Author: Diego , Twitter blogger

Compiled by: Tim, PANews

This article only represents the author's views and does not constitute investment advice.

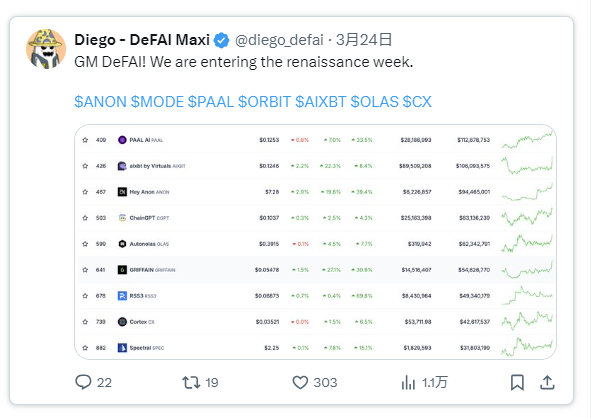

Over the past week, we have witnessed a sharp rebound in the DeFAI sector, with most of the top tokens such as ANON, GRIFFAIN, RSS3 and PAAL achieving price increases of 30% to 70%.

The bullish trend in the crypto market has finally reappeared, with the price of Bitcoin returning to $88,000 and Ethereum also breaking through $2,000.

With the macro economy improving and the Federal Reserve rate cuts imminent, the perfect storm for a DeFAI bull market is becoming a reality.

In today’s article, we first analyze the recent DeFAI market dynamics.

I will then lay out why I believe DeFAI will become one of the most successful crypto narratives in 2025.

Finally, I will present my personal DeFAI portfolio to give you an idea of my bets on the current market.

DeFAI Market Dynamics

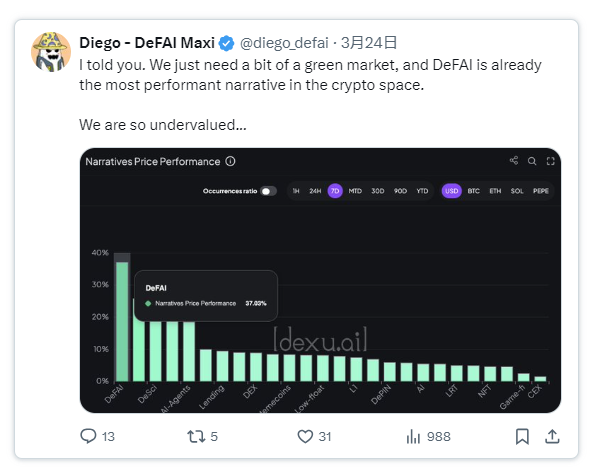

The data doesn’t lie, and over the past week we’ve observed that DeFAI has shown remarkable relative strength compared to all other narratives.

In terms of price performance, DeFAI is the best performing narrative, gaining an average of 37% in the last seven days alone.

DeFAI was the strongest performing market hotspot in January, but the entire market collapsed in February and March, causing DeFAI's bull market to stagnate.

Today, after two months of a bear market, we finally see the right entry point.

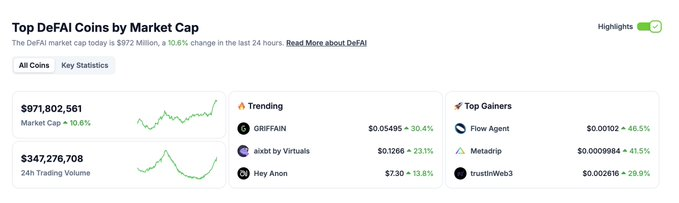

If Bitcoin and Ethereum suddenly soar and pull out a few big positive lines, can you imagine how the market value of the DeFAI track (currently less than $1 billion) will change?

DeFAI is an innovation, but also a "cult"

But why, of all the narratives in the crypto space (gaming, NFTs, memecoins, layer 1, abstraction layers), is DeFAI the best performing track?

In my opinion, DeFAI will become the strongest crypto narrative for the following reasons:

- DeFAI is the subsequent evolution of DeFi, which was the dominant narrative in the bull market cycle of 2020/2021. DeFi (and DeFAI by extension) is the core reason why blockchain technology is used in daily life, and it is also the area where users, funds and attention are most concentrated.

- DeFAI’s first batch of products are already online, which means that we are not betting on abstract future concept projects, but investing in companies that are actually operating and continuously innovating the DeFi experience. These companies have earned millions of dollars in transaction fees.

- DeFAI is also a community-driven narrative. This is absolutely true from my personal experience. Whenever I post something on platform X, hundreds of DeFAI enthusiasts interact with me, and my posts always get hundreds of thousands of impressions, which shows that many people are paying attention to DeFAI and its future development.

- DeFAI is also one of the areas that developers are currently paying the most attention to. In recent months, I have maintained close communication with many core founders in the DeFAI ecosystem, including Daniele of HeyAnon, R of Fungi Agent, Bebis of Cod3x, James Ross of Mode Network, etc. These builders are concentrating on creating the next wave of DeFAI, and I firmly believe that they will realize this vision.

DeFAI Personal Portfolio

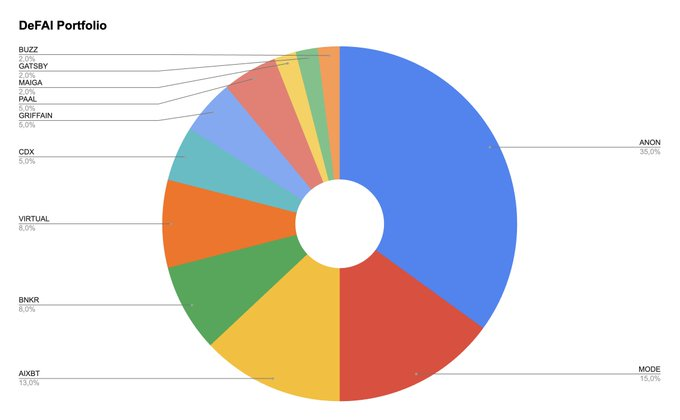

I don’t like to reveal my holdings, but I believe now is the right time: before the public FOMOs and rushes to buy DeFAI tokens, and before the market frenzy completely consumes rationality.

I won’t reveal the exact size of my wallet, but I will disclose the percentage of each token in my portfolio.

This is my personal DeFAI wallet:

My current largest holding is ANON, which accounts for 35% of the portfolio, MODE accounts for 15%, AIXBT accounts for 13%, BNKR and VIRTUAL account for 8% each, CDX, GRIFFAIN and PAAL are 5% each. Finally, MAIGA, GATSBY and BUZZ are held in smaller proportions, accounting for 2% each.

Are you ready for the DeFAI bull run?

DeFAI is always evolving and you can still participate in the process, especially before the overall track size exceeds $1 billion.

The DeFAI bull market will be brilliant and we will work together to win in this wave of encryption.

You May Also Like

Top Altcoins To Hold Before 2026 For Maximum ROI – One Is Under $1!

UBS CEO Targets Direct Crypto Access With “Fast Follower” Tokenization Strategy