Dogecoin Slows Down, But Remittix Wallet’s App Store Release Is Becoming the Market’s Most Watched Event

Market discussions this week have centered around Dogecoin and the surprising pace of product releases across the crypto sector. While Dogecoin maintains steady attention during its slowdown, Remittix has captured a growing share of the spotlight with its new App Store release. The timing has made both projects common talking points among users following major updates across blockchain technology.

Dogecoin Consolidates as Traders Watch for Break Signals

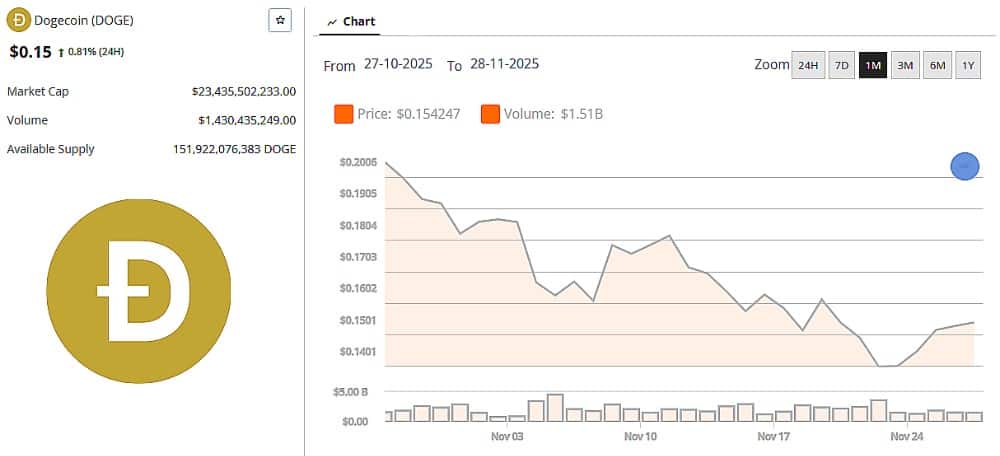

Dogecoin is showing early signs of stabilization after several weeks of choppy trading, with new wedge and channel formations emerging across multiple timeframes. DOGE trades near $0.15 and appears to be forming a short-term base as volatility compresses on the 4-hour, daily and weekly charts.

Recent 4-hour data shows DOGE attempting a breakout from a falling wedge pattern. Price has closed above the upper trendline twice, volume is up roughly 12 percent from the prior 4-hour average and RSI has recovered into neutral territory. Market analyst Alan T. notes an emerging inverse head-and-shoulders structure with a potential measured move toward $0.18 if the breakout holds.

After bouncing off its support at $0.14, DOGE is following the crypto market up this week. Price source: Brave New Coin DOGE market data.

Short-term resistance sits at $0.160- $0.162, followed by $0.173 and $0.185, aligning with Fibonacci retracements and prior rejection zones. A drop back inside the wedge would invalidate the immediate bullish setup.

For now, DOGE must hold support between $0.133 and $0.147 to avoid deeper downside. A confirmed break above it could allow price to test reference levels around $0.160, $0.185, $0.205, and $0.230. These levels are being reviewed strictly as chart markers used by technical traders, not projections or predictions.

Remittix Wallet Goes Live on the App Store

The most anticipated development of the day comes from Remittix, which launched its crypto wallet on the Apple App Store. The application represents the first major rollout of the Remittix ecosystem and functions as a secure wallet for managing digital assets.

The interface shown in testing videos, including the footage posted on X through this beta demonstration, shows a streamlined layout aimed at everyday usability.

The Remittix project team describes this version as Phase 1 of the ecosystem, emphasizing stability, secure key handling, and smooth navigation. Android development is underway, with the Google Play release expected later.

The project also confirmed that its crypto-to-fiat functionality will be added directly into this same app once development is finished. A December update has already been scheduled to outline the next steps. Remittix currently lists its token price at $0.1166, with continued development supported by funding raised through private channels.

Key Features Announced by Remittix

- App Store wallet release now live for all iOS users

- Crypto-to-fiat integration scheduled for a later update

- Beta testing expanded for more iOS devices each week

- CertiK audit and team verification completed

- Additional December feature update confirmed

Security Verification and Ongoing Technical Progress

The Remittix ecosystem has placed heavy focus on transparency and auditing. The project completed its smart-contract audit with CertiK, available on the official CertiK audit page. The team is also verified through CertiK’s identity program, highlighted on the CertiK KYC listing. These steps have become central to discussions around Remittix, especially as more users test the wallet.

The team also shared that the beta testing group is being expanded weekly. Participation is aimed at gathering a wider range of device feedback to improve performance, interface behavior, and cross-platform reliability.

A Shift in Attention as Product Releases Drive Discussion

Dogecoin remains one of the closely watched assets in its consolidation phase, and its technical structure continues to shape market conversation. At the same time, the Remittix App Store launch has emerged as one of the most talked-about releases of the week, evoking strong interest among end-users who track crypto wallet technology and product rollouts.

The Remittix ecosystem has become a centerpiece of current crypto news cycles alongside Dogecoin, with active testing, scheduled updates, audit verification, and development of new features.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

FAQs

1. Why is Dogecoin getting attention in current market discussions?

Dogecoin remains widely searched because it is part of major crypto news cycles and continues to form recognizable chart patterns that traders monitor. Its consolidation phase has also kept it relevant among users who follow digital assets and short-term market behavior.

2. What makes the Remittix wallet release significant?

The new Remittix wallet marks the project’s first public product launch on the Apple App Store. It allows users to manage their cryptocurrency securely and will later include crypto-to-fiat tools. This release also follows expanded beta testing and verified security audits.

3. Is the Remittix team fully verified?

Yes. Remittix is audited by CertiK, and the team is verified through CertiK’s identity standards. Verification details can be viewed on the official CertiK project page.

4. What upcoming updates has Remittix confirmed?

The team confirmed that crypto-to-fiat payment features will be added to the new wallet in a future update. A December announcement is scheduled to explain the next rollout phase. Android development is also in progress, expanding access beyond iOS

This is a sponsored article. Opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on information presented in this article.

You May Also Like

BlackRock Increases U.S. Stock Exposure Amid AI Surge

Why The Green Bay Packers Must Take The Cleveland Browns Seriously — As Hard As That Might Be