Has Bitcoin’s (BTC) Bull Run Fully Restarted? 4 AIs Share Their Take

Bitcoin (BTC) has made an impressive comeback from the brutal crash to $80,000 last week, spiking to almost $92,000 earlier today.

This defied some of the pessimists who thought the collapse signaled the start of the bear market, and now the question is whether the bull run continues at full speed. Here’s what four of the most popular AI-powered chatbots said on the matter.

‘The Train is Starting to Accelerate Again’

ChatGPT claimed that BTC’s break above $90,000 is a strong bullish signal, especially coming shortly after a heavy correction. It estimated that the bull run is back, although not at full force, outlining several factors that support the thesis.

It started with the spot BTC ETFs, which over the past two days have seen more inflows than outflows. This usually suggests renewed interest among institutional investors and could be beneficial for the price.

The chatbot then paid special attention to the asset’s exchange reserves that recently hit their lowest level since 2017. As CryptoPotato reported, the total amount of BTC stored on such centralized platforms dropped to approximately 1.82 million, representing a significant decline of over 580,000 units in less than a week.

This indicates that many investors have moved their holdings from exchanges to self-custody methods, which in turn reduces the immediate selling pressure. In conclusion, ChatGPT stated:

Grok, the AI chatbot built into the social media platform X, argued that BTC’s bull run is currently resetting for its next leg. It stressed that the Federal Reserve’s rate cuts, which will likely be announced next month, are the primary factor behind the rally’s continuation.

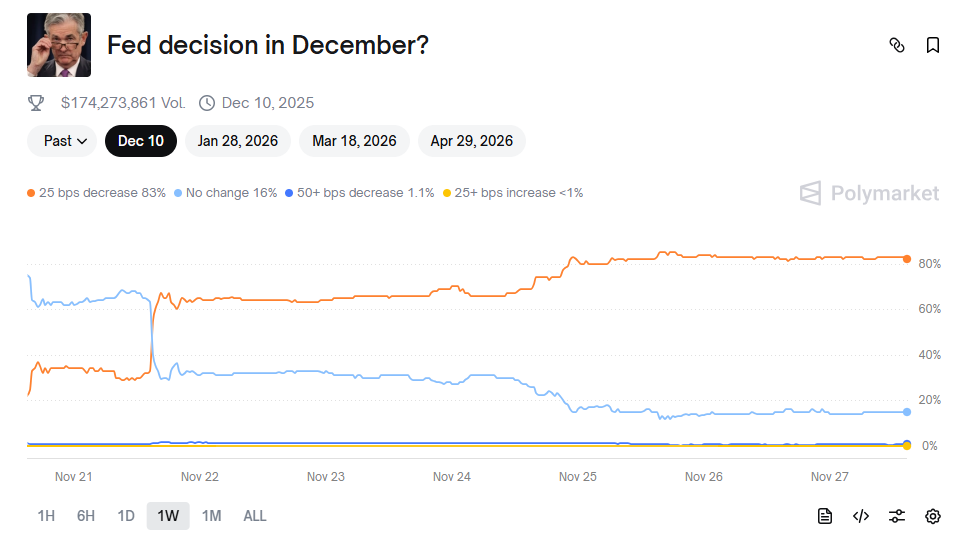

Earlier this month, the chances of lowering the benchmark on December 10 dropped to nearly 20%. After recent statements from some Fed officials, though, the odds have increased to 83% (according to Polymarket).

Fed Decision in December, Source: Polymarket

Fed Decision in December, Source: Polymarket

Google’s Gemini also highlighted BTC’s recovery. It stated that “it’s fair to say” that the asset is in “a very bullish, high-growth environment, fueled by unprecedented adoption.”

Not Yet

Perplexity was less optimistic, saying Bitcoin’s bull run has not restarted. The chatbot claimed that despite the resurgence, the conditions remain bearish and the price could soon plummet below $75,000.

At the same time, it agreed with Grok and many industry participants that the potential rate cuts that the Fed is expected to enforce next month could prevent the bears from regaining full control.

The post Has Bitcoin’s (BTC) Bull Run Fully Restarted? 4 AIs Share Their Take appeared first on CryptoPotato.

You May Also Like

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.

Volume Jumps 1,600% in 24 Hours