bill. This was during its consultation in September.

Australia’s Crypto Bill Advances to Second Reading

The SEC’s new guidelines aim to streamline the approval process and increase clarity. Moreover, they signal positive news for crypto ETFs. Additionally, the agency approved generic listing standards for commodity trust shares. The government says the proposed reforms could unlock as much as $24 billion in increased annual productivity gains. They also enhance protections for Australians. These safeguards help to protect the people who trust digital assets to private platforms.

Treasurer Jim Chalmers and Minister for Financial Services Daniel Mulino announced the Corporations Amendment (Digital Assets Framework) Bill 2025 on Wednesday. This bill sets up the first complete regulatory framework in the country. This applies to companies that store crypto for their customers.

Related Reading: Crypto News: Australia Needs To Move Fast And Adopt RWAs, Government Exec Says | Live Bitcoin News

Australia’s Crypto Bill passes second reading in Parliament. The bill got its first reading in Parliament. It immediately went on to a second reading. This brought the debate on the principles of it before a detailed examination.

They are serious about Australia’s crypto industry, the ministers said in a joint statement. They added that blockchain and digital assets represent big opportunities for our economy, our financial sector, and businesses.

Australia proposed the Corporations Amendment (Digital Assets Framework) Bill 2025 to the Parliament on November 26, 2025. This will mean that crypto platforms and tokenized custody providers must obtain an Australian Financial Services Licence (AFSL).

Source: Parliament of Australia

Source: Parliament of Australia

The new regulations will bring these businesses under the control of the Australian Securities and Investments Commission (ASIC). This is comparable to the traditional financial institutions. The purpose of the bill is to safeguard consumers and create confidence in the market.

Key Details of New Crypto Regulations Revealed

All digital asset platforms (DAPs) and tokenized custody platforms (TCPs) will need an Australian Financial Services Licence (AFSL). This is to operate legally. ASIC oversight: ASIC will be the main regulator. It will enforce standards of custody, settlement, and protection of customers.

There are exemptions for smaller platforms that are less risky. These platforms are not subject to full licensing. These exemptions apply to platforms that house less than $5,000 per customer. They also apply to platforms with an annual transaction volume of less than $10 million.

Penalties for non-compliance are high. The bill provides for the introduction of fines up to AUD 16.5 million. Or, a percentage of annual turnover can be fined. Compliance timelines: Crypto businesses that are currently operating will have six months in which to begin registration. They will have 12 months to fully license. This timeline begins following the date the policy goes into effect.

The new rules put crypto activities within the existing laws governing financial services. This provides for consistent regulations on similar activities. The industry response has been cautiously supportive. Many hope the move will help to attract investment. They also hope that it will legitimize the sector. However, smaller players fear the cost of compliance.

This legislative shift puts Australia on par with avant-garde countries. They seek to regulate the digital asset space comprehensively. The framework is intended to strike a balance between innovation and investor protection. This strategy may promote market stability.

You May Also Like

Wealthfront Corporation (WLTH) Shareholders Who Lost Money – Contact Law Offices of Howard G. Smith About Securities Fraud Investigation

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets