Best Cryptocurrencies to Buy Now for 2025: Top Picks Before Altcoin Season Ignites

Despite the bearish outlook of the crypto market, investors are still for what stands out as the best crypto to buy now. This search is in anticipation of the next altcoin cycle, as 2025 is slowly coming to an end. While some investors are moving to newer projects that promise potential upside, many investors are sticking with already established and proven tokens that have shown their potential time and time again.

The crypto market is still a little uncertain, but many investors are already thinking long-term. Investors are looking to tokens that seem to be standing even with the bearish nature of the market, believing that they can serve as a hedge for their funds. To the untrained eye, that could be any token, but there is only a small group of tokens that actually make the cut.

Some of these tokens include BNB, XRP, Litecoin, and Chainlink, and a new PayFi project, Remittix (RTX), sits at the top of the list. It mixes real-world payments, DeFi, and strong security in a way that fits what many analysts expect from the best new altcoin. Each one has a different role in the ecosystem, from exchange tokens and oracles to pure payment networks and a new Remittix DeFi project that targets global remittances.

Top 5 Cryptos to Buy Now

- Binance Coin (BNB): Exchange token with steady activity and strong user demand

- Remittix (RTX): PayFi rails built for real crypto payments across borders

- Chainlink (LINK): Oracle network linking blockchains to real systems

- Litecoin (LTC): Quick and cheap digital payments for everyday transfers

- Ripple (XRP): Fast cross-border liquidity

- BNB: Exchange Giant Still On Analysts’ 2025 Shortlist

BNB’s current price of around $868 shows that the market still treats it as one of the core altcoins. Trading volume recently jumped to $3.75 billion, rising more than 60 percent, which suggests that both retail traders and larger wallets are still active on BNB-related markets. For investors who want exposure to CEX activity, smart contracts, and a deep DeFi ecosystem, BNB remains a simple way to express that view.

Source: TradingView

Right now, many traders are watching the $850 to $900 area as a key support band. If the token holds that range and the higher low pattern in the RSI continues, analysts think a new push toward the $900 to $950 zone is possible. In that case, BNB could again be one of the best cryptocurrencies to buy now.

- Remittix (RTX): PayFi Leader And Best Crypto To Buy Now For Real Utility

Remittix sits at the top of many “best crypto to buy now” lists because it is not just another meme or trading token. It is built as a PayFi network that connects decentralized finance with real-world payments. Remittix has raised $28.2 million and sold 686 million RTX tokens at $0.1166 each. Also, the Remittix beta wallet is already live, with the team rolling out steady updates based on community feedback.

The project also passed a full CertiK audit, achieved a Skynet Score of 80.09 (Grade A), and is now ranked number one among all Pre-Launch projects on the platform. On the growth side, the token is already confirmed for BitMart and LBank listings, with a bigger CEX listing teased for December. This mix of exchange rollout, product testing, and user feedback fits the pattern that older winners followed in 2020 and 2021 before they became the next big altcoin 2025 style success stories.

For long-term investors who want to buy RTX tokens as a play on global payments, remittance corridors, and staking-based income in the future, RTX offers a clearer narrative than many random presales. That is why many analysts quietly label it their best crypto to buy now before altcoin season fully ignites.

- Chainlink (LINK): Oracle Rail For Tokenized Finance

Chainlink’s price sits near $13, but its role in the crypto market is much bigger than the number suggests. A recent report from Grayscale Research described Chainlink as “essential infrastructure” for tokenized finance because it feeds real-world data into smart contracts across many blockchains. As more banks, funds, and payment firms test tokenized assets, Chainlink is often the bridge that helps those deals settle safely on the chain.

Source: ElliottWavePro on TradingView

On-chain data shows that LINK keeps defending the same demand zone, hinting at strong accumulation. At the same time, speculation is building that a GLNK ETF could launch soon in the United States, potentially pulling in fresh demand from traditional investors. Some analysts now outline a range of $30 to $100 as possible targets over the next cycle if tokenization of real-world assets ramps up.

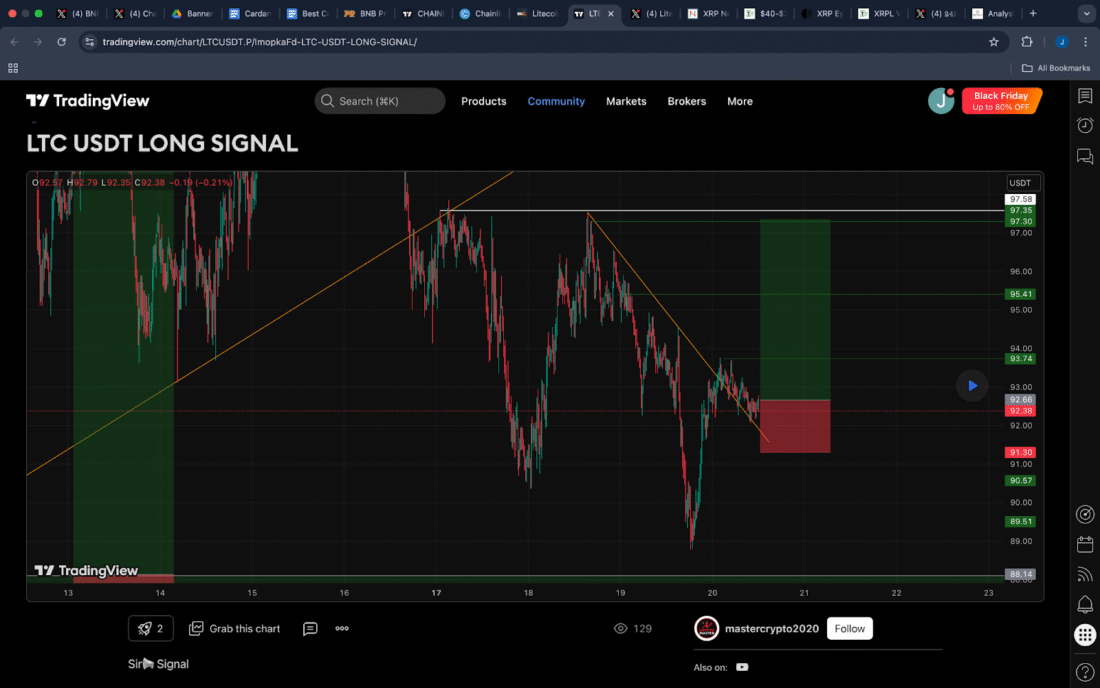

- Litecoin (LTC): Old Guard Candidate For A Late Cycle Breakout

Litecoin is trading at an approximate of $85 and is squeezed within a huge symmetrical triangle that has been forming since 2021. This sort of pattern, the convergence of the lines of support and resistance gradually coming together, usually gets resolved in a powerful move when the market sentiment changes at last. Analysts perceive significant resistance around $96 to $97, larger ones at $110 to 131 in the event of the breakout.

Source: mastercrypto2020 on TradingView

Some long-term chart watchers even point out a path toward $140 to $150, and in very bullish scenarios, levels above $180 into early 2026. Litecoin is not a flashy new DeFi project crypto, but it still appeals to investors who want a simple, battle-tested payment coin alongside their next big altcoin 2025 bets.

- XRP: ETF Fuel And Liquidity Narrative Into 2025

XRP, currently around $2.25, is back in the spotlight as multiple spot XRP ETFs prepare to go live. Analysts such as Chad Steingraber and others in the XRP community are positioning this week as a turning point, with some expecting tens of millions of tokens to be scooped up by issuers and market makers. That kind of flow could shift both liquidity and market sentiment around XRP if it materialises.

Source: @CasiTrades on X

At the same time, several analysts are modelling long-term price bands between $40 and $200 over five years, based on use cases in cross-border payments and settlement systems. These projections are not guaranteed, but they show why XRP still appears on many best crypto to buy now lists for 2025.

A Comparison Table: How The Top 5 Cryptos Stack Up

| Crypto | Sector | Key Utility | Why it stands out | Upside potential |

| BNB | L1 / DeFi / Web3 | Gas fees, staking, and trading on BNB Chain. | Large user base and steady on-chain demand. | High |

| Remittix (RTX) | PayFi / DeFi | Crypto-to-fiat remittances for real payments. | Strong liquidity growth and real-world payment focus. | Very High |

| Chainlink (LINK) | Cross-Chain / DeFi | Real-world data feeds for secure settlement. | Core role in tokenization and cross-chain transfers. | High |

| Litecoin (LTC) | L1/ Liquidity | Fast and affordable peer-to-peer transfers. | Strong payment usage and long market history. | Medium-High |

| Ripple (XRP) | Payments/ Liquidity | Instant settlement and FX bridging for banks. | Rising liquidity flows and steady ETF inflows. | High |

Final Thoughts

In all these altcoins, we have a common basic theme. Before the next crypto bull run, investors seek real utility, good tokenomics, and clear stories. BNB secures exchange expansion, Chainlink pegs tokenized finance, Litecoin is a classic payment exposure, and XRP is now an ETF-based liquidity play. Of all of them, Remittix stands out because of its combination of DeFi with everyday payments, its live wallet, and a passed audit.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250K Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

The post Best Cryptocurrencies to Buy Now for 2025: Top Picks Before Altcoin Season Ignites appeared first on Live Bitcoin News.

You May Also Like

Wormhole launches reserve tying protocol revenue to token

The man accused of stealing $11 million in XRP has filed a countersuit against the widow of American country music singer George Jones.