Fixing India’s insurance paradox: AI, trust, and the road to digital inclusion

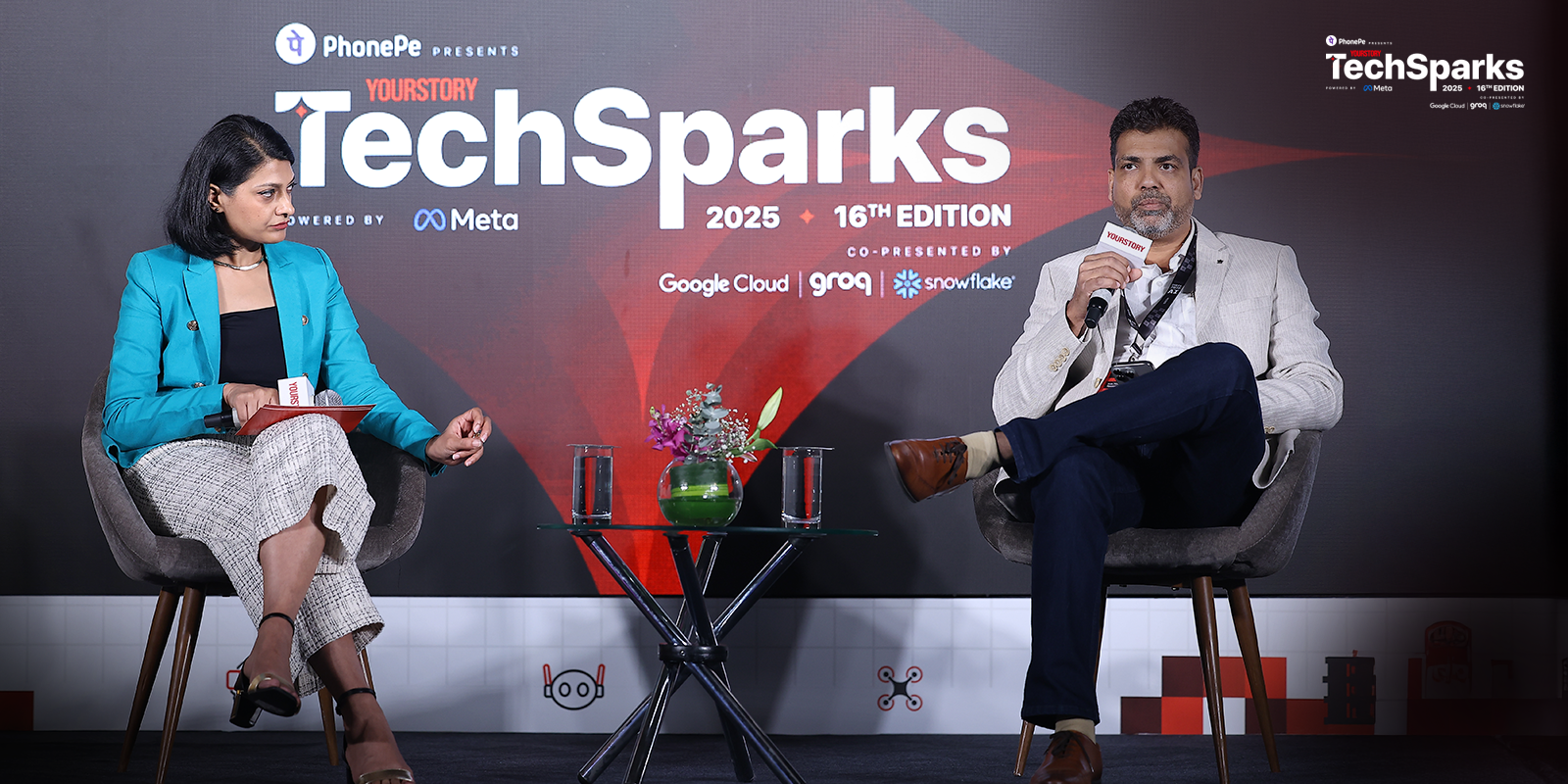

Insurers may be digitizing quickly, but India’s insurance penetration is one of lowest globally. One of the fastest growing sectors in India continues to be bogged down by complex and non-standardized products. How can this dichotomy be resolved? Vishal Gupta, CEO, PhonePe Insurance, shared his insights on what’s needed to galvanize India’s digital transformation with Shivani Muthanna, Senior Director - Strategic Partnerships & Content, YourStory.

From artificial intelligence to policy-changes and trust-building processes, the fireside chat, titled ‘Insurtech for all: Reimagining India’s insurance future’, at TechSparks 2025 was a deep dive into India’s data-driven, proactive insurtech revolution.

The insurance gap in India

Gupta began the conversation by mapping India’s insurance landscape and the gaps that needed to be filled. While insurance should be a priority for financial and personal security, many Indians view it as an obligation.

Life insurance penetration, Gupta revealed, is at 2.8% compared to developed countries where the average ranges from 7-9%. Non-life insurance, which hovers at 1% in India, is around 9% in the US and 4.2% in terms of the world average. India’s first mandate will be to bridge this massive gap.

“Many families in India need this protection. There are 173 million households in the range of Rs 3 to 11 lakh income. If they don’t have the right coverage, they will be impacted severely,” he said, adding that “around 60 million Indians go into poverty because they lack proper insurance coverage”. He elaborated on these numbers sharing that only 54% of the vehicles in India are insured. When it comes to four-wheelers, 85% are insured, with 15% outside coverage. Only 35% of two-wheelers in the country are insured, which means a huge gap needs to be bridged.

The trust deficit: Making insurance transparent

One of the biggest challenges the Indian industry faces is a severe trust deficit. At its core, insurance is a legal contract; when customers buy insurance, they are effectively entering a legal agreement. However, many remain uncertain about the process and the support they will receive at a time of crisis. Gupta feels that this distrust is a critical issue that must be addressed.

He stated that there are many reasons that lie at the heart of this distrust. One key factor is the way insurance is sold. Many customers are not proactive about buying insurance, which necessitates agents to sell using various selling pitches. This leads to agents focussing their time towards what will make a customer buy rather than focusing on solving the customer’s problems or building trust. Products are sold for quick gains, instead of genuine protection or service value.

This mismatch in the products sold and customer requirements can create downstream issues. Customers who don’t fully understand the product proceed either by unintentionally omitting or hiding important information out of fear that their premiums may increase or policy may be declined, eventually to face difficulties during the claims process leading to heartburn later. Such discrepancies lead to two-way trust issues which creates a vicious circle of increasing complexity in terms and conditions of the contract.

To address these issues, PhonePe has focused on making insurance simple and trustworthy by bringing transparency. “We are trying to make it as simple as buying any other ecommerce product by displaying details in a very simplified manner. We also make sure that the process is largely DIY (do it yourself), rather than assisted, because we believe that assistance can lead to mis-selling,” he said. “Whatever product we are selling, our focus is on making sure that the legal contract is well understood.”

When it comes to tapping AI/Machine Learning (ML) at PhonePe, Gupta stressed the importance of leveraging data effectively. While AI is not new to PhonePe, the company has long integrated machine learning models across multiple functions — from helping customers discover the right products to enhancing claims support. During the claims journey, AI tools identify potential issues early and predict likely outcomes. These insights enable PhonePe to collaborate closely with insurers, ensuring a smoother claims experience and even overturning a significant number of rejections.

“With automation handling different services, we are left with a narrow band of cases where PhonePe can provide deeper support using customer experts and claim officers.. In my opinion, to solve all the challenges in insurance digital transformation will be very critical. I don’t think there’s any other solution,” Gupta said.

Micro and sachet insurance products are significantly expanding insurance access in India, especially among underserved and low-income populations, and PhonePe is leading the charge.

Gupta said there are two types of micro products, cohort specific and impulse purchases, at PhonePe. For instance, personal accident is a product that is helpful to any Indian, and is not significantly expensive. He said this product is the largest selling product at the company other than vehicle insurance, and recommended that young people should buy it.

Building a digital foundation for insurance

Successful digital transformation hinges on the convergence of several different factors. True transformation will only come about by the industry uniting around three core pillars: access, infrastructure, and policy.

The first, access, is foundational. Today, about 20-30% of potential insurance buyers drop off during purchase due to missing information—like previous policy or vehicle details—which causes friction. If customers can easily fetch existing policy and asset details via simple identifiers like mobile numbers (similar to how bank account information can be accessed), the buying journey becomes smoother and simpler, removes barriers, and boosts conversation rates.

Second, in terms of infrastructure, digital capabilities must expand to cut down costs and enable broad participation. Gupta stated that insurance needs a digital revolution much like UPI in payments. This should be an open system that can enable intermediaries and innovation to grow by reducing distribution costs, bringing in more players into insurance distribution and product manufacturing.

On the policy-level, Gupta called for regulators to bring in a few specific changes towards digital push. One of the critical things towards that is simplification and standardization of products, features and related metrics. Not only will this make insurance easy to understand; but it will also help insurance providers to focus on servicing instead of finding unique selling points.

Another critical lever for affordability is enabling upfront, non-discriminatory discounts funded through intermediary commissions. Because these discounts are transparent and uniform for all customers, they do not create any incentive for solicitation or mis-selling, they simply make insurance more accessible and better priced. Allowing this flexibility can meaningfully expand the market by improving affordability and customer appeal.

While Gupta acknowledged the importance of KYC, he pointed out that the current requirement for full KYC including PAN and address proof creates unnecessary friction for low-premium policies. Many two-wheeler owners buying sub-₹1,000 policies, for instance, do not possess PAN cards, leading to dropped conversions. He argued for a graded, risk-based KYC framework, similar to what many digital wallets follow, where soft KYC is sufficient for low-value products. At the very least, KYC should not be mandated for renewals where the proposer or owner remains unchanged.

Another thing, which can help spread awareness is by allowing referrals and affiliates program, which are amongst the key reasons for content proliferation in various complex e-commerce categories.Transaction is between customer and intermediary/insurer and affiliates/referer is only bringing the leads, however to ensure the lead quality its important to tie the payout to the sale event. Payout while linked with sale, should not be linked to premium or product. Such an approach will enable many people to generate awareness content which is customer-centric, and in the process earn a flat fee for every converted lead.

You May Also Like

Top 3 Price Prediction for Ethereum, XRP and Bitcoin If Crypto Structure Bill Passes This Month

US Jobless Claims Lower Than Forecasted, Impact on Crypto Unclear