Sei (SEI) Price Prediction 2026, 2027-2030

- Bullish SEI price prediction for 2026 is $0.1527 to $0.1691.

- Sei (SEI) price might reach $2 soon.

- Bearish SEI price prediction for 2026 is $0.1202.

In this Sei (SEI) price prediction 2026, 2027-2030, we will analyze the price patterns of SEI by using accurate trader-friendly technical analysis indicators and predict the future movement of the cryptocurrency.

|

TABLE OF CONTENTS

|

|

INTRODUCTION

|

|

|

SEI (SEI) PRICE PREDICTION 2026

|

|

| SEI (SEI) PRICE PREDICTION 2027, 2028-2030 |

| CONCLUSION |

| FAQ |

Sei (SEI) Current Market Status

| Current Price | $0.1344 |

| 24 – Hour Price Change | 8.78% Up |

| 24 – Hour Trading Volume | $104.76M |

| Market Cap | $874.71M |

| Circulating Supply | 6.49B SEI |

| All – Time High | $1.14 ( On Mar 16, 2024) |

| All – Time Low | $0.007989 (On Aug 15, 2023) |

What is Sei (SEI)

| TICKER | SEI |

| BLOCKCHAIN | Sei |

| CATEGORY | Layer 1 blockchain |

| LAUNCHED ON | August 2023 |

| UTILITIES | Governance, security, gas fees & rewards |

Sei (SEI) stands out as a specialized Layer 1 blockchain, specifically tailored to enhance trading operations. Its primary objective is to empower exchanges with superior speed, scalability, and reliability. Positioned as a Layer 1 blockchain, Sei sets ambitious goals, targeting a high throughput of orders per second and ensuring transaction finality within an impressive 380 milliseconds. Notably, Sei prioritizes security, aiming to garner the trust of prominent institutions.

As an open-source platform, Sei incorporates features like native frontrunning protection, seamless interoperability, and advanced transaction bundling options. It is designed to adapt alongside industry developments, showcasing modularity that enables integration with emerging innovations as guided by the community. Sei’s genesis is rooted in addressing the demand for a more dependable, scalable, and swift blockchain tailored for trading, with ongoing evolution marked by environmental consciousness through proof of stake mechanisms, reflecting a commitment to minimal ecological impact.

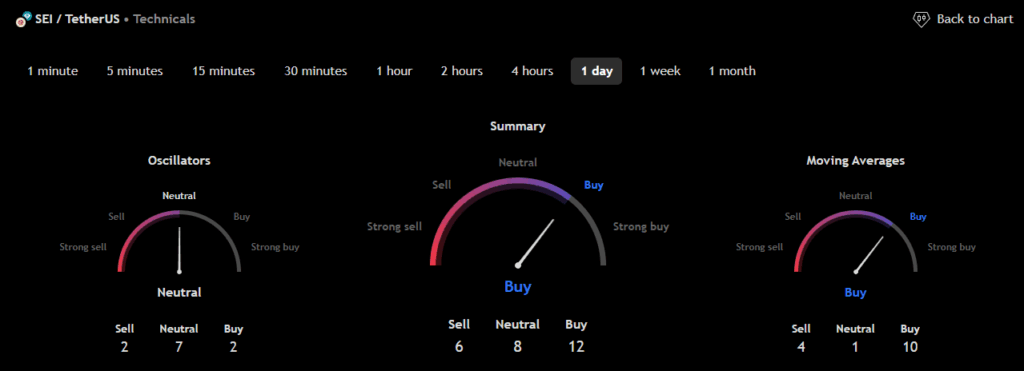

Sei 24H Technicals

(Source: TradingView)

(Source: TradingView)

Sei (SEI) Price Prediction 2026

Sei (SEI) ranks 71st on CoinMarketCap in terms of its market capitalization. The overview of the Sei price prediction for 2026 is explained below with a daily time frame.

In the above chart, Sei (SEI) laid out a Descending Channel pattern. A descending channel, also known as a falling channel, is a bearish technical analysis pattern formed by two parallel downward-sloping trendlines. The upper trendline connects a series of high points, indicating resistance where the price struggles to rise above, while the lower trendline connects the lower points, acting as support.

This pattern suggests that sellers are in control, with the price consistently making lower highs and lower lows. Traders often look to sell near the upper trendline and buy near the lower trendline, as the price typically oscillates within this defined range. Overall, the descending channel helps traders identify potential shorting opportunities and assess market sentiment.

At the time of analysis, the price of Sei (SEI) was recorded at $0.1344. If the trend continues, the price of SEI may reach the resistance levels of $0.1529, $0.1965, and $0.2485. If the trend reverses, then the price of SEI may fall to the support level of $0.1189.

Sei (SEI) Resistance and Support Levels

The chart given below elucidates the possible resistance and support levels of Sei (SEI) in 2026.

From the above chart, we can analyze and identify the following as resistance and support levels of Sei (SEI) for 2026.

| Resistance Level 1 | $0.1527 |

| Resistance Level 2 | $0.1691 |

| Support Level 1 | $0.1355 |

| Support Level 2 | $0.1202 |

Sei (SEI) Price Prediction 2026 — RVOL, MA, and RSI

The technical analysis indicators such as Relative Volume (RVOL), Moving Average (MA), and Relative Strength Index (RSI) of Sei (SEI) are shown in the chart below.

From the readings on the chart above, we can make the following inferences regarding the current Sei (SEI) market in 2026.

| INDICATOR | PURPOSE | READING | INFERENCE |

| 50-Day Moving Average (50MA) | Nature of the current trend by comparing the average price over 50 days | 50 MA = $0.1343 Price = $0.1415 (50MA < Price) | Bullish/Uptrend |

| Relative Strength Index (RSI) | Magnitude of price change;Analyzing oversold & overbought conditions | 58.0524 <30 = Oversold 50-70 = Neutral >70 = Overbought | Neutral |

| Relative Volume (RVOL) | Asset’s trading volume in relation to its recent average volumes | Below cutoff line | Weak volume |

Sei (SEI) Price Prediction 2026 — ADX, RVI

In the below chart, we analyze the strength and volatility of Sei (SEI) using the following technical analysis indicators — Average Directional Index (ADX) and Relative Volatility Index (RVI).

From the readings on the chart above, we can make the following inferences regarding the price momentum of Sei (SEI).

| INDICATOR | PURPOSE | READING | INFERENCE |

| Average Directional Index (ADX) | Strength of the trend momentum | 23.6867 | Weak Trend |

| Relative Volatility Index (RVI) | Volatility over a specific period | 54.51 <50 = Low >50 = High | High Volatility |

Comparison of SEI with BTC, ETH

Let us now compare the price movements of Sei (SEI) with those of Bitcoin (BTC) and Ethereum (ETH).

From the above chart, we can interpret that the price action of SEI is similar to that of BTC and ETH. That is, when the price of BTC and ETH increases or decreases, the price of SEI also increases or decreases, respectively.

Sei (SEI) Price Prediction 2027, 2028 – 2030

With the help of the aforementioned technical analysis indicators and trend patterns, let us predict the price of Sei (SEI) between 2027, 2028, 2029, and 2030.

| Year | Bullish Price | Bearish Price |

| Sei (SEI) Price Prediction 2027 | $3.6 | $0.1 |

| Sei (SEI) Price Prediction 2028 | $4.2 | $0.09 |

| Sei (SEI) Price Prediction 2029 | $4.5 | $0.08 |

| Sei (SEI) Price Prediction 2030 | $5.3 | $0.07 |

Conclusion

If Sei (SEI) establishes itself as a good investment in 2026, this year would be favorable to the cryptocurrency. In conclusion, the bullish Sei (SEI) price prediction for 2026 is $0.1691. Comparatively, if unfavorable sentiment is triggered, the bearish Sei (SEI) price prediction for 2026 is $0.1202.

If the market momentum and investors’ sentiment positively elevate, then Sei (SEI) might hit $2. Furthermore, with future upgrades and advancements in the SEI ecosystem, SEI might surpass its current all-time high (ATH) of $1.14 and mark a new ATH.

FAQ

1. What is Sei (SEI)?

Sei (SEI) stands out as a specialized Layer 1 blockchain, specifically tailored to enhance trading operations.

2. Where can you purchase Sei (SEI)?

Sei (SEI) has been listed on many crypto exchanges, including Binance, UZX, Bitrue, Bybit, and Bitget.

3. Will Sei (SEI) reach a new ATH soon?

With the ongoing developments and upgrades within the Sei Platform, SEI has a high possibility of reaching its ATH soon.

4. What is the current all-time high (ATH) of Sei (SEI)?

On March 16, 2024, SEI reached its new all-time high (ATH) of $1.14.

5. What is the lowest price of Sei (SEI)?

According to CoinMarketCap, SEI hit its all-time low (ATL) of $0.007989 on Aug 15, 2023.

6. Will Sei (SEI) reach $2?

If Sei (SEI) becomes one of the active cryptocurrencies that majorly maintain a bullish trend, it might rally to hit $2 soon.

7. What will be Sei (SEI) price by 2027?

Sei (SEI) price is expected to reach $3.6 by 2027.

8. What will be Sei (SEI) price by 2028?

Sei (SEI) price is expected to reach $4.2 by 2028.

9. What will be Sei (SEI) price by 2029?

Sei (SEI) price is expected to reach $4.5 by 2029.

10. What will be Sei (SEI) price by 2030?

Sei (SEI) price is expected to reach $5.3 by 2030.

Top Crypto Predictions

Worldcoin (WLD) Price Prediction

ChainGPT (CGPT) Price Prediction

Vine Coin (VINE) Price Prediction6Disclaimer: The opinion expressed in this chart is solely the author’s. It does not represent any investment advice. TheNewsCrypto team encourages all to do their own research before investing.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

XRPR and DOJE ETFs debut on American Cboe exchange