Crypto Funds See $1.94B in Weekly Outflows as Bitcoin, Ethereum Lead Withdrawals

- Crypto funds saw heavy weekly outflows while late-week inflows hinted at fragile support.

- Bitcoin faced severe pressure, yet Friday brought a sizable recovery with investors testing lower levels.

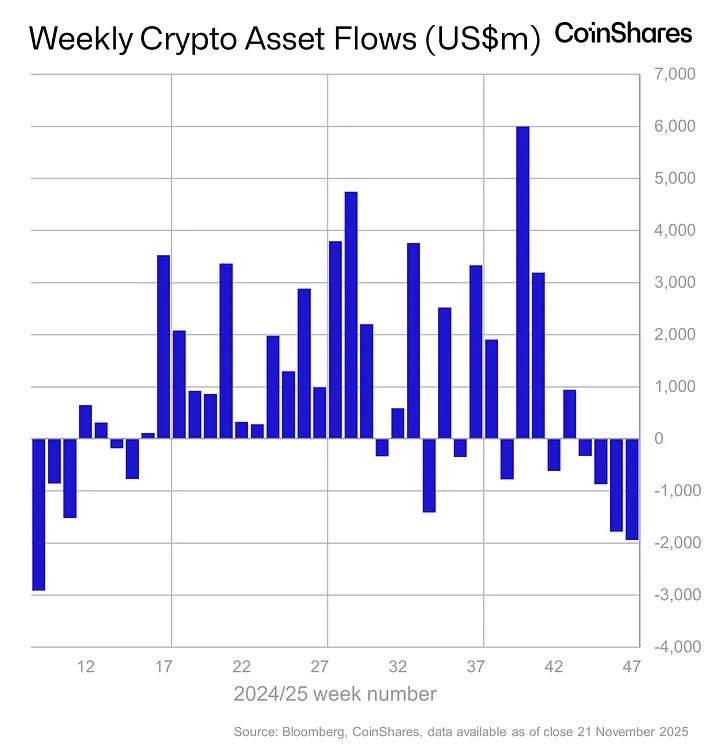

Crypto funds recorded $1.94 billion in outflows last week, stretching the selloff streak to a whole month. The ongoing retreat has now totaled $4.92 billion over four weeks, placing it as the third-largest withdrawal run since early 2018, according to CoinShares Research.

The withdrawals represent about 2.9% of total assets under management and mark a substantial shift in market sentiment. Investors are reacting to falling prices, profit-taking, and economic uncertainty.

Source: CoinShares Report

Source: CoinShares Report

Despite the selloff, markets indicated a possible change over the weekend. On Friday, Investment flows returned, showing investors are slowly regaining confidence in some products.

Bitcoin Leads Losses But Shows Late Rebound

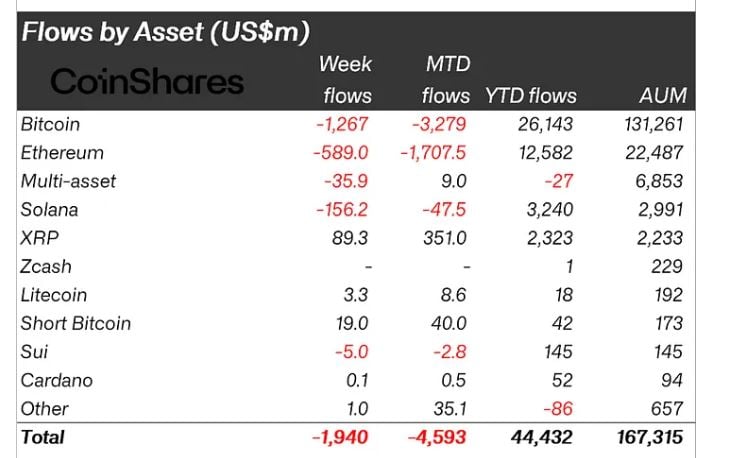

Bitcoin saw the heaviest pressure, with crypto outflows reaching $1.27 billion during the week. This accounted for the majority of total withdrawals. However, Friday’s trading showed signs of life, as Bitcoin pulled in $225 million in inflows, the highest single-day recovery among all products.

Investor hedging was evident in the performance of Short-Bitcoin funds. These products saw $19 million in inflows last week and $40 million over three weeks. They now account for 23% of their total managed assets, with the value of such funds rising 119%.

Ethereum recorded $589 million in outflows, representing 7.3% of its total AUM. ETH also reversed course on Friday, taking in $57.5 million and hinting at investor interest near lower price levels.

Source: CoinShares Report

Source: CoinShares Report

Capital Exits Solana, While XRP Attracts New Funds

Among altcoins, Solana recorded a $156 million loss as investors took profits after a strong year-long performance. In contrast, XRP attracted an investment of $89.3 million and was the only major altcoin to draw in significant new capital. Analysts attribute this interest to its use case in payments. Additionally, the token has drawn investor attention after Franklin Templeton received NYSE approval to launch its XRP ETF, as CNF earlier reported.

CoinShares highlighted that the US remained the most active country for outflows, contributing $1.686 billion to the global total. Germany, Canada, Sweden, and Switzerland also saw withdrawals during this period.

On the other hand, Brazil recorded $3.5 million in inflows, while Australian exchanges put in $2 million. These figures point to selective regional buying despite global weakness.

]]>You May Also Like

Stocks and Crypto Market Face Volatility From U.S. Tariffs

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon