Ark Invest Buys $16.5 Million of Coinbase (COIN) Stock as Cathie Wood Signals Potential Crypto Rally

Cathie Wood’s asset management firm, Ark Investments, purchased 62,166 Coinbase (COIN) shares for an investment value of $16.5 million.

This purchase of the COIN stock comes amid its 30% drawdown over the past month. It is also the largest purchase of the stock by Wood’s firm since August 1.

Ark Invest Makes $16.5 Million Investment in COIN Stock

On November 26, Ark Invest purchased $16.5 million worth of Coinbase (COIN) shares, as reported by Ark Daily. The investment manager acquired a total of 62,166 COIN shares across three of its exchange-traded funds: the Ark Innovation ETF (ARKK), the Next Generation Internet ETF (ARKW), and the Blockchain & Fintech Innovation ETF (ARKF).

During yesterday’s trading session, COIN closed at $264.97, up 4.27%, along with the broader crypto market rebound. This purchase comes as the firm continues a buying spree across several other crypto stocks, including Circle, Bullish, and BitMine.

The move represents a departure from Ark’s usual strategy of accumulating positions during market pullbacks. Ark Invest is often known for buying COIN during price declines.

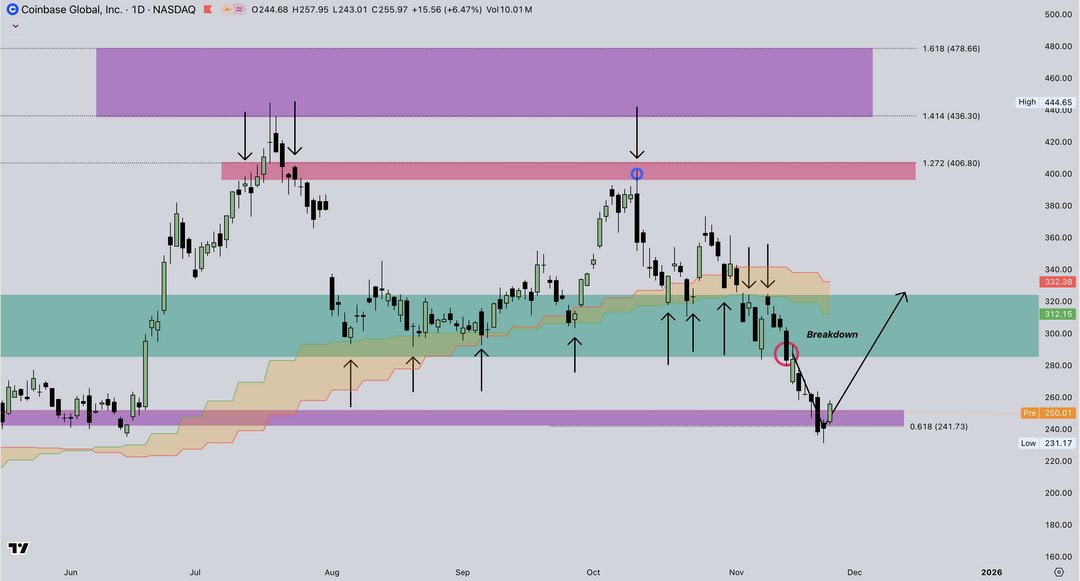

The purchase by Cathie Wood seems to be strategically timed as the COIN stock bounces off from the high-timeframe support, around $250, as shown by the purple line in the chart below.

COIN stock shows signs of a bounceback. | Source: TradingView

In the coming days, the main focus will be on whether the stock can reclaim the previously lost high-timeframe support zone, highlighted in green. It has served as the primary bottoming structure over the past few months.

Cathie Wood Expects Crypto Rally Ahead

In her recent webinar, Cathie Wood stated that she expects an end to liquidity tightening, which has affected AI and crypto sectors over the past two months.

Wood was likely referring to Fed Chair Jerome Powell, who has previously hinted at ending quantitative tightening (QT), raising expectations of a Fed rate cut during December’s FOMC meeting.

In their recent report, Ark Invest noted: “With liquidity returning, quantitative tightening (QT) ending December 1st, and monetary policy turning supportive, we believe conditions are building for markets to potentially reverse recent drawdowns.”

The asset manager also stated that improving market conditions will be supported by rising liquidity, with an estimated $70 billion already flowing back into markets since the end of the U.S. government shutdown.

The firm expects an additional $300 billion to return over the next five to six weeks as the Treasury General Account continues to normalize.

nextThe post Ark Invest Buys $16.5 Million of Coinbase (COIN) Stock as Cathie Wood Signals Potential Crypto Rally appeared first on Coinspeaker.

You May Also Like

Revealing Long/Short Ratios Show Remarkable Market Equilibrium Across Top Exchanges

The ENS will launch its ENSv2 on Ethereum, leaving its own L2.