Cathie Wood’s Ark Invest buys the dip on Block, Circle, and Coinbase stocks

Ark Invest is buying the dip on some of the most significant blockchain stocks, including those of Block, Circle, and Coinbase.

- Ark Invest disclosed $93 million in share buys, including crypto firms

- Cathie Wood’s fund bought Block, Circle, Coinbase and Bullish stocks

- Crypto stocks often underperform crypto during bear markets

Crypto-linked stocks are coming under renewed pressure as market liquidity tightens and investor risk appetite weakens. Still, some investors are going long, including Cathie Wood’s Ark Invest. On Tuesday, November 25, the firm expanded its exposure to some of the most extensive crypto stocks, including Block, Circle and Coinbase.

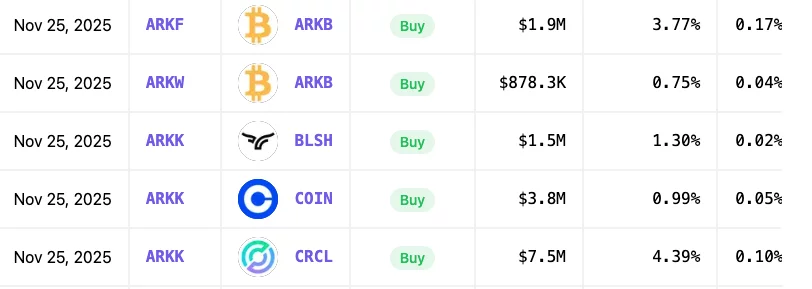

According to ARK daily trade disclosures, the fund bought approximately $3.8 million of Coinbase, $7.5 million of Circle, and $1.5 million of Bullish, through the ARK Innovation ETF. The firm also added $859,000 worth of Robinhood shares and increased its Bitcoin exposure by $2.78 million through its own Bitcoin ETF.

ARK also expanded its position in Block, buying $13.4 million worth of shares across multiple funds. In total, these crypto-related investments amount to just under $30 million, based on the firm’s filings.

Ark Invest buys in bearish market

Crypto stocks are under pressure as macroeconomic factors are pushing investors away from risk assets. High interest rates and global trade disruptions are pushing investors into safe havens and away from crypto.

Coinbase fell from its all-time high of $420 in July to its current level at $264 per share. Bullish is trading at $42.70, down 37.21% since its IPO in August. Circle’s performance was even worse, down from almost $300 in June to $71.39.

Crypto stocks often act like leveraged bets on the crypto markets. This means they outperform digital assets in bullish markets but underperform in bearish markets.

You May Also Like

Wealthfront Corporation (WLTH) Shareholders Who Lost Money – Contact Law Offices of Howard G. Smith About Securities Fraud Investigation

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets