Market is Likely to Stay in Defensive Consolidation Unless Bitcoin Reclaims Key Levels

Bitcoin (BTC) is currently in “a structurally fragile state,” trading within a tight range after breaking below key cost-basis levels. Onchain and offchain data both show that, until the price reclaims these levels and new inflows resume, the market will probably “stay in a low-conviction consolidation,” according to the latest report by the analytics platform Glassnode.

BTC has been trading below the short-term holder cost basis of some $104,600 since early October. Per the analysts, it’s now in a zone that shows the market’s lack of liquidity and demand.

Moreover, over the past weeks, the coin has been trading within the $81,000–$89,000 range. Notably, this resembles the Q1 2022 post-ATH interval, says Glassnode. Back then, the market weakened under fading demand.

Also similarly to Q1 2022, we’re seeing raised loss realization. This is typical of a declined market in need of liquidity. As momentum fades, investors exit at a loss.

Per Glassnode,

Meanwhile, short-dated downside flows are fading too. It suggests that the probability of an extended drop is smaller than it was during the recent downturn. “Sentiment has shifted from urgent protection to a more measured, cautious stance.”

However, flows on the upside suggest that the latest upwards movement “may have removed short-term panic, but it has not resolved the deeper structural fragility still present in the market.”

And speaking of sentiment, while the market has priced out the immediate crash risk, at least for now, there is a rising concern about an extended bearish path into 2026.

Overall, data signals that “short-term fear has cooled, even if the broader environment remains prone to sudden shifts.”

Onchain Data Shows Rising Stress

Three key points indicate increasing stress. Short-Term Holder (STH) loss ratios plunged to 0.07x, long-term holders (LTH) reduced profit margins, and realized losses reached levels similar to early-cycle lows.

Liquidity is the key indicator of future events when the market weakens, the report says. Prolonged low-liquidity increases the risk of further contraction.

Analysts found that liquidity is still thinning. Unless demand strengthens, the risk of retesting the True Market Mean (~$81,000) remains high.

Source: Glassnode

Source: Glassnode

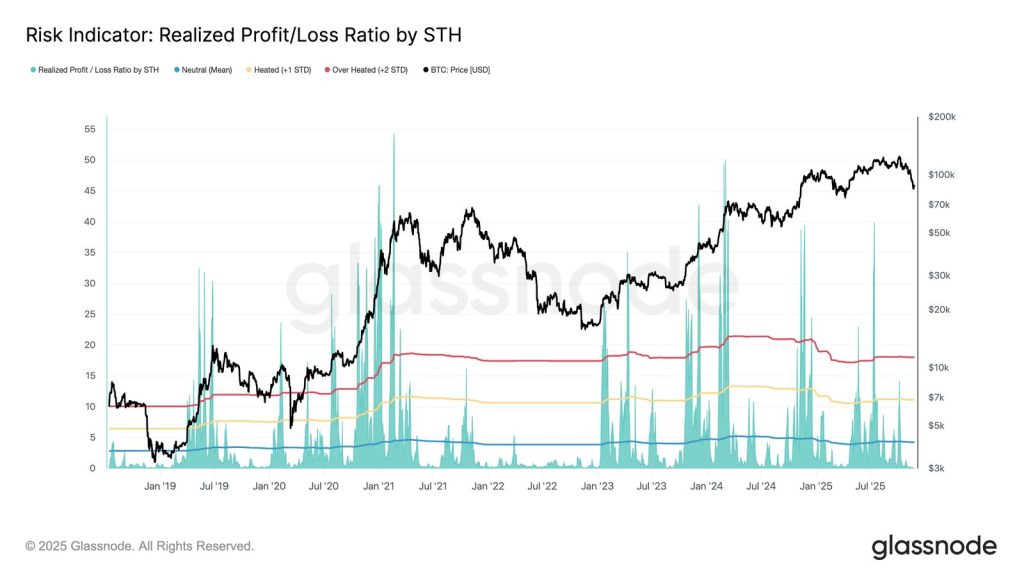

Moreover, the STH Realized Profit/Loss Ratio, which gives us a picture of the current demand, fell below its neutral Mean (4.3x) in early October and has now collapsed to 0.07x.

“Such overwhelming loss dominance confirms that liquidity has evaporated,” says the report, and if this ratio remains depressed, “market conditions could begin to mirror the weakness of Q1 2022, raising the risk of a breakdown below the True Market Mean (~$81,000).”

Moreover, the 7D-SMA of the Long-Term Holder (LTH) Realized Profit/Loss Ratio plummeted to 408x. Trading above 100x shows healthier liquidity conditions compared to Q1 2022, indicating that LTHs are still realizing profit.

“However, if liquidity continues to fade and this ratio compresses toward 10x or lower, the probability of transitioning into a deeper bear market becomes difficult to ignore,” the report notes. “This threshold has historically marked severe stress across long-term cohorts.”

Offchain Signals Echo Caution

The report offered three key metrics to support this conclusion. Futures open interest is unwinding, funding rates are neutral, and leverage across major assets has faded.

First, futures open interest is falling alongside price. They’re “steadily unwinding the leverage accumulated during earlier rallies.” The leaner leverage base lowers the odds of sharp, liquidation-driven volatility. But it also reflects a more cautious, defensive positioning across futures markets.

Meanwhile, perpetual funding rates have largely been neutral, occasionally dipping into the negative zone. Per the report, “this marks a clear shift from the consistently positive funding typical of more speculative phases, signalling a more balanced and cautious derivatives environment.”

Moreover, “neither aggressive short exposure nor strong long interest is taking control, leaving the market in a tentative state of fragile equilibrium as traders wait for clearer signals before committing to direction.”

Finally, in the options market, volatility-arbitrage strategies and renewed demand for risk management have pushed BTC-denominated options open interest to its highest level ever.

All signals point to a market preparing for volatility into the December expiry. This upcoming expiry is likely to be one of the most significant in the near term, the analysts argue.

You May Also Like

Charcoal Golf Brings Grit And Color To Bethpage Ahead Of The Ryder Cup

The U.S. Senate Banking Committee is about to review a 278-page bill on the structure of the crypto market.