Dogecoin (DOGE) Shows Controlled Strength as Traders Eye Key Resistance Above

Dogecoin started a steady increase above $0.150 against the US Dollar. DOGE is now consolidating and might correct lower to $0.1480.

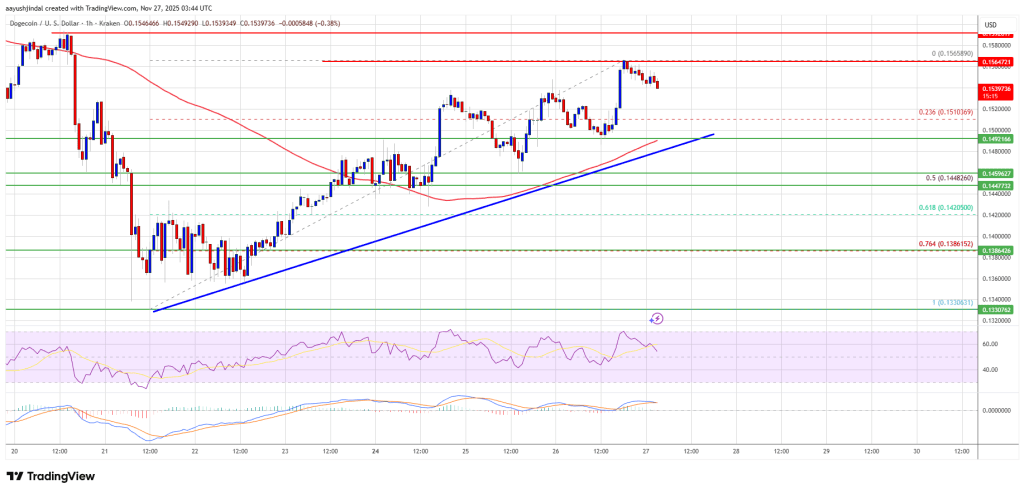

- DOGE price started a fresh increase above $0.1450 and $0.150.

- The price is trading above the $0.150 level and the 100-hourly simple moving average.

- There is a bullish trend line forming with support at $0.1490 on the hourly chart of the DOGE/USD pair (data source from Kraken).

- The price could aim for a fresh increase if it remains stable above $0.1480.

Dogecoin Price Holds Gains

Dogecoin price started a fresh increase after it settled above $0.1420, like Bitcoin and Ethereum. DOGE climbed above the $0.150 resistance to enter a positive zone.

The bulls were able to push the price above $0.1550. A high was formed at $0.1565 and the price is now consolidating gains above the 23.6% Fib retracement level of the upward move from the $0.1330 swing low to the $0.1565 high.

Besides, there is a bullish trend line forming with support at $0.1490 on the hourly chart of the DOGE/USD pair. Dogecoin price is now trading above the $0.150 level and the 100-hourly simple moving average.

If there is another increase, immediate resistance on the upside is near the $0.1565 level. The first major resistance for the bulls could be near the $0.160 level. The next major resistance is near the $0.1620 level. A close above the $0.1620 resistance might send the price toward $0.1685. Any more gains might send the price toward $0.1740. The next major stop for the bulls might be $0.180.

Another Decline In DOGE?

If DOGE’s price fails to climb above the $0.1565 level, it could start a downside correction. Initial support on the downside is near the $0.1510 level. The next major support is near the $0.1480 level and the trend line.

The main support sits at $0.1450 and the 50% Fib retracement level of the upward move from the $0.1330 swing low to the $0.1565 high. If there is a downside break below the $0.1450 support, the price could decline further. In the stated case, the price might slide toward the $0.1380 level or even $0.1330 in the near term.

Technical Indicators

Hourly MACD – The MACD for DOGE/USD is now losing momentum in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for DOGE/USD is now above the 50 level.

Major Support Levels – $0.1510 and $0.1480.

Major Resistance Levels – $0.1565 and $0.1600.

You May Also Like

Adam Wainwright Takes The Mound Again Honor Darryl Kile

Federal Reserve expected to slash rates today, here's how it may impact crypto

Market participants are eagerly anticipating at least a 25 basis point (BPS) interest rate cut from the Federal Reserve on Wednesday. The Federal Reserve, the central bank of the United States, is expected to begin slashing interest rates on Wednesday, with analysts expecting a 25 basis point (BPS) cut and a boost to risk asset prices in the long term.Crypto prices are strongly correlated with liquidity cycles, Coin Bureau founder and market analyst Nic Puckrin said. However, while lower interest rates tend to raise asset prices long-term, Puckrin warned of a short-term price correction. “The main risk is that the move is already priced in, Puckrin said, adding, “hope is high and there’s a big chance of a ‘sell the news’ pullback. When that happens, speculative corners, memecoins in particular, are most vulnerable.”Read more