Can Dip-Buying Turn Into Full Fledged Recovery?

Market analysts are optimistic about Bitcoin's outlook, noting that the cryptocurrency market has begun to rebound since Friday's low of slightly over $82,000.

The market's erratic anticipation of a possible Federal Reserve rate cut in December is largely to blame for the recent downturn in tech shares and cryptocurrency markets.

The bets are for the recovery through dip-buying to extend to somewhat higher, with the peg for a break above another ATH being the Fed rate path for next year.

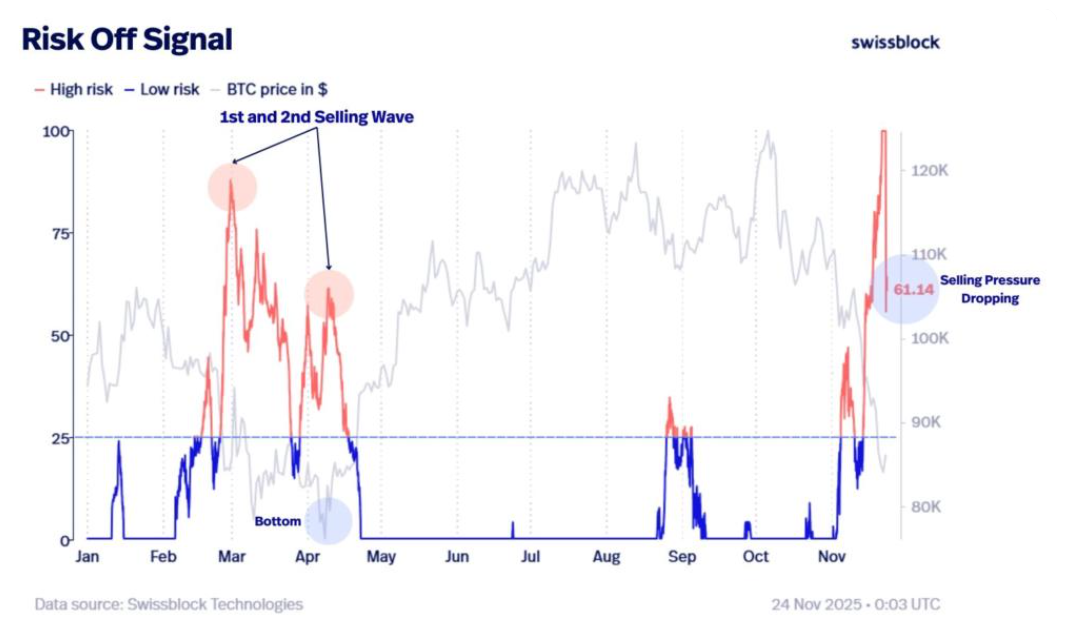

This week is pivotal, with a sustained fall in selling pressure a key requirement.

It is one of the most reliable signs of a market bottom when prices tend to stay near their previous lows and a second wave of selling follows, which is usually weaker than the first.

When the second wave hits, it usually means the sellers' momentum is fading and the power is shifting back to the buyers.

Bitcoin hit a new low of $80,600 on Friday, its lowest level since mid-April. From its all-time high in early October, when it exceeded $126,000, the drop represented a 36% correction.

Bitcoin started the week at a disadvantage after an extended period of selling pressure, positioning the asset for its most challenging month since 2022.

Following a slight recovery over the weekend, the leading cryptocurrency experienced a decline of up to 2.3%, momentarily dropping below $86,000 on Monday, before paring some of its losses.

Although this figure is significantly above the Friday lows of $80,553, market participants find little reason to celebrate.

The broader cryptocurrency landscape is experiencing a significant downturn, even in the face of increasing institutional engagement and a number of favorable policy advancements advocated by US President Donald Trump, who has shown support for the sector.

Unless there is a significant shift, November is poised to be Bitcoin’s most challenging month since a series of corporate failures shook the cryptocurrency landscape in 2022, leading to the dramatic collapse of FTX, Sam Bankman-Fried’s exchange.

Source: CoinGecko

Source: CoinGecko

What the Fed Does is Important

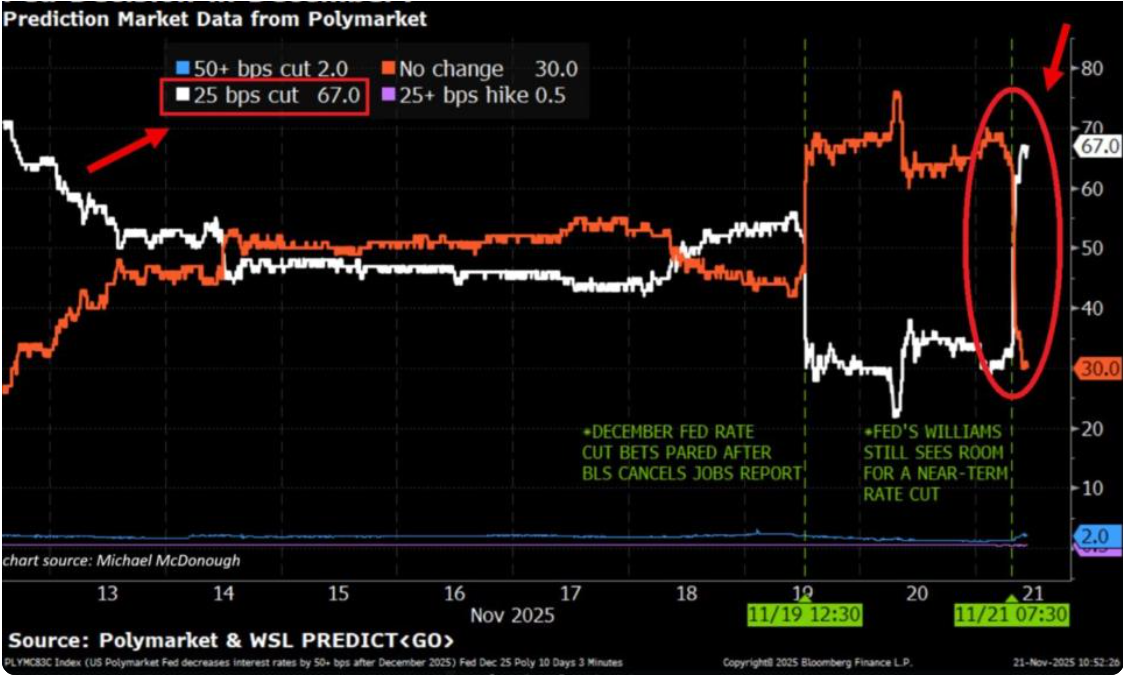

The likelihood of a Federal Reserve rate cut in December collapsed to about 30% last week. However, that has now rebounded to 70%, and with it, the optimism for cryptos, too, has reversed.

At the central bank's meeting on December 10, the CME Fed Watch Tool now shows a 69.3% possibility of a 0.25 basis point drop. The see-saw in Fed rate path expectations was driven by the lack of data due to the recent record-longest US government shutdown.

The US labour department has said jobs data for October and November will now be released 10 days after the Fed meeting, and the central bank will be "driving in the fog," again, as mentioned by Fed Chief Jerome Powell.

Still, the reversal for a rate cut bet rests entirely on expectations of control in inflation and a weakening jobs market derived from private reports. Predictions have flipped, and the Polymarket chart shows that drama.

Cryptocurrencies and other high-risk assets tend to do well in environments when interest rates are low and liquidity is strong; in the past, bouts of quantitative easing have frequently resulted in significant market rallies.

Bets for Fed QE have also risen in recent days, adding to the allure of cryptos once again.

Bottom Done?

The drop in Bitcoin's price could indicate a potential bottom and the onset of a "renewed bullish trend," coinciding with a decrease in open interest in the crypto token.

According X user "Darkfost," Bitcoin's open interest has dropped to $114 billion, with the cryptocurrency trading at $87,500 per token.

This reduction in open interest in Bitcoin is the most dramatic 30-day decline in the cycle, amounting to almost 1.3 million BTC. Traders are being forced to either fortify their positions or change their strategies due to the recent drop in Bitcoin prices, which has triggered a wave of liquidations.

Market players appear to be temporarily halting futures trade in an effort to reduce their exposure to risk.

Darkfost observed that the recent rapid decline in Bitcoin open interest over a 30-day period mirrors the patterns seen during the 2022 bear market, underscoring the importance of the current market correction.

Since hitting a high of almost $126,000 in early October, almost two months ago, the value of Bitcoin has fallen by more than 30%, with a 20% decline in the last month alone.

Can Bitcoin Climb Back Above $90K?

The upcoming week will be "decisive" for the price of Bitcoin and its ability to achieve a new all-time high shortly, according to Michaël Van de Poppe, a well-known player in the cryptocurrency industry and founder of MN Fund.

If Bitcoin can regain its previous strength and maintain a price range of $90,000 to $96,000, according to Van de Poppe's Sunday X post, "then the chances of a revival toward a new ATH have significantly increased."

Greed and fear have reached an all-time high in recent days.

"Those are the most promising market opportunities," he declared.

Elsewhere

Blockcast

Kaia's Path to Mass Adoption: Blockchain in Everyday Apps

This week, Takatoshi Shibayama hosts Dr Sangmin "Sam" Seo and John Cho from the Kaia DLT Foundation. They discuss the merger of Kakao and Line to create the Kaia blockchain, the integration of stablecoins and DeFi into their messaging apps, and the strategies for attracting Web2 users to Web3. The conversation also covers the potential of stablecoins in cross-border remittance and the user journey from fiat to digital assets.

Thanks for tuning in! If you enjoyed this episode, please like and subscribe to Blockcast on your favorite podcast platforms like Spotify and Apple.

Blockhead is a media partner for Consensus Hong Kong 2026. Readers can save 20% on tickets using exclusive code BLOCKDESK at this link.

You May Also Like

STRC Stock Surge: How Much Bitcoin Can Saylor Buy?

Ethereum co-founder Jeffrey Wilcke sends $157M in ETH to Kraken after months of wallet silence