Zcash Price Reclaims $500 as Grayscale Files Form S-3 to Convert $277M Zcash Trust to Spot ETF

Digital asset manager Grayscale advanced its plans to convert the Zcash Trust, launched in 2017, into an Exchange-Traded Fund as US regulatory posture begins to shift under the Trump administration. The firm submitted its ZCSH Form S-3 filing, marking a required step toward launching the first Zcash ZEC $520.1 24h volatility: 3.5% Market cap: $8.53 B Vol. 24h: $915.55 M exchange-traded products.

Posting on X on Tuesday, Grayscale said it has filed the ZCSH Form S-3, describing it as an important step required to launch the first ZEC ETPs.

The company also emphasized its position as one of the earliest institutional investors in Zcash. The $35 billion asset manager launched its Grayscale Zcash Trust as a private placement in 2017, just a year after the blockchain genesis block.

The Trust has now filed a registration statement, including a prospectus, with the SEC for the offering, with investors encouraged to review the documents before participating.

Chairman Barry Silbert also weighed in on the Trust’s planned transition, signaling confidence in the asset’s long-term role as US regulators softened their stance on crypto ETFs.

Zcash Price Struggles at $500 Resistance

Grayscale’s Zcash Trust currently oversees $196.8 million in assets under management, trading under the ticker ZCSH with a 2.50% expense ratio. The conversion to a spot ETF would bring ZEC into alignment with newly approved altcoin ETFs, including the Bitwise Solana ETF, which has already accumulated $621 million in under a month. The strong inflows into comparable products highlight expectations that ZEC could attract significant institutional capital once conversion is complete.

Despite the positive regulatory and structural catalyst, Zcash price action remains muted. ZEC hovered around the $500 resistance, posting less than a 1% intraday gain as the broader crypto market stayed stagnant. Futures markets indicated a decisive sell-the-news reaction.

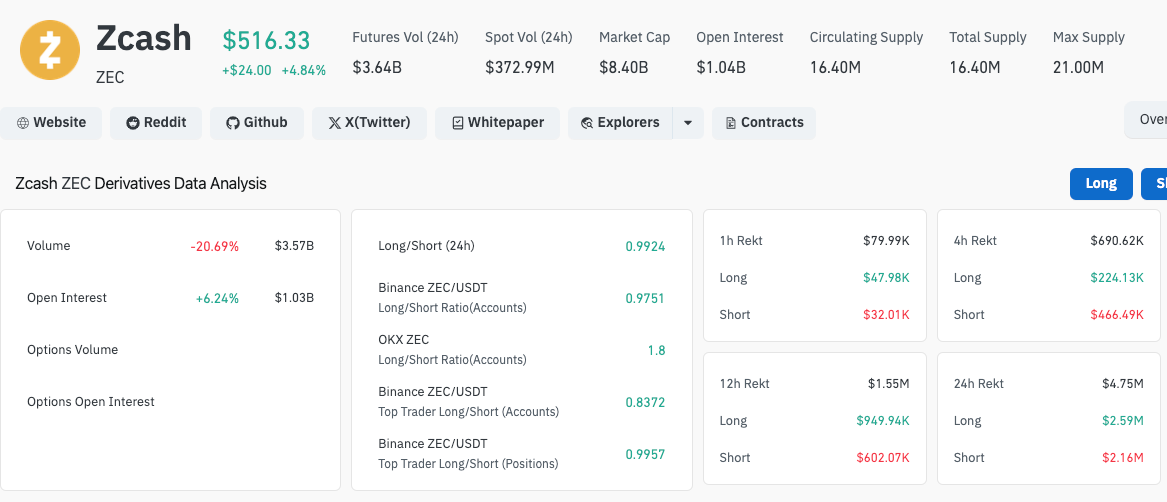

Zcash Derivatives Market Analysis, November 26, 2025 | Source: Coinglass

Coinglass data shows Zcash open interest fell 6.24%, holding just above $1 billion, even as trading volume jumped 20.7% to $3.57 billion. The combination of declining open interest and rising volume suggests that most intraday activity came from traders taking profit on the news and those adjusting existing positions.

Bearish bets piled up as bulls took profit, dragging the ZEC long-to-short ratio below 1 on Tuesday, plunging as low as 0.88 among whale traders on Binance.

With fewer upside bets being placed, traders are pricing in a low probability of ZEC breaking meaningfully above the $505 resistance level in the near term.

nextThe post Zcash Price Reclaims $500 as Grayscale Files Form S-3 to Convert $277M Zcash Trust to Spot ETF appeared first on Coinspeaker.

You May Also Like

Why the UK Is Seeing an Uplift in Property Sales in 2026

CME Group to launch options on XRP and SOL futures